eBay Inc. (NASDAQ:EBAY) just released its fourth-quarter 2017 financial results, posting adjusted earnings of $0.59 per share and revenues of $2.61 billion. Currently, eBay is a Zacks Rank #5 (Strong Sell), and is up over 7% to 43.50 per share in after-hours trading shortly after its earnings report was released.

EBAY:

Matched earnings estimates. The company posted adjusted earnings of $0.59 per share, matching the Zacks Consensus Estimate of $0.59 per share.

Matched revenue estimates. The company saw revenue figures of $2.61 billion, which also met our consensus estimate of $2.61 billion.

EBay reported quarterly revenues that popped 9% year-over-year, driven in large part by a 10% gain in gross merchandise volume. Total GMV reached $24.4 billion in Q4.

The online marketplace giant posted a GAAP net loss of $2.6 billion in the fourth-quarter, or $2.51 per share, due to a $3.1 billion tax charge from the new Republican Tax law. On an adjusted basis, eBay posted net income of $618 million in Q4.

The company saw its active buyers jump by 5% to end its fiscal year with 170 million global active buyers.

"Q4 was a record quarter for eBay, representing the fifth quarter in a row of volume acceleration in our US Marketplace," CEO Devin Wenig said in a statement.

"We have made great progress transforming eBay while delivering meaningful growth and we expect further acceleration in 2018 as we continue to execute our strategy."

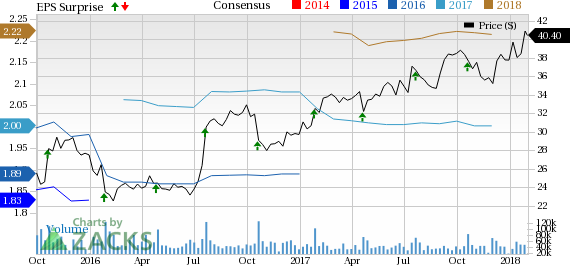

Here’s a graph that looks at EBAY’s Price, Consensus and EPS Surprise history:

eBay Inc. is a global commerce leader, which includes our Marketplace, StubHub and Classifieds platforms. Collectively, eBay connect millions of buyers and sellers around the world. The technologies and services that power platforms are designed to enable sellers worldwide to organize and offer their inventory for sale, and buyers to find and purchase it, virtually anytime and anywhere.

Check back later for our full analysis on EBAY’s earnings report!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

eBay Inc. (EBAY): Free Stock Analysis Report

Original post

Zacks Investment Research