Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

It was a strange day yesterday with the ECB printing over EUR500bn and loaning them to banks and markets doing very little while a few short words from the Chairman of the Federal Reserve saw large shifts in the FX space.

The ECB’s quantitative easing plan is ambitious to say the least and yesterday they lent a further EUR529bn to the European banking sector. A liquidity crunch such as the one the world went through in the post-Lehman landscape has been averted but the question remains, as it does with all QE plans it seems, as to whether this will benefit the real economy. Readers of this update sat in businesses large and small will know that obtaining credit from the banking sector is still very difficult at the moment. It is more difficult in Europe with demand and supply both being affected. As with all the easing programmes that we have seen from the US to Europe, they are not long-term fixes but merely a painkiller, an anaesthetic against the labour pains of fiscal contraction and therefore more must be done by the people in power in Europe. We do think that this will be the last liquidity operation by the ECB for a while, unless we see some sort of unexpected negative from sovereign markets.

The market reaction was muted after the announcement with traders here and elsewhere unsure as to how to play it. Markets were very messy as they digested the data with lifts seen in gold, oil, silver and peripheral government bonds in the minutes after publication. The euro remained resilient however, until Ben Bernanke began his Humphrey-Hawkins testimony on Capitol Hill.

The Chairman’s overall tone and speech was downbeat compared to previous testimonies and certainly when held up against recent positive data from the States. The lack of any language surrounding further monetary stimulus for the US economy was the main cause of a general risk-off shift in asset classes with GBPUSD slipping having got within touching distance of 1.5990 and EURUSD is back into 1.33s. As a result GBPEUR has managed to climb back into the mid-1.19s following its little trip below 1.18 for the past week; I know a lot of people will be looking for further gains but we think they will remain hard-fought and hoping for price actions in the 1.22s is dangerous.

As it is the first of a new month – isn’t 2012 going quickly already – it is a day to focus on the manufacturing sector. China’s manufacturing sector expanded for the 3rd month in a row and at the fastest rate since September of last year. EU manufacturing is expected to remain below 50.0 and therefore in contraction in February whilst the UK number should remain positive.

Recent data from the sector has been positive with the latest CBI survey showing that total orders rose to the highest since August and the export component hit the strongest level in the survey’s 35 year history. While this series is typically volatile it suggests that the 0.8% contraction in manufacturing output through Q4 was merely a blip. The EU number is due at 09.00, the UK’s is at 09.30 and the US ISM measure is released at 15.00

It would of course not be a week without an EU summit either and one starts today in Brussels.

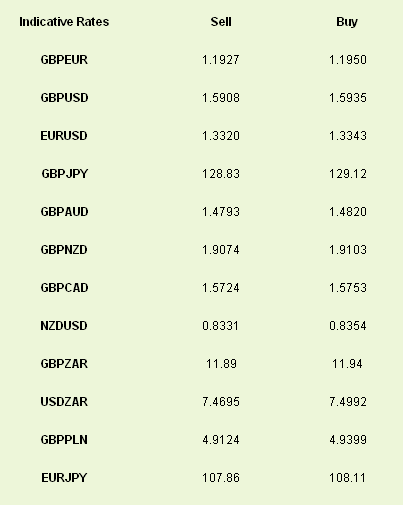

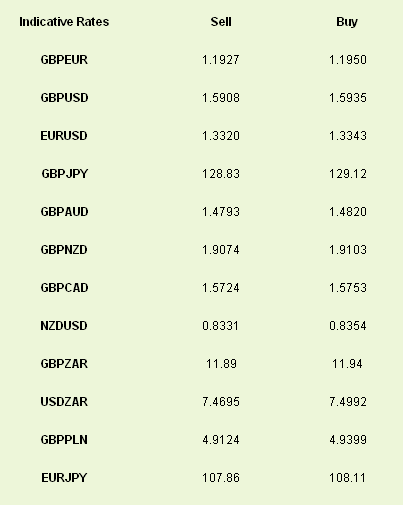

Latest exchange rates at time of writing

The ECB’s quantitative easing plan is ambitious to say the least and yesterday they lent a further EUR529bn to the European banking sector. A liquidity crunch such as the one the world went through in the post-Lehman landscape has been averted but the question remains, as it does with all QE plans it seems, as to whether this will benefit the real economy. Readers of this update sat in businesses large and small will know that obtaining credit from the banking sector is still very difficult at the moment. It is more difficult in Europe with demand and supply both being affected. As with all the easing programmes that we have seen from the US to Europe, they are not long-term fixes but merely a painkiller, an anaesthetic against the labour pains of fiscal contraction and therefore more must be done by the people in power in Europe. We do think that this will be the last liquidity operation by the ECB for a while, unless we see some sort of unexpected negative from sovereign markets.

The market reaction was muted after the announcement with traders here and elsewhere unsure as to how to play it. Markets were very messy as they digested the data with lifts seen in gold, oil, silver and peripheral government bonds in the minutes after publication. The euro remained resilient however, until Ben Bernanke began his Humphrey-Hawkins testimony on Capitol Hill.

The Chairman’s overall tone and speech was downbeat compared to previous testimonies and certainly when held up against recent positive data from the States. The lack of any language surrounding further monetary stimulus for the US economy was the main cause of a general risk-off shift in asset classes with GBPUSD slipping having got within touching distance of 1.5990 and EURUSD is back into 1.33s. As a result GBPEUR has managed to climb back into the mid-1.19s following its little trip below 1.18 for the past week; I know a lot of people will be looking for further gains but we think they will remain hard-fought and hoping for price actions in the 1.22s is dangerous.

As it is the first of a new month – isn’t 2012 going quickly already – it is a day to focus on the manufacturing sector. China’s manufacturing sector expanded for the 3rd month in a row and at the fastest rate since September of last year. EU manufacturing is expected to remain below 50.0 and therefore in contraction in February whilst the UK number should remain positive.

Recent data from the sector has been positive with the latest CBI survey showing that total orders rose to the highest since August and the export component hit the strongest level in the survey’s 35 year history. While this series is typically volatile it suggests that the 0.8% contraction in manufacturing output through Q4 was merely a blip. The EU number is due at 09.00, the UK’s is at 09.30 and the US ISM measure is released at 15.00

It would of course not be a week without an EU summit either and one starts today in Brussels.

Latest exchange rates at time of writing