Market movers today

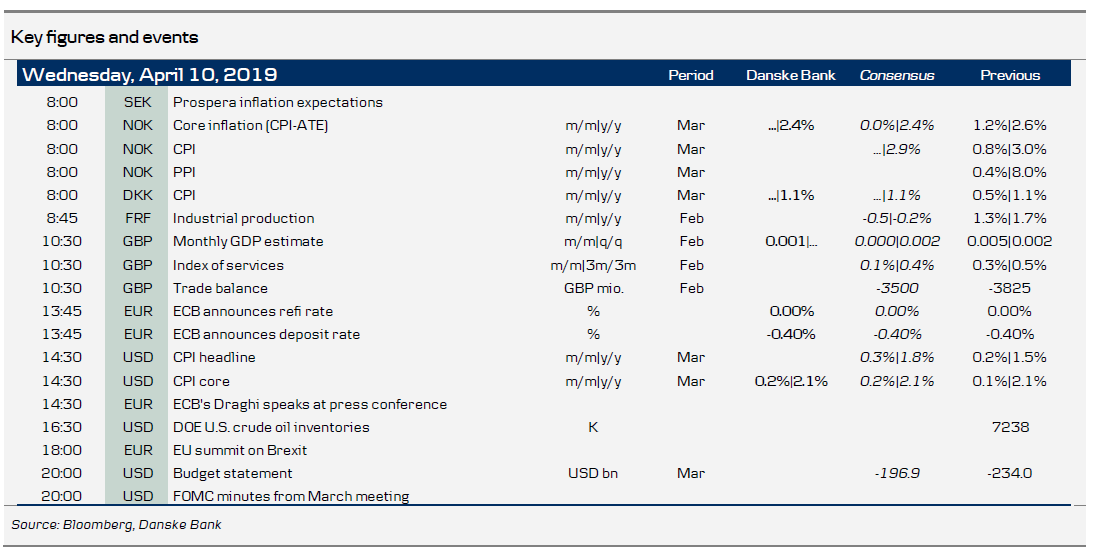

It's a busy day today with lots of data and events. The ECB kicks of the action with its meeting and press conference at 14.30 CEST. We expect Draghi to repeat his 'delayed, not derailed' inflation message, therefore no new policy signals from the ECB. However, we expect Draghi to strike an overall cautious tone and the ECB to keep its downside risks assessment on growth, see ECB Preview - No new policy actions expected as 'inflation is delayed, not derailed ', 5 April 2019. We expect questions on a tiering system and Draghi may reflect on the recent ECB lending survey (see below).

US inflation data is also set for release at 14.30 CEST. We agree with the consensus that we will see an unchanged core inflation rate of 2.1% y/y.

Tonight at 18:00 CEST, the EU leaders are set to meet to discuss and decide on whether to grant the UK another Brexit extension and, in that case, for how long. Yesterday, EU Council President Donald Tusk sent the EU leaders a letter suggesting a flexible approach by extending the deadline for one year with the possibility of the UK leaving earlier if the Brexit deal passes the House of Commons. While Tusk's letter is positive, we note he is considered one of the more "soft" Brexiteers and some EU leaders including French President Macron are more sceptical. A long extension is also our base case (75%) but we cannot rule out neither a short extension nor a no deal Brexit (both 10%), see Brexit Monitor: Long extension despite Brexit fatigue , 8 April.

The FOMC minutes from the March meeting are due for release at 20.00 CEST. It was the meeting of the big dovish turn, but we doubt the minutes will add much more colour to the shift in the Fed's message as we have had a wide range of Fed speeches explaining the move.

In Norway, it's time for inflation for March and we get the inflation expectations survey from Sweden. The Riksbank's Ohlsson also speaks, see page 2 for more details.

Selected market news

The risk market took a breather yesterday as equities were lower and bond yields declined. The decline in sentiment also put a halt to the rise in the oil price seen lately. Asian markets are also lower but mostly catching up with the decline in the US and Europe.

Markets faced some headwinds from a new downbeat IMF outlook , as global growth for 2019 was revised lower by 0.2 percentage points to 3.3% for 2019. However, the IMF expects a recovery in H2 19, paving the way for global growth of 3.6% in 2020. The news of US tariffs on USD11bn of EU goods, on Monday night, also weighed on risk sentiment.

The ECB lending survey released yesterday showed that credit standards were broadly unchanged for enterprises but tighter for housing loans ( link to survey ). The most interesting part was that while a clear majority of banks said negative rates weighed on profitability, a small majority also said it had a positive impact on their lending volumes. It will be interesting to see how the survey affects the ECB's message on tiering today.

Scandi markets

In Norway, core inflation surprised to the upside in February, climbing to 2.6% y/y from 2.1% in January. Part of this was due to stronger increases in prices for some imported goods, including clothing and furniture. To some extent, we believe this was only a temporary phenomenon due to an earlier rebound than usual after the January sales. We therefore anticipate a slight correction in March, with the annual rate of core inflation slowing to 2.4% y/y, marginally lower than consensus (2.5 %) and Norges Bank’s estimate (2.6 %).

In Sweden, inflation expectations (monthly survey, money-market) are due to be released this morning. Among Riksbank board members, Flodén has taken notice of the fact that money-market players’ CPIF expectations have dampened somewhat of late. More generally though, the board does not appear to be too concerned. Maybe the latest couple of months’ low inflation data will affect expectations to some extent in today’s survey. Later RB board member Ohlsson speaks.

Fixed income markets

Bond yields declined on the back of the weaker growth outlook presented by the IMF as well as weaker equity markets. However, it is remarkable to us that Italy ends up both outperforming other peripheral markets and given that the Italian government with its new growth and fiscal deficit forecasts for the coming years is likely to clash with the EU Commission. However, both the growth and especially the deficit is in line with the ratings agencies forecasts for the Italian economy.

The main event today will be the ECB meeting. We do not expect much new from the ECB, as described in our preview. See more here ECB Preview - No new policy actions expected as ‘inflation is delayed, not derailed’, 5 April 2019.

Today, Finland is tapping in the 7Y and old 30Y benchmark bonds. It intends to sell up to EUR1bn in total and will have fulfilled some 45% of the funding target for 2019 after the auction. We recommend buying at the auction and selling either Germany or the Netherlands. See more in our auction preview.

On top of this, Germany intends to sell EUR3bn in the 5Y segment, while Portugal will tap in the new 10Y benchmark and the 18Y benchmark. Portugal is to sell up to EUR1bn at the tap auction. Finally, Sweden will do a tap in the 10Y benchmark, while Norway will tap in the 4Y bond. See more on the Norwegian auction here.

FX markets

The strong risk-off move yesterday in particular favoured the JPY against the EUR and USD. The move did not seem to relate to any particular headlines, other than perhaps the IMF’s downwards revision of its global growth forecast to the lowest level since the financial crisis. We do not expect any big news from the ECB, which in turn should keep EUR/USD in the recent tight range. With ECB tightening pushed far out into the horizon, in the short term the market will be alert to QE and/or rate cut signals from ECB, which have the potential to lower EUR/USD to 1.10 short-term, see ECB Preview - No new policy actions expected as ‘inflation is delayed, not derailed’, 5 April 2019.

If we are right in our call for Norwegian core inflation to disappoint consensus expectations today, it might initially weigh on the NOK. However, we stress that this would be merely a correction from the high print last month and not a sign of weakening in the sound domestic fundamentals, which underpin our positive view on the NOK.

In Reading the Markets Sweden last week, we argued that the options market underestimated the potential in EUR/SEK on the 25 April Riksbank decision. Hence, we recommended a EUR/SEK calendar spread, covering the Riksbank event. The first leg in that strategy was selling a 10 April 10.38/10.47 strangle based on the view that the cross would stay stable ahead of CPI, which so far has performed as intended. We doubt that neither today’s Prospera nor the Ohlsson speech (see Scandi section) will be significant market movers.

We believe a long extension is only slightly GBP-positive but it may be sufficient for the cross to start trading in the 0.84-0.86 range instead of the current 0.85-0.87. In case of a short extension, we will probably remain in the 0.85-0.87 range but markets may get disappointed given the high expectations of a long one. If we are heading for a no deal Brexit, we still believe EUR/GBP will move towards 1. See also Brexit Monitor: Long extension despite Brexit fatigue, 8 April 2019.