Central banks still have the ability to surprise the markets as we were reminded yesterday. The Federal Reserve’s decision to keep asset purchases going in September was a great example. Yesterday the ECB called a play from the same playbook. The decision to do so, however, was unlike that of the Federal Reserve in that it stemmed from, in our eyes, panic as opposed to caution.

The 0.25% cut in the ECB’s refinancing rate seems to have come as a response to last week’s desperate fall in inflation to an all-time low. We tend to look at blended inflation – over the course of the past few months – to discount for potential one-off slip ups. Combined with the fact that the ECB is releasing updated economic estimates in December, it was perhaps too obvious that next month would herald their move. Something has scared the horses in Frankfurt, and looking forward to next week’s data calendar, we have to focus on Thursday’s GDP announcement. The market is looking for a 0.1% increase; yesterday’s decision limits our shock should the figure turn out to be negative.

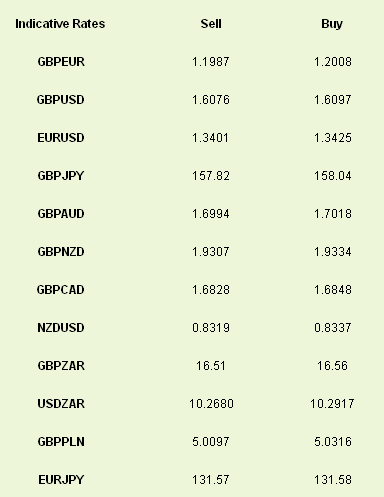

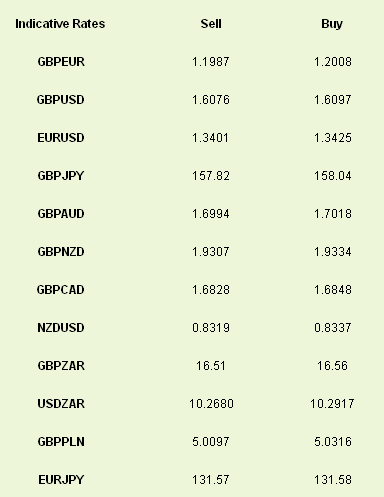

Euro naturally took a bath after the announcement, with GBP/EUR back above the 1.20 level for the first time since Jan 17, while EUR/USD briefly traded below the levels seen before the Fed’s surprise extension of QE at current levels in September.

Further euro weakness has occurred this morning as France has been downgraded by the ratings agency S&P. The attached statement argued that “the downgrade reflects our view that the French government’s current approach to budgetary and structural reforms to taxation, as well as to product, services, and labour markets, is unlikely to substantially raise France’s medium-term growth prospects,”

“Moreover, we see France’s fiscal flexibility as constrained by successive governments’ moves to increase already-high tax levels, and what we see as the government’s inability to significantly reduce total government spending.” We view this as old news and therefore expect limited fallout from the decision.

Yesterday’s other central bank decision was obviously lost in the noise but will have been impacted by the ECB’s decision. The Bank of England left rates and QE exactly where they were and we expect to see some form of acknowledgement from them next Wednesday at the Quarterly Inflation Report that the UK economy is healing itself faster than it had originally thought. Participants in yesterday’s central banks webinar will know our timeline for a raise in rates here in the UK sits in March 2015 – a full year earlier than the Bank of England is looking for. The ECB will have helped the Bank keep interest rates lower however.

We now have an ECB with a lower “main” rate than the BOE for the first time since 2008. This divergence of monetary policy – a “cutting” ECB and a “hiking” BOE – should engender a higher GBP/EUR rate and bring with it a lower CPI rate via lower imported inflation. Lower inflation means less pressure on rates in the short term. That’s our thinking anyway.

Non-Farm Friday is rarely overshadowed but today’s could easily be. As we said on Wednesday, we forecast that payrolls on Friday will rise by 141k; above the 120k market consensus. The survey has its normally wide spread of predictions; the low is 50k, the high is 175k. The downward move this month should be cancelled out in November’s numbers; the crucial part will be by how much? A 200k figure in next month’s release will balance the tapering argument very delicately between December and March.

Yesterday’s GDP report showed an economy that hit the shutdown with a bit more momentum than most had thought. GDP for Q3 was released at 2.8% vs. 2.0% although a large portion can be attributed to inventory building – no help for those looking for a longer-term, strong recovery.

The 0.25% cut in the ECB’s refinancing rate seems to have come as a response to last week’s desperate fall in inflation to an all-time low. We tend to look at blended inflation – over the course of the past few months – to discount for potential one-off slip ups. Combined with the fact that the ECB is releasing updated economic estimates in December, it was perhaps too obvious that next month would herald their move. Something has scared the horses in Frankfurt, and looking forward to next week’s data calendar, we have to focus on Thursday’s GDP announcement. The market is looking for a 0.1% increase; yesterday’s decision limits our shock should the figure turn out to be negative.

Euro naturally took a bath after the announcement, with GBP/EUR back above the 1.20 level for the first time since Jan 17, while EUR/USD briefly traded below the levels seen before the Fed’s surprise extension of QE at current levels in September.

Further euro weakness has occurred this morning as France has been downgraded by the ratings agency S&P. The attached statement argued that “the downgrade reflects our view that the French government’s current approach to budgetary and structural reforms to taxation, as well as to product, services, and labour markets, is unlikely to substantially raise France’s medium-term growth prospects,”

“Moreover, we see France’s fiscal flexibility as constrained by successive governments’ moves to increase already-high tax levels, and what we see as the government’s inability to significantly reduce total government spending.” We view this as old news and therefore expect limited fallout from the decision.

Yesterday’s other central bank decision was obviously lost in the noise but will have been impacted by the ECB’s decision. The Bank of England left rates and QE exactly where they were and we expect to see some form of acknowledgement from them next Wednesday at the Quarterly Inflation Report that the UK economy is healing itself faster than it had originally thought. Participants in yesterday’s central banks webinar will know our timeline for a raise in rates here in the UK sits in March 2015 – a full year earlier than the Bank of England is looking for. The ECB will have helped the Bank keep interest rates lower however.

We now have an ECB with a lower “main” rate than the BOE for the first time since 2008. This divergence of monetary policy – a “cutting” ECB and a “hiking” BOE – should engender a higher GBP/EUR rate and bring with it a lower CPI rate via lower imported inflation. Lower inflation means less pressure on rates in the short term. That’s our thinking anyway.

Non-Farm Friday is rarely overshadowed but today’s could easily be. As we said on Wednesday, we forecast that payrolls on Friday will rise by 141k; above the 120k market consensus. The survey has its normally wide spread of predictions; the low is 50k, the high is 175k. The downward move this month should be cancelled out in November’s numbers; the crucial part will be by how much? A 200k figure in next month’s release will balance the tapering argument very delicately between December and March.

Yesterday’s GDP report showed an economy that hit the shutdown with a bit more momentum than most had thought. GDP for Q3 was released at 2.8% vs. 2.0% although a large portion can be attributed to inventory building – no help for those looking for a longer-term, strong recovery.