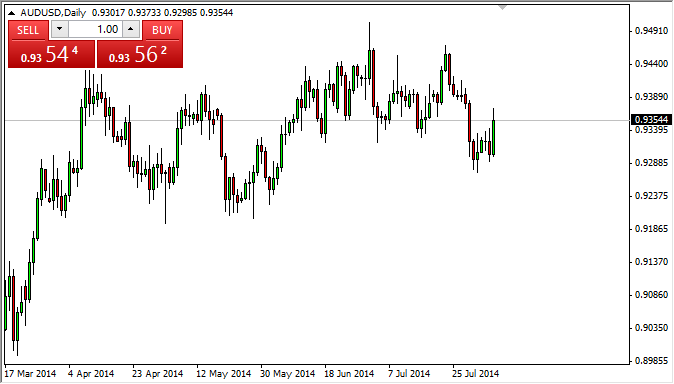

The Thursday session has plenty of news coming out, and it starts off right away with the Australians announcing their employment rate. The employment rate is anticipated to be 6%, for the month of July. The employment change is expected to be 13,200 jobs added for the same month, so of course is will have a significant influence on the AUD/USD pair. The pair is currently pressing up against the 0.9350 handle, which is the bottom of the previous consolidation area. With that, we feel that the market is in fact trying to bring back into the previous consolidation area. If we can get above the 0.9375 handle, we think that this market goes to the 0.9450 level over the course of the next day or two.

Without a doubt, the Bank of England and it’s rate decision is the next important announcement. There is no change expected, but quite frankly the Bank of England is probably closer to tightening than not. So look for the market to react to the statement more so than the actual number. We actually believe that the British pound will probably go higher anyway, because it is most certainly in a positive frame of mind at the moment. In fact, we would probably be comfortable buying the GBP/USD pair ahead of the announcement. We believe that the market has found significant support at the 1.68 handle, and is probably heading to the 1.70 handle next.

The European Central Bank is up next, and quite frankly the European economy isn’t strong enough to support any type of change. There might be hence of further monetary loosening, so that could be negative for the Euro, but the EUR/USD pair has been beaten down so much that we would more than likely wait for some type of bounce to start selling as selling here would be simply chasing the trade.

The US Initial Jobless Claims number comes out a little bit later, and is expected to be at 304,000. Any deviation from this could influence the stock markets in the US, but quite frankly since we just got the nonfarm payroll numbers lastly, we find it a bit difficult to think that this is going to be a major market mover.

The EIA Natural Gas Storage Change number comes out a little bit later, which of course can move the natural gas markets themselves. The easiest way to trade the natural gas markets is to simply sell any rally that appears. The $4.00 level continues to be massively resistive, so any type of short-term rally, we are more than willing to sell on signs of weakness.