Market movers today

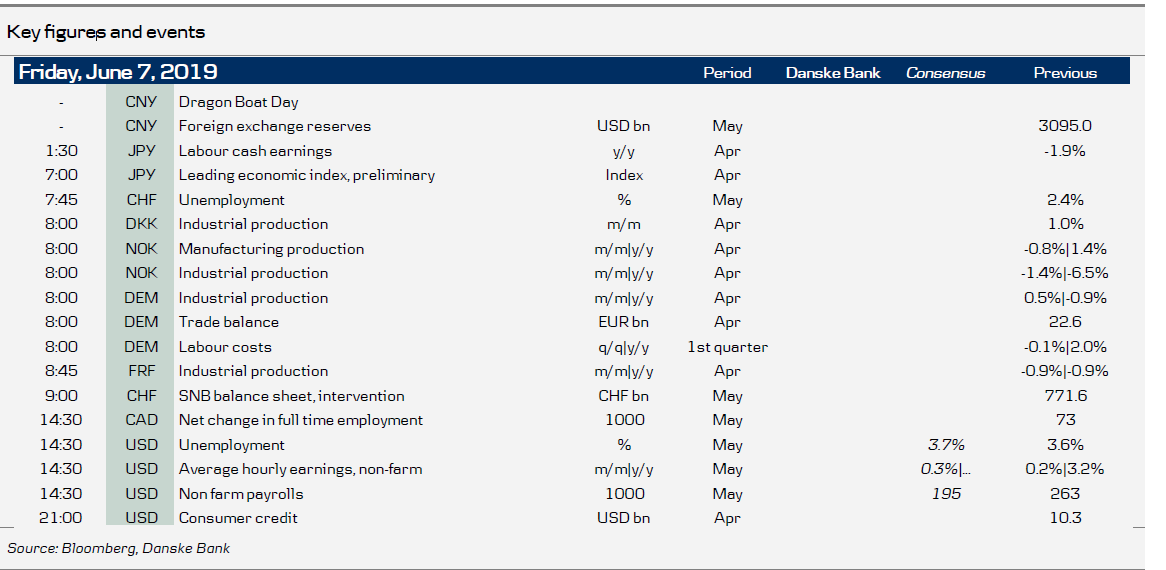

Today's highlight will be the US labour market report. The wage growth figures will be in focus as many FOMC members have opened up for a change in the policy rate during the past days.

In the European space, the French and German industrial production figures will take centre stage. German prints have recently been bad and are particularly important in order to see whether the verge between hard and soft data starts to close or it remains wide. Furthermore, markets will digest yesterday's ECB meeting, where focus will also be on the inflation market pricing which suffered late yesterday.

Today and during the weekend the US-Mexico tariff war will gain focus as Trump has threatened to put a 5% tariff on Mexican goods starting Monday. Mexico wants a delay 'as negotiations advance'.

We also get the Norwegian GDP figure for April and manufacturing production (see next page).

Selected market news

The ECB yesterday joined the camp of central banks looking at easing monetary policy to fend off moderation in economic growth and declining inflation expectations. At the meeting the ECB extended its forward guidance to "at present levels at least through H1 2020" and Draghi also acknowledged on the subsequent press conference that a possible rate cut or restart of QE as a contingency tool had been discussed at the meeting. Yet, it was not as dovish as expected by markets given the market pricing of an almost 50/50 chance of a 10bp cut already in September. As a result, the EUR/USD and the front-end of the euro curve moved higher. The announced TLTRO3 modalities were broadly as expected. The new staff projections were broadly unchanged, leading to an unchanged baseline narrative, although the external environment posed a more prominent risk than previously. Markets are still pricing a 10bp rate cut by summer next year, for more details see, ECB not delivering to market expectations .

Yesterday, US president Trump said that he will decide whether to enact tariffs on another USD 325 billion of Chinese imports after the Group of 20 summit at the end of the month in Japan, where President Trump is expected to meet with Chinese President Xi Jinping. In a taped interview with Fox News the US president also said that China wanted a deal and predicted the two sides would definitely reach agreement. Meanwhile, the governor of The Peoples Bank of China stressed yesterday that China has a lot of options to stimulate its economy, including cutting interest rates and the required reserve ratio rate, as well as stimulating the economy through fiscal measures. For our latest take on the difficult US-China trade discussion, please see yesterday's China Weekly Letter - Are we heading for an all-out trade war? .

Scandi markets

In Norway, the GDP figures for April will finally be adjusted for supply-side effects from power and fisheries, and we expect an increase of 0.3% m/m, which will indicate continued above-trend growth. Manufacturing production has surprised to the downside lately, and based on the PMI we are looking for a rebound in April, expecting manufacturing production to grow 0.5 % m/m.

Fixed income markets

The ECB statement and press conference was a disappointment for the front-end of the curve that jumped some 4bp. However, importantly Draghi did mention the possibility of rate cuts or restarting QE as a contingency tool. There is now priced 8bp of cut on a 12M horizon. See our ECB review here.

In respect of the long-end we doubt that Draghi will trigger a Bund sell-off despite the move higher in short-rates. First of all, the risk is still skewed towards a future rate cut given the prominent risks lurking on the horizon. Secondly, Draghi did very little to lift inflation expectations that trade close to an all-time low with 5y5y EUR inflation as low as 1.24% after the meeting. Hence, yesterday’s flattening of the German curve 2s10s and 5s10s could very well continue over the next couple of weeks dependent on risk-appetite. The higher EUR/USD also adds further downside for eurozone inflation.

The conclusion from yesterday is that a significant part of the EGB market will continue to trade with negative yields for an extended period. Hence, the hunt for positive yields in periphery markets are set to continue. Note that 10Y France is also fast approaching negative territory after some very strong auctions yesterday. The latter could increasingly push Japanese investors towards higher yielding Spain.

Today, the attention turns to non-farm payrolls where the market is probably prepared for a weaker number after the weak ADP (NASDAQ:ADP) report this Wednesday.

FX markets

ECB turned its back on the dovishly priced market and the market reacted by appreciating the EUR and lowering inflation expectations. As for EUR/USD, it is now faced with a Fed ready to cut rates and an ECB who has only started discussing easing. That should keep positive EUR/USD momentum going. We forecast EUR/USD at 1.15 in 6M. A sound US jobs report could temporarily weigh on EUR/USD though, but it should not derail the outlook for a summer Fed rate cut.

In the Scandies, external developments have been key in driving NOK for some time. That said we now face a key couple of sessions in terms of domestic data releases: first today’s GDP and manufacturing production and then Tuesday’s blockbuster set with inflation and the Regional Network Survey due. We expect this data package to support the case for a June rate hike which is only priced at slightly more than 50/50. Relative rates have admittedly had less of an impact on the NOK in recent months. However, as long as the NOK remains weak and domestic data strong that will just underpin the case for additional rate hikes and likely at some point reach a pivotal carry level as NOK surpasses the carryattractiveness of AUD, NZD and CAD. For more on pivotal carry and our view on NOK please see NOK see FX Strategy – Why is the NOK so weak?, 28 May 2019.