eBay Inc. (NASDAQ:EBAY) recently partnered with Spring to offer a wide range of apparel and accessories through ebay.com. Users can browse Spring’s offerings through its storefront on eBay’s website.

The duo has agreed to put up more than 300 fresh brands on ebay.com. Currently, Spring offers clothes from more than 1,500 brands including Urban Outfitters (NASDAQ:URBN), Michael Kors, Gucci, Prada and Coach.

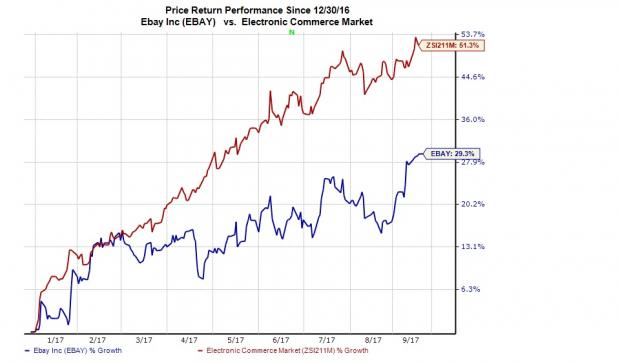

Investors will surely keep an eye on such deals to see whether these can boost eBay’s stock that has underperformed the industry year to date. It has returned 29.3% compared with the industry’s gain of 51.3%.

A Win-win Situation

The deal gives the duo an opportunity to leverage on each other’s strengths to further expand their reach. While Spring could leverage on eBay’s reimagined platform features and a huge customer base to expand its market, eBay looks to boost its Marketplace, benefiting from added selection of luxury brands.

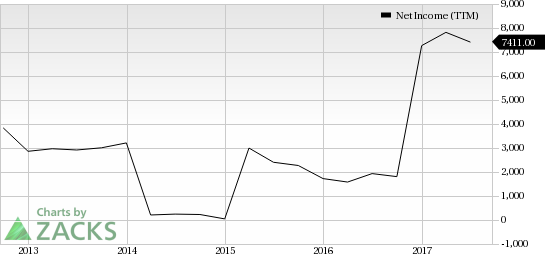

eBay Inc. Net Income (TTM)

With a similar objective in mind, eBay recently struck two major partnerships, with Facebook, Inc. (NASDAQ:FB) and Shopify Inc. (NYSE:SHOP) . The company is offering daily deals on Facebook’s Mobile Marketplace and getting access to the latter’s huge user base in return.

And with Shopify, eBay has launched a new sales channel, an integrated platform that allows Shopify sellers to synchronize inventory information, sell products ordered on eBay and view eBay buyer messages directly from Shopify accounts. This is helping eBay to gain access to sellers on Shopify sellers.

Our Take

eBay is currently re-platforming itself by building product catalogs on structured data, enhancing mobile platform, rolling out new browse inspired shopping journeys and strengthening its brand. It appears that with partnerships such as these, eBay is trying to put its replatforming efforts to gainful use.

We also believe that eBay’s accelerated partnership spree is a counter strategy against mounting competition from the likes of Amazon (NASDAQ:AMZN) , Wal-Mart (NYSE:WMT) and Alibaba (NYSE:BABA).

eBay has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Shopify Inc. (SHOP): Free Stock Analysis Report

Original post

Zacks Investment Research