For the 24 hours to 23:00 GMT, the EUR rose 0.36% against the USD and closed at 1.0577, after the European Central Bank (ECB) President, Mario Draghi, struck a more optimistic tone on the Euro-zone’s economic recovery.

The ECB, in its latest monetary policy meeting, left the key interest rate unchanged at 0.00%, as widely expected and pledged to keep its unprecedented stimulus in place at least until the end of the year. In a post meeting statement, the ECB President, Mario Draghi, stated that the governing council does not expect to loosen monetary policy further to prop-up growth and inflation in the common currency region. Additionally, the central bank raised its forecasts for economic growth and inflation for this year and next, and now expects growth of 1.8% in 2017 and 1.7% in 2018, compared with earlier forecasts of 1.7% and 1.6%, respectively. Also, the bank sharply raised its inflation projection for this year to 1.7%, from 1.3% estimated in December.

In the US, data indicated that new claims for jobless benefits advanced more-than-expected to a level of 243.0K in the week ended 04 March 2017, compared to a reading of 223.0K in the previous week, while markets anticipated it to advance to a level of 238.0K. Moreover, the nation’s export price index rose more-than-anticipated by 0.3% MoM in February, compared to a revised gain of 0.2% in the prior month. Also, the import price index increased more-than-estimated by 0.2% on a monthly basis in February, after rising by a revised 0.6% in the previous month.

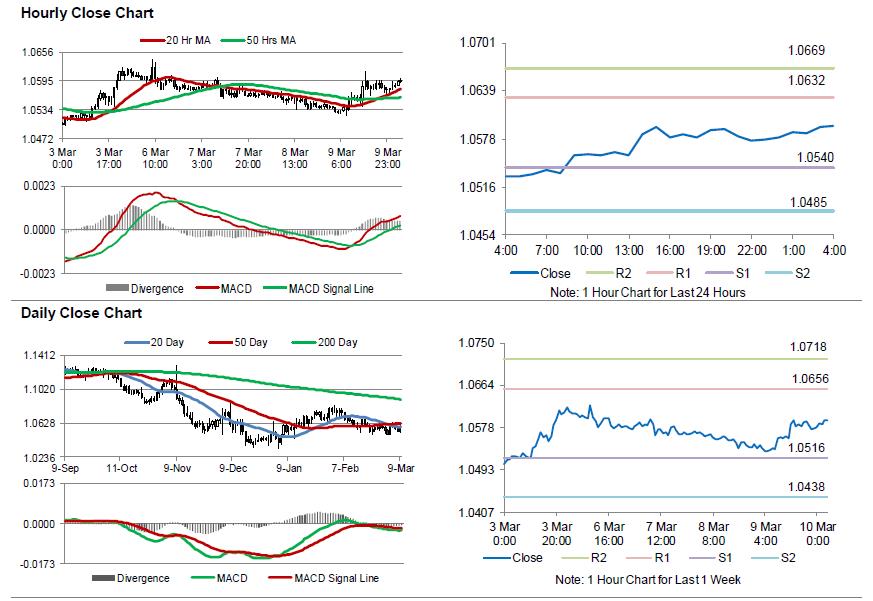

In the Asian session, at GMT0400, the pair is trading at 1.0594, with the EUR trading 0.16% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0540, and a fall through could take it to the next support level of 1.0485. The pair is expected to find its first resistance at 1.0632, and a rise through could take it to the next resistance level of 1.0669.

Looking ahead, investors will concentrate on Germany’s trade balance figures for January, scheduled to release in a few hours. Moreover, traders would eye crucial economic releases in the US, consisting of non-farm payrolls and unemployment rate, both for February along with monthly budget statement for February, slated to release later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.