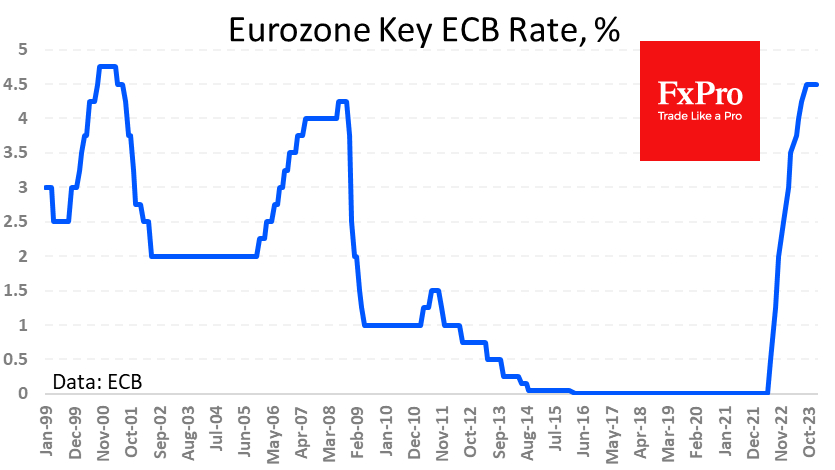

The European Central Bank left monetary policy unchanged, keeping the key rate at 4.5% since September. Much of the focus of the Q&A session revolved around the timing of the first decline, with commentators trying to figure out whether June was indeed the most likely date. Meanwhile, money markets are pricing 0.5 percentage points cut by this date.

At the same time, in an official commentary on the decision, the ECB expressed confidence in the downward trend in inflation, linking the latest acceleration with the base effect and expected changes in Germany’s calculations. Simply put, inflation dynamics are developing in accordance with previously announced forecasts.

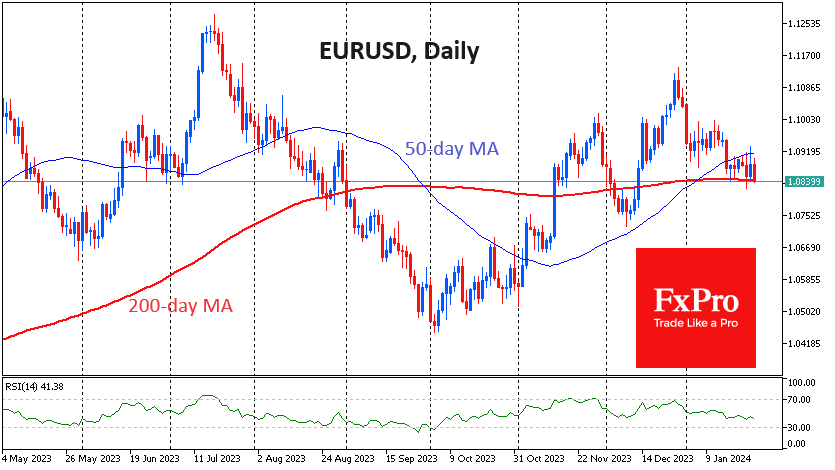

This is moderately bad news for the single currency, which lost up to a third of a per cent against the dollar after the publication of the rate decision. Against the pound, the euro fell for the fifth week in a row, finding itself near the lows of last year. The EURUSD weakening trend continues for the same amount of time.

The single currency's weakness stems from relatively sluggish economic activity, with declining output and stagnant retail sales, contrasting with positive inflation and PMI surprises in the US and UK.

The EURUSD is currently trading near the 1.0850 level, near which the important 200-day moving average is also located. It has been holding back the euro's decline since last Wednesday, and it is worth paying increased attention to whether it will be able to stay above it in the future.

A dip below could intensify the sell-off with immediate targets at 1.07 and further lower towards 1.05. If euro bulls manage to defend important levels against the dollar and pound, a reversal to an upward trend could become a significant medium-term trend.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ECB Dovish Assurance Hurts Euro

Published 01/25/2024, 10:48 AM

Updated 03/21/2024, 07:45 AM

ECB Dovish Assurance Hurts Euro

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.