Key Points:

- DE IFO Business Climate rises to 110.5.

- Growing inflationary outlook for Germany.

- ECB’s path on monetary policy complicated by two-speed economy.

Germany has largely been seen as the economic powerhouse of the Eurozone over the past few years as the economy continues to expand and confirm a growing positive sentiment. Until recently, this has been a relatively welcome development by the ECB. However, the central bank is now nearing a critical juncture for its monetary policy which is significantly complicated by what is rapidly becoming a two speed economy.

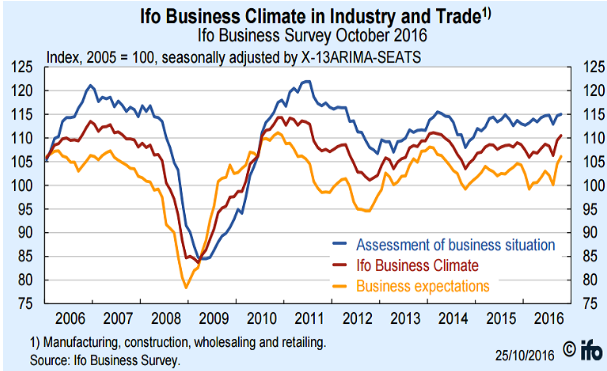

The latest German business confidence figures for October gain highlight the large divide between the various EU member states. The Munich based IFO institute has just released the latest round of the DE Business Climate Index results which demonstrated another expansion to 110.5 (109.50 prev). In addition, both the Services and Manufacturing PMI’s also proved robust at 54.1 and 55.1 respectively for October.

Subsequently, the German economic machine continues to march on and while it most definitely supports the Eurozone economy, it poses a unique challenge to the ECB. As Germany expands, the rest of Europe is largely still in the doldrums and the need for expansionary monetary policy is relatively strong.

This means that the ECB is faced with a difficult choice of expanding or continuing their QE program to support the broader Eurozone or restraining any additional purchases to stop growth accelerating too far within Germany.

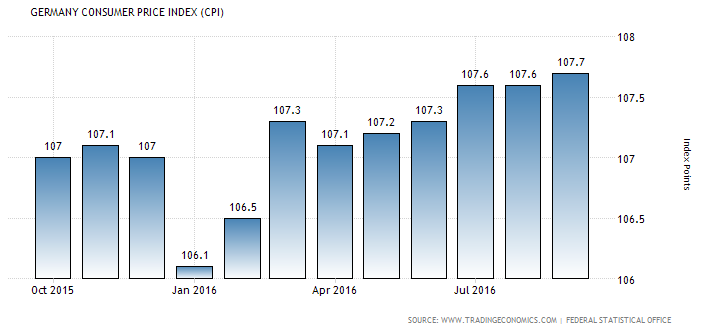

Although, German inflation still remains below the target range, there is very clearly a trend of building inflationary pressures that will eventually need to be managed appropriately. This may also lead to additional upward moves within the DE GDP results in the final quarter of 2016. The two-speed nature of the economy therefore dictates plenty of friction between the Bundesbank and other ECB member banks.

Subsequently, as the divergence continues to be exacerbated by ECB policy, you can expect the acrimony between the various states to grow which only further complicates the way forward for the European Union. How this will assist the ECB in attaining their near term inflation goals is unclear but the ongoing argument around German centrism within Europe will only continue to grow in the ensuing period.