ECB Interest Rate Decision

- ECB is to announce its interest rate decision today and is widely expected to remain on hold at 0.00%. Currently, EUR OIS imply a probability for ECB to remain on hold at 98.39%. Market focus is expected to shift to the accompanying statement and the following press conference. We see the case for the statement to sound a bit more cautious and a bit less upbeat as recent financial data were quite soft. Should there be a more dovish tone we could see the EUR weakening.

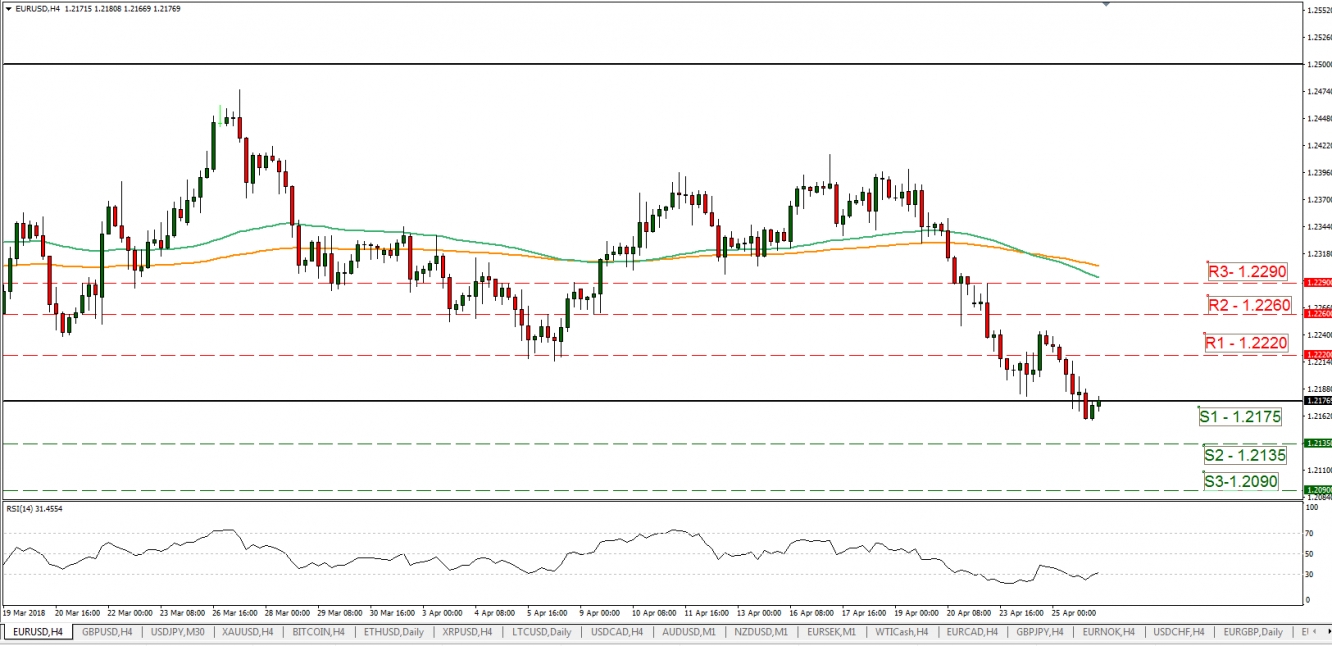

- EUR/USD dropped further yesterday breaking the 1.2175 (S1) support line, however, corrected somewhat during today’s Asian morning. We see the case to continue in a bearish market as the ECB interest rate decision could weaken the EUR side, while on the other hand, the USD side seems to be still enjoying a positive momentum. Should the bears continue to be in the driver’s seat we could see the pair breaking the 1.2175 (S1) support line and aim if not break the 1.2135 (S2) support level. Should the bulls take the reins we could see the pair breaching the 1.2220 (R1) resistance line.

BoJ Interest Rate Decision

- Bank of Japan will announce its interest rate decision during the Asian morning on Friday and is widely expected to remain on hold at -0.10%.Currently, JPY OIS imply a probability for BoJ to remain on hold at 91.62%. Softening inflation data, household spending and weak wage growth also support the argument to remain on hold. Market focus is expected to shift to the accompanying statement, however, no surprises are expected. The key issue seems to be if the BoJ will continue to project the inflation rate hitting its target of +2.0% yoy in 2019 or not. Should there be a rather dovish tone we could see the JPY weakening.

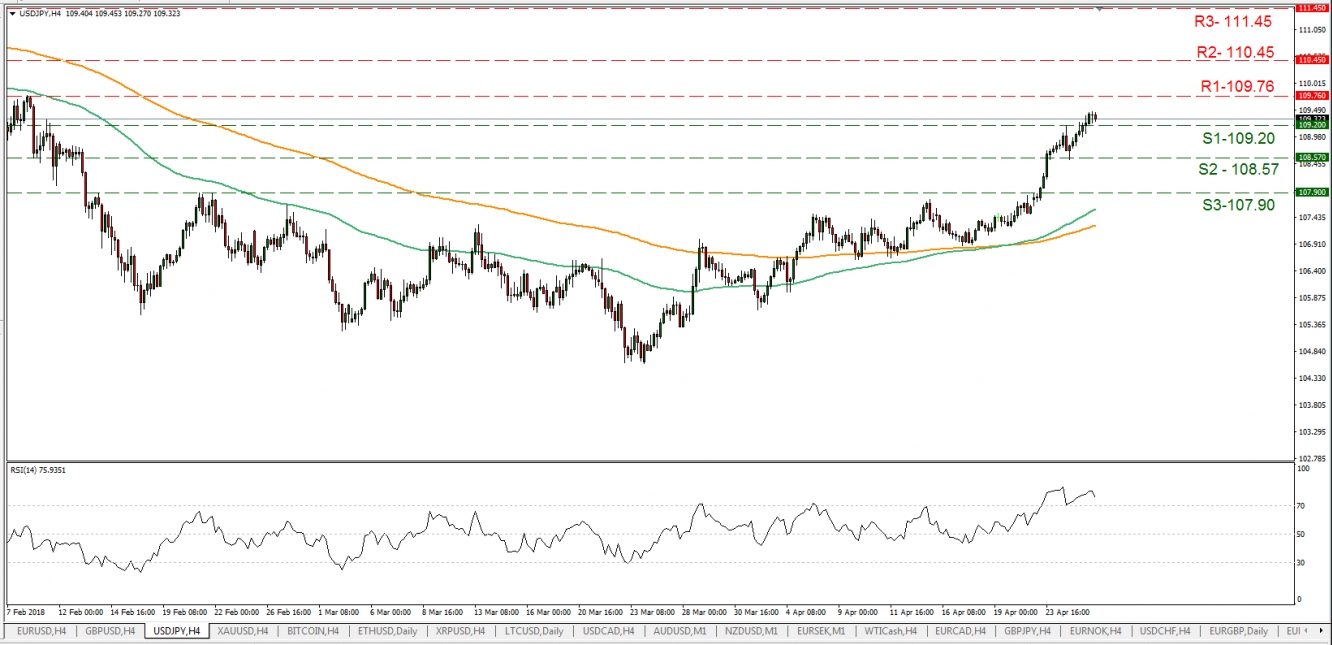

- USD/JPY rose yesterday breaking the 109.20 (S1) resistance level (now turned to support). We could see the pair continuing its rise today as the market positions itself ahead of the BoJ interest rate decision. Should the pair find fresh buying orders along its path we could see it breaking the 109.76 (R1) resistance level and aim for the 110.45 (R2) resistance barrier. Should it come under selling interest, we could see it breaking the 109.20 (S1) support level and aim for the 108.57 (S2) support barrier.

In today’s other economic highlights:

- During today’s European session we get Germany’s GfK Consumer Sentiment for May and Sweden’s interest rate decision which is expected to remain on hold at -0.50% and could weaken the krona. In the American session we get the headline and core durable goods orders for March, the preliminary Goods Trade Balance figure for March and the initial jobless claims figure. Also please be advised that the Board of the Czech National Bank will have a meeting today.

EUR/USD

·Support: 1.2175 (S1), 1.2135 (S2), 1.2090 (S3)

·Resistance: 1.2220 (R1), 1.2260 (R2), 1.2290 (R3)

USD/JPY

·Support: 109.20(S1), 108.57(S2), 107.90(S3)

·Resistance: 109.76(R1), 110.45(R2), 111.45(R3)