Investing.com’s stocks of the week

For all the build-up, I can’t help feeling a tad disappointed by yesterday’s events which were roughly in line with expectations.

The main news is that the European Central Bank lowered its main interest rate from 0.25% to 0.15%. This makes it cheaper for banks to borrow, the benefit of which they should in turn pass onto the wider community. Alongside this, they also lowered the deposit rate, the rate of interest they pay banks on money held with them, from zero to -0.1%.

This negative deposit rate means that in effect, banks will be charged for holding surplus cash on deposit with them. This is the first time a major central bank has done so, though the Danish central bank did do this back in 2012 and it was effective in weakening the currency. If banks are being charged to keep their money with the ECB, then the thinking is that they’re likely to move it elsewhere such as to lend it to households and businesses. Finally, the ECB also lowered its marginal lending facility rate from 0.75% to 0.4%.

All of these measures are aimed at boosting inflation in the Eurozone alongside indirectly encouraging lending. May’s Eurozone-wide inflation reading came in lower than expected on Tuesday morning at 0.5% per year while the ECB yesterday lowered its forecasts for inflation to 0.7% in 2014, 1.1% in 2015, and 1.4% in 2016. It also cut its growth forecasts to 1% in 2014 while increasing it for 2015 to 1.7%.

Finally, the ECB announced it would be offering banks long term loans at cheap rates (TLTROs). Mario Draghi in his press conference also said that the ECB would consider further unconventional measures if the need arose – i.e. inflation continued to move lower or remained low. This hint that the door is open to quantitative easing will stay in the back of all market participants’ mind alongside Draghi’s statement of “Are we finished? No.”

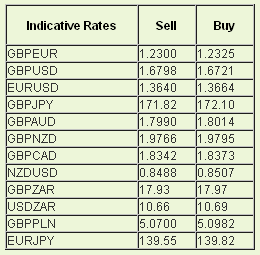

In terms of the price action, the euro was sold off on the initial policy announcement and suffered further losses during Draghi’s press conference with EUR/USD eventually hitting a low of 1.3504. GBP/EUR meanwhile hit a high of 1.2398 – its highest level in almost 18 months. Despite these initial moves, the euro rallied back over the course of the afternoon with it finishing higher for the day against most currencies including the dollar.

Earlier in the day, the Bank of England surprised no one by keeping the main interest rate unchanged at 0.5%. The market is expecting interest rates to begin to rise in January/February 2015 while a survey of economists is predicting the base rate will be 1% by Q3 2015. Meanwhile in the US yesterday, Initial Jobless Claims came in a touch worse than expected at 312,000, up from the previous week’s 304,000.

For all of yesterday’s excitement from Europe, besides Goods Trade balance data from the UK out at 0930, today is all about the other side of the Atlantic. We have Nonfarm Payrolls from the US at 1330 which is expected to come in at an increase of 218,000, lower than last month’s impressive 288,000. If it comes in at or above expectations, it’ll be a solid figure which supports the notion that US growth is starting to accelerate and the Fed will keep on tapering. Having said that, earlier in the week the ADP Employment Report showed private sector employment increasing by 179,000, a fair bit lower than the expected 210,000.

Their Canadian neighbours release their own employment data simultaneously with 25,000 jobs expected to have been added in the month of May, with the unemployment rate staying at 6.9%.