eBay Inc.’s (NASDAQ:EBAY) second-quarter 2017 earnings of 34 cents per share missed the Zacks Consensus Estimate by 2 cents. Shares fell 5.19% in after-hours trading in response to the earnings miss.

Adjusted earnings per share exclude one-time items but include stock-based compensation expense.

In the quarter, increase in cost of revenues and operating expenses (predominantly sales and marketing) weighed on eBay’s bottom line.

Revenues of $2.33 billion, however, beat the Zacks Consensus Estimate by a slight margin and came ahead of the guided range.

Revenue growth was driven by strength in international markets, increase in active buyers, expansion of new user experience and brand advertising. eBay added 2 million active buyers in the second quarter taking the total to 171 million.

Management appeared to be impressed with the progress of replatforming efforts. The company continues to strengthen its core platform and improve user experience. The company accelerated its efforts by building product catalogs on structured data, enhancing mobile platform, rolling out new browse inspired shopping journeys, rejuvenating customer-to-customer (C2C) business and strengthening its brand.

In the second quarter, eBay collaborated with Shopify to allow sellers to synchronize inventory information, sell products ordered on eBay and view eBay buyer messages directly from Shopify accounts. The company partnered with Disney to offer exclusive Pirates of the Caribbean merchandise. It also rolled out nest and EGI as new brands on its platform. eBay also has extended its price matching program to the U.K. The company’s new home page has been expanded to eight geographies.

Overall, we remain positive on eBay’s replatforming and brand enhancement initiatives. Its unique capabilities backed by technological improvements give it an edge over competitors such as Etsy (NASDAQ:ETSY) , Alibaba (NYSE:BABA) and Facebook (NASDAQ:FB) .

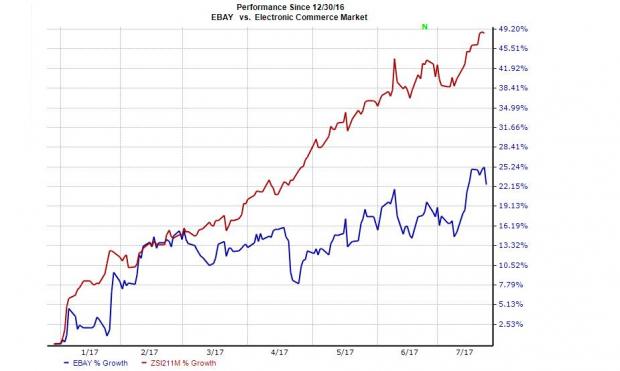

However, expected results may take some time to show up due to weak global economy, slow e-commerce growth and increasing competition. Year to date, the stock underperformed its industry, gaining only 22.5% compared with the industry’s gain of 48.4%.

Let’s delve deeper into the numbers:

Revenues

Gross revenues of $2.3 billion were up 4.4% on a year-over-year basis (up 7% on an Fx-neutral basis). In the second quarter, the Marketplace platform contributed $20.5 billion of gross merchandise volume (GMV) and $1.9 billion of revenues. Marketplace GMV grew 3% year over year on a reported basis and 6% on an FX-Neutral basis. StubHub also showed signs of accelerated growth with contribution of $1 billion of GMV, down 5% on a year-over-year basis, and revenues of $236 million, up 5% year over year.

Classifieds platforms also performed well with contribution of $219 million of revenues, up 6% year over year on a reported basis and 11% on an FX-Neutral basis.

Gross merchandise volume grew 3% year over year on a reported basis and 5% on an Fx-neutral basis to $21.5. Active buyers/customers increased 4% from the year-ago quarter.

Margins and Income

Pro-forma gross margin for the quarter was 76.2%, down 191 basis points (bps) year over year and 93 bps sequentially.

Cost of revenues increased 13.8% on a year-over-year basis primarily due to expenses associated with TicketbiS operations, incremental investments in customer support and the expansion of first-party inventory program in Korea.

Adjusted operating expenses of $1.3 billion increased 5.9% from the prior-year quarter and 11.9% sequentially. Operating margin shrank 267 bps year over year and 430 bps sequentially to 21%.

GAAP net income was $27 million (2 cents per share) compared with $437 million (38 cents per share) in the year-ago quarter.

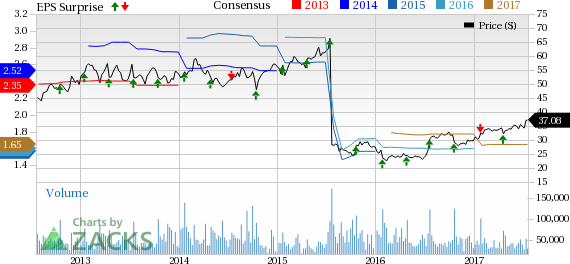

eBay Inc. Price, Consensus and EPS Surprise

Balance Sheet and Cash Flow

eBay’s balance sheet is highly leveraged, with total debt of $11.5 billion eclipsing cash and short-term investments balance of $9 billion. The company generated $699 million in cash from operating activities and spent $182 million on capex. Share repurchases were $507 million in the quarter.

Outlook

For the third quarter of 2017, eBay expects revenues to grow 6%–8% on an Fx-neutral basis to $2.35–$2.39 billion, better than the Zacks Consensus Estimate of $2.32 billion. Non-GAAP earnings are expected within 46–48 cents. The Zacks Consensus Estimate is pegged at 39 cents. GAAP earnings per share from continuing operations are expected in the range of 30–32 cents.

In 2017, eBay expects revenues to grow 6%-8% on an Fx-neutral basis to $9.3–$9.5 billion.

Zacks Rank

Currently, eBay carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

eBay Inc. (EBAY): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Etsy, Inc. (ETSY): Free Stock Analysis Report

Original post

Zacks Investment Research