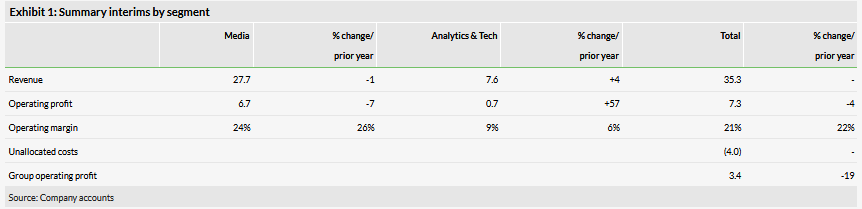

Ebiquity (LON:EBQ)’s interim figures reflect its transitional phase post the £26m AdIntel disposal, with revenues flat against the prior period on continuing business and a broadly stable operating profit margin (pre-unallocated costs). We have trimmed our FY19 and FY20 revenue expectations but maintained our operating profit forecasts. The focus is now on building operating margin through careful cost management, and consolidating and building on the group’s positioning as a trusted advisor to CMOs. The shares are priced at a clear discount to smaller marcomms companies on an EV/EBITDA basis, nearer parity on P/E.

Opportunities and challenges from market shifts

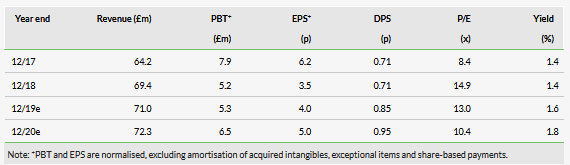

In the Media practice, a 1% revenue decrease on the prior period comprised a 3% reduction in Media Performance & Management, partly offset by 15% progress in Contract Compliance (which we estimate at around 20% of the segment). Demand from some market areas, such as FMCG, retail and automotive, reflected economic pressures, while the continuing shift of budgets to digital alters the type of support required by advertisers. However, Ebiquity (EBQ) has been gaining business from large digital players, including Deliveroo and Facebook (NASDAQ:FB), who have become large advertising spenders in their own right and use EBQ’s services such as media performance and contract compliance. Analytics & Tech practice revenues grew by 4%. EBQ is increasingly aligning its offering towards forward-looking advice and is focusing on those areas where its expertise can most effectively be leveraged, such as in analytics and digital. Its independence from media buying and trading is a clear advantage in a market where trust issues have been to the fore.

Financially strengthened

The balance sheet was notably strengthened by the AdIntel disposal (net debt of £7.0m from £27.5m at the prior year-end). EBQ is now through most of the cost duplication associated with the decoupling, but still carries additional costs related to property as it prepares to move its London head office. Savings of £1m (mostly from staff costs) are targeted on an annualised basis, largely arising in FY20.

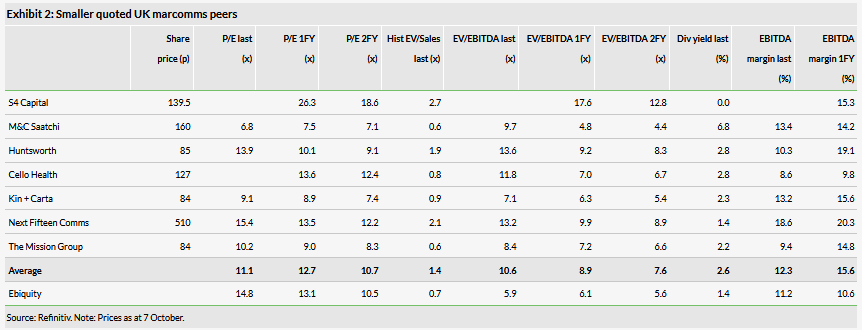

Valuation: Discount to peers

Ebiquity trades at a considerable discount to other smaller marketing services groups on an EV/EBITDA basis, albeit that they have markedly different business models. Parity across FY1 and FY2 suggests a share price of 82p, 58% above the current price. On a 12% EBITDA margin assumption for FY22–27e (a conservative scenario) and factoring in no revenue growth at all (highly unlikely) suggests a share price of 69p. Some execution risk should also be factored in.

Share price performance

Business description

Ebiquity is a leading independent marketing and media consultancy, working for 70 of the world’s 100 leading brands to optimise their media investments.

Targeting improving margins

Results by segment

Full descriptions of the business activities were given in our outlook note published on 12 April.

The largest element of the £7.0m H119 highlighted items was a £5.9m write-down of goodwill and intangibles relating to the closing of Stratigent, a loss-making marketing technology business in Chicago. We estimate that this was turning over around $4.0m (£3.2m).

Aligning the costs to the ongoing business is not simply a matter of cutting overhead, it is making sure that the costs relate to the right people in the right places, which can be a more protracted exercise. The commitments to support AdIntel post its sale to Nielsen are unwinding, although there continue to be elements of IT support for the remainder of the year. The group is also in the process of moving head office to a more flexible space near Old Street, London, which has involved an element of double running while the new office is fitted out.

Management has identified £1m of cost reduction across the business, which would principally accrue from FY20.

Group margin should also be lifted by the increase in productisation in the media practice in data processing, analysis and reporting, all of which also make the business more scalable. Efficiency in data capture from the agency (providing the benchmarking data) is now being achieved by direct upload through the ‘Connect’ tool. A new tool, "EbiquitySync", for digital benchmarking has also been developed which is being rolled out across the group.

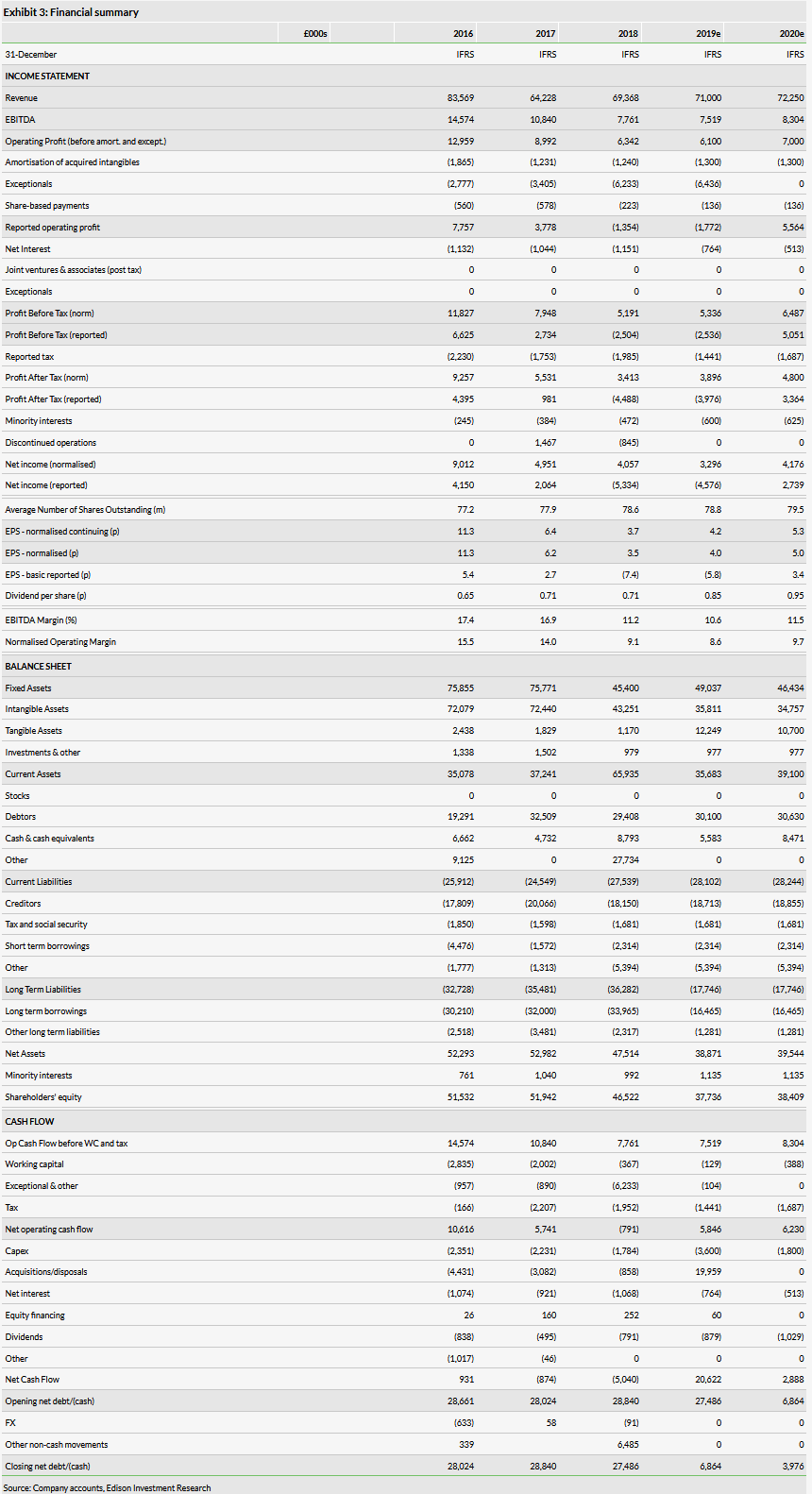

Adjustments to forecasts

H119 revenues were softer than we had been anticipating, but management’s focus on costs has enabled it to deliver operating profits in line and on track to meet expectations for the full year, ie operating margins are head of where we thought they would be. Our revised revenue forecast for FY20 assumes an underlying growth rate of around 6% (this compares to Zenith’s current global ad spend forecast of 4.4%), less the revenue previously contributed by Stratigent.

Our operating margin projections are therefore now for 8.6%, rising to 9.7% for FY20 (previously 8.1%, rising to 8.6%).

Focus on analytics, digital, US

These are the key areas for investment to drive top-line growth and improve margin. Forward-looking analytics coupled with the expertise on markets gives a strong proposition to support and advise CMOs in their decision-making. Revenue growth of the analytics business in this reporting period was held back by a large UK retailer reducing spend (due to its own difficulties) but is expected to return to double digit growth in the second half aided by expansion into France. New client wins, though, have brought some strong new names onto the roster including Volkswagen (DE:VOWG_p), a global telecoms group and a leading European airlines group.

Further investment in digital media services is an obvious need and is continuing in response to the shift of advertising away from traditional media platforms. The US is the largest advertising market and Ebiquity is under-represented on the ground. A new MD North America, Jed Meyer, was appointed in May, joining from Google (NASDAQ:GOOGL), with previous experience including time at Omnicom and at Nielsen.

Valuation

Using the same approach as in our outlook note, we have looked at Ebiquity’s valuation in comparison to a UK peer set of smaller quoted peers in the sector and also on a DCF basis.

On an EV/EBITDA basis, the shares are trading at a substantial discount in both forecast years. Parity on current year and next, averaged, suggests a share price of 82p.

As previously, we have looked at the DCF at varying margin assumptions and at varying revenue growth rates across FY22–27e, on fixed assumptions of an 8.5% WACC and terminal growth of 2%. An EBITDA margin of 12%, a shade above the 11.5% we forecast for FY20, derives an implied share price of 69p, on flat revenues. As outlined above, we do anticipate further margin expansion and flat revenues would obviously be a very disappointing outturn.