H114 EPS up 18%; strategic review completed

Ebiquity Plc's, (EBQ) H114 results show strong growth. On revenue up 7%, underlying operating profit rose 26% and underlying diluted EPS increased 18% to 3.1p. The strategic review announced last August has now been completed and management has begun implementing its conclusions. The group’s businesses have been restructured into three segments, which should more closely address the needs of clients and future-proof the business in the increasingly complex media and marketing environment. Management has also concluded that the group’s future “can be best served in a public environment”. The group is acquiring China Media Consulting for £1.6m initial cash and £5.2m maximum cash in earn-outs.

Strong H114, FY14e EPS maintained, FY15e initiated

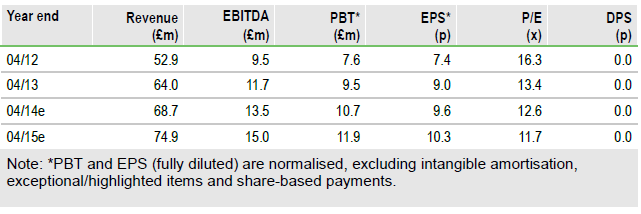

H114 revenues rose 7% to £32.7m (H113: £30.5m). Underlying operating profit (after higher central costs) grew 26% to £4.1m (H113: £3.2m) aided by higher margins in each of the three newly formed segments. While we estimate 21% H214 growth in segment operating profit, we maintain our FY14 EPS estimate as the comparative impact of group central costs is likely to suppress H2 profit growth. We initiate an FY15 estimate of £74.9m revenue and diluted EPS of 10.3p (up 7.3%).

Strategic review outcomes being implemented

While management says that some of the outcomes from the strategic review will emerge in the coming months, a number have already been implemented. The business has been restructured into three segments: Media Value Measurement (MVM), Market Intelligence (MI) and Marketing Performance Optimization (MPO). Management believes this new structure could lead to significant growth opportunities.

Valuation: On significant discount to comparators

Ebiquity’s share price rose significantly after the August 2013 announcement that the group was reviewing strategic options, which might have included a sale of the company. Now that management has concluded that the group’s future “can be best served in a public environment”, the share price may come under some short-term pressure. However, Ebiquity is trading at a significant discount to all of our suggested metrics when compared to selected proxy comparators. While near-term EPS growth is below our medium-term 15% pa projection, we contend this to be achievable through organic growth, economies of scale and further acquisitions financed by strong operating cash flow.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Ebiquity Plc: On Significant Discount To Comparators

Published 01/15/2014, 07:09 AM

Ebiquity Plc: On Significant Discount To Comparators

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.