Equities

Asian markets advanced on Wednesday, buoyed by strong Tuesday’s outstanding US housing data. The Nikkei gained 1.5% to 8460, the Kospi jumped 3.1%, and the ASX 200 rallied 2.1%. Hong Kong’s Hang Seng climbed 1.9% to 18416, while China’s Shanghai Composite bucked the uptrend, sliding 1.1% to 2191.

European markets declined, as a morning spike faded. The DAX fell 1% to 5792, the CAC40 dropped .8% and the FTSE declined .6% to 5390. The ECB offered 489 billion euros in 3-year notes, in an effort to increase liquidity to struggling banks.

Germany's DAX Slides 1%, Erasing Morning Gains

US markets closed mixed as the Nasdaq dropped 1%, while the S&P 500 gained .2%, and the Dow inched up 4 points.

Currencies

The major currencies swung widely in a volatile session, as the ECB’s efforts triggered a brief dollar selloff which quickly reversed. The Euro closed down .3% to 1.3048, after spiking as high as 1.3188 earlier in the day. The Australian Dollar rose by .2% to 1.0092, the Pound edged up .1% to 1.5676. and the Canadian Dollar settled up .3% to 1.0263.

Economic Outlook

Existing home sales rose by much less than forecast, climbing to 4.42M from 4.25M, as opposed to a forecast of 5.04 million.

Weekly Jobless Claims Drop to 3.5 Year Low

Equities

Asian markets traded lower, as the ECB’s liquidity efforts failed to inspire confidence amongst investors. The Nikkei dropped .8% to 8395, and the Kospi edged down fractionally. Australia’s ASX 200 slumped 1.2% as retailers continue to slash their outlook for the first quarter, due to weak Christmas sales. In greater China, the Hang Seng and Shanghai Composite both declined .2%, but were well-off their earlier lows.

In contrast, European markets rallied, led by banks, which gained 2%. The CAC40 climbed 1.4%, the FTSE gained 1.3%, and the DAX advanced 1.1%.

Currencies

The Pound, Euro, and Swiss Franc all ended little changed from their Wednesday settlement prices, closing near the center of their intraday price range. The Canadian Dollar climbed .6% to 1.0208, and the Australian Dollar gained .4% to 1.0130, as traders moved back into “risk on” mode. The Yen eased .2% to 78.17.

Economic Outlook

3rd quarter GDP was revised downward to 1.8% from 2.0%, showing the economy is growing slowly, but steadily. Weekly jobless claims fell to 364K, 12K better than expected, hitting their best level since 2008. Consumer confidence moved up to 69.9 from 67.7, better than forecast.

Upbeat US Data Continues to Push Stocks Higher

Equities

A drop in US unemployment claims helped push Asian markets higher on Friday. The Kospi climbed 1.1%, and the ASX 200 added 1.2%, led by materials stocks. The Shanghai Composite rose .9%, and Hong Kong’s Hang Seng advanced 1.4%, gaining 1.9% for the week. The Nikkei was closed for a holiday.

The equity rally continued in Europe, as the FTSE and CAC40 rallied 1%, while the DAX gained .5%. Oil and gas stocks were the largest gainers, as crude oil continued its recent advance.

Similar gains were achieved in the US. The Dow climbed 124 points, the S&P 500 gained .9%, and the Nasdaq rose .7%. Congress passed a 2 month extension on a payroll tax cut, which affects 160 million workers.

Dow Rallies 124 Points

Rambus shares jumped 12% after signing a licensing agreement with Broadcom.

Currencies

The major pairs traded in narrow ranges as the market prepared for the extended holiday weekend.. The Euro closed down fractionally at 1.3048, while the Swiss Franc, Australian Dollar, and Yen all edged up .1%. The British Pound was a notable mover, dropping .6% to 1.5588.

Economic Outlook

Yet another report suggested that the US housing market is finally beginning to recover, as new home sales edged up to 315K, better than last month’s 310K, and slightly above expectations.

Equities Trade Narrowly

Equities

Asian markets traded lower in thin trading, following Monday’s holiday closure of American and European markets. The Nikkei declined .5% to 8441, and the Kospi dropped .8% to 1842. China’s Shanghai Composite sank 1.1% to 2166 on extremely light volume. Markets in Australia and Hong Kong remained closed.

In Europe, the DAX edged up .2%, and the CAC40 closed up fractionally in light trading. Markets in the UK were closed for an extended weekend. Italy’s MIB index dropped 1% as regional banks fell following a weak bond auction.

Thin trading continued in the US, and is likely to last through the rest of the year. The Dow and S&P 500 closed little changed, while the Nasdaq rose .3% to 2625.

Currencies

Currency markets traded in very narrow ranges as the world remained on vacation. The Dollar settled mostly lower, as the Euro edged up .1% to 1.3068, and the Pound gained .3% to 1.5668. The Yen and the Swiss Franc both rose .2% to 77.87 and 1.0707 respectively. The Australian Dollar and the Canadian Dollar slipped fractionally.

Economic Outlook

Tuesday’s economic data was mixed. The Case-Shiller home price index showed house prices continued to drop, with the annual rate reaching 3.4%, slightly more than expected. The Richmond manufacturing index rose to 3 from last month’s zero reading, but fell shy of forecasts. Consumer Confidence jumped to 64.5 from last month’s 55.2 reading, blowing past analyst expectations.

Dollar and Bonds Surge

Equities

Asian markets extended their declines on Wednesday in very thin trading. Korea’s Kospi skidded .9% to 1825, the Nikkei edged down .2%, and the ASX 200 dropped 1.3%. The Hang Seng closed down .6% to 18519, while the Shanghai Composite managed a slight .2% gain.

European markets fell, pressured by an ECB report showing banks were increasingly depositing cash with the central bank, rather than lend to each other. The DAX tumbled 2%, the CAC40 slid 1%, and Italy’s MIB declined .7%. The FTSE closed flat, as gains in retailers offset losses from other sectors. An auction of 6-month Italian bonds was a major success, with yields dropping to 3.25%, compared to 6.5% just one month ago.

US stocks dropped sharply, with the Nasdaq and S&P 500 both dropping 1.3%, and the Dow losing 140 points to 12151.

Currencies

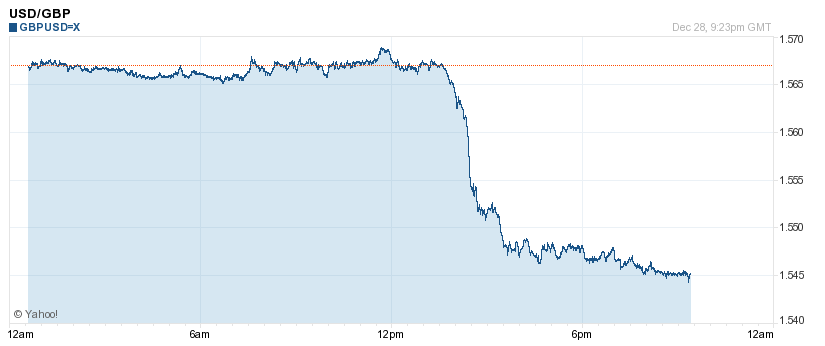

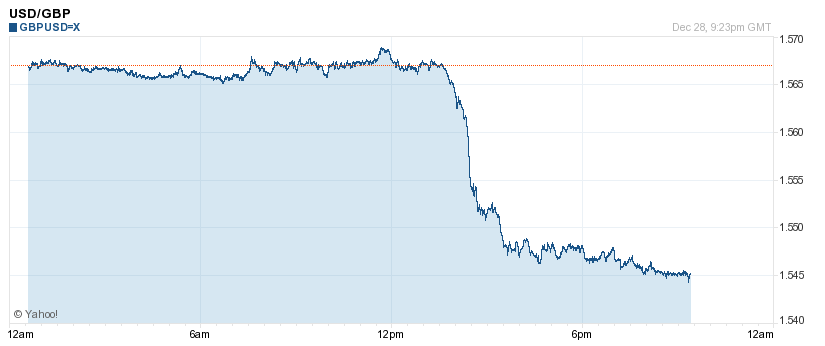

The Dollar surged, while European currencies plunged. The Euro dropped 1% to 1.2935, hitting a 1-year low, the Pound fell 1.4% to 1.5448, and the Swiss Franc sank .9% to 1.0607. The Australian Dollar declined .6% to 1.0090, and the Canadian Dollar slid .5% to 1.0244. The Yen slipped fractionally to 77.92.

USD/GBP" title="USD/GBP" width="825" height="346" />

USD/GBP" title="USD/GBP" width="825" height="346" />

Economic Outlook

Thursday’s economic calendar will include weekly unemployment claims, Chicago PMI, pending home sales, and weekly oil inventories.

Asian markets advanced on Wednesday, buoyed by strong Tuesday’s outstanding US housing data. The Nikkei gained 1.5% to 8460, the Kospi jumped 3.1%, and the ASX 200 rallied 2.1%. Hong Kong’s Hang Seng climbed 1.9% to 18416, while China’s Shanghai Composite bucked the uptrend, sliding 1.1% to 2191.

European markets declined, as a morning spike faded. The DAX fell 1% to 5792, the CAC40 dropped .8% and the FTSE declined .6% to 5390. The ECB offered 489 billion euros in 3-year notes, in an effort to increase liquidity to struggling banks.

Germany's DAX Slides 1%, Erasing Morning Gains

US markets closed mixed as the Nasdaq dropped 1%, while the S&P 500 gained .2%, and the Dow inched up 4 points.

Currencies

The major currencies swung widely in a volatile session, as the ECB’s efforts triggered a brief dollar selloff which quickly reversed. The Euro closed down .3% to 1.3048, after spiking as high as 1.3188 earlier in the day. The Australian Dollar rose by .2% to 1.0092, the Pound edged up .1% to 1.5676. and the Canadian Dollar settled up .3% to 1.0263.

Economic Outlook

Existing home sales rose by much less than forecast, climbing to 4.42M from 4.25M, as opposed to a forecast of 5.04 million.

Weekly Jobless Claims Drop to 3.5 Year Low

Equities

Asian markets traded lower, as the ECB’s liquidity efforts failed to inspire confidence amongst investors. The Nikkei dropped .8% to 8395, and the Kospi edged down fractionally. Australia’s ASX 200 slumped 1.2% as retailers continue to slash their outlook for the first quarter, due to weak Christmas sales. In greater China, the Hang Seng and Shanghai Composite both declined .2%, but were well-off their earlier lows.

In contrast, European markets rallied, led by banks, which gained 2%. The CAC40 climbed 1.4%, the FTSE gained 1.3%, and the DAX advanced 1.1%.

Currencies

The Pound, Euro, and Swiss Franc all ended little changed from their Wednesday settlement prices, closing near the center of their intraday price range. The Canadian Dollar climbed .6% to 1.0208, and the Australian Dollar gained .4% to 1.0130, as traders moved back into “risk on” mode. The Yen eased .2% to 78.17.

Economic Outlook

3rd quarter GDP was revised downward to 1.8% from 2.0%, showing the economy is growing slowly, but steadily. Weekly jobless claims fell to 364K, 12K better than expected, hitting their best level since 2008. Consumer confidence moved up to 69.9 from 67.7, better than forecast.

Upbeat US Data Continues to Push Stocks Higher

Equities

A drop in US unemployment claims helped push Asian markets higher on Friday. The Kospi climbed 1.1%, and the ASX 200 added 1.2%, led by materials stocks. The Shanghai Composite rose .9%, and Hong Kong’s Hang Seng advanced 1.4%, gaining 1.9% for the week. The Nikkei was closed for a holiday.

The equity rally continued in Europe, as the FTSE and CAC40 rallied 1%, while the DAX gained .5%. Oil and gas stocks were the largest gainers, as crude oil continued its recent advance.

Similar gains were achieved in the US. The Dow climbed 124 points, the S&P 500 gained .9%, and the Nasdaq rose .7%. Congress passed a 2 month extension on a payroll tax cut, which affects 160 million workers.

Dow Rallies 124 Points

Rambus shares jumped 12% after signing a licensing agreement with Broadcom.

Currencies

The major pairs traded in narrow ranges as the market prepared for the extended holiday weekend.. The Euro closed down fractionally at 1.3048, while the Swiss Franc, Australian Dollar, and Yen all edged up .1%. The British Pound was a notable mover, dropping .6% to 1.5588.

Economic Outlook

Yet another report suggested that the US housing market is finally beginning to recover, as new home sales edged up to 315K, better than last month’s 310K, and slightly above expectations.

Equities Trade Narrowly

Equities

Asian markets traded lower in thin trading, following Monday’s holiday closure of American and European markets. The Nikkei declined .5% to 8441, and the Kospi dropped .8% to 1842. China’s Shanghai Composite sank 1.1% to 2166 on extremely light volume. Markets in Australia and Hong Kong remained closed.

In Europe, the DAX edged up .2%, and the CAC40 closed up fractionally in light trading. Markets in the UK were closed for an extended weekend. Italy’s MIB index dropped 1% as regional banks fell following a weak bond auction.

Thin trading continued in the US, and is likely to last through the rest of the year. The Dow and S&P 500 closed little changed, while the Nasdaq rose .3% to 2625.

Currencies

Currency markets traded in very narrow ranges as the world remained on vacation. The Dollar settled mostly lower, as the Euro edged up .1% to 1.3068, and the Pound gained .3% to 1.5668. The Yen and the Swiss Franc both rose .2% to 77.87 and 1.0707 respectively. The Australian Dollar and the Canadian Dollar slipped fractionally.

Economic Outlook

Tuesday’s economic data was mixed. The Case-Shiller home price index showed house prices continued to drop, with the annual rate reaching 3.4%, slightly more than expected. The Richmond manufacturing index rose to 3 from last month’s zero reading, but fell shy of forecasts. Consumer Confidence jumped to 64.5 from last month’s 55.2 reading, blowing past analyst expectations.

Dollar and Bonds Surge

Equities

Asian markets extended their declines on Wednesday in very thin trading. Korea’s Kospi skidded .9% to 1825, the Nikkei edged down .2%, and the ASX 200 dropped 1.3%. The Hang Seng closed down .6% to 18519, while the Shanghai Composite managed a slight .2% gain.

European markets fell, pressured by an ECB report showing banks were increasingly depositing cash with the central bank, rather than lend to each other. The DAX tumbled 2%, the CAC40 slid 1%, and Italy’s MIB declined .7%. The FTSE closed flat, as gains in retailers offset losses from other sectors. An auction of 6-month Italian bonds was a major success, with yields dropping to 3.25%, compared to 6.5% just one month ago.

US stocks dropped sharply, with the Nasdaq and S&P 500 both dropping 1.3%, and the Dow losing 140 points to 12151.

Currencies

The Dollar surged, while European currencies plunged. The Euro dropped 1% to 1.2935, hitting a 1-year low, the Pound fell 1.4% to 1.5448, and the Swiss Franc sank .9% to 1.0607. The Australian Dollar declined .6% to 1.0090, and the Canadian Dollar slid .5% to 1.0244. The Yen slipped fractionally to 77.92.

USD/GBP" title="USD/GBP" width="825" height="346" />

USD/GBP" title="USD/GBP" width="825" height="346" />Economic Outlook

Thursday’s economic calendar will include weekly unemployment claims, Chicago PMI, pending home sales, and weekly oil inventories.