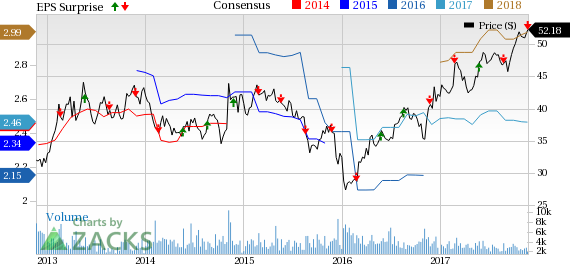

Eaton Vance Corp.’s (NYSE:EV) fourth-quarter fiscal 2017 (ended Oct 31) adjusted earnings of 70 cents per share lagged the Zacks Consensus Estimate by a penny. However, the bottom line was 23% above the prior-year quarter’s figure.

Results were adversely impacted by a rise in operating expenses. However, higher revenues, growth in assets under management (AUM) and a robust liquidity position supported earnings to some extent.

Net income attributable to shareholders was $82.1 million or 69 cents per share, up from $65.1 million or 57 cents in the year-ago quarter.

For fiscal 2017, adjusted earnings were $2.48 per share, up 16% year over year. The figure also beat the Zacks Consensus Estimate of $2.47. Net income attributable to shareholders was $282.1 million or $2.42 per share, up from $241.3 million or $2.12 per share in the year-ago quarter.

Revenues & Expenses Rise

Total revenues for the quarter amounted to $405.7 million, up 17% year over year. This upside was mainly driven by higher management fees, and distribution and service fees. However, the top line missed the Zacks Consensus Estimate of $409 million.

Total expenses increased 13% from the prior-year quarter to $267.3 million, largely due to higher compensation and related costs, fund-related expenses, distribution expenses and service fee costs.

Total operating income jumped 24% year over year to $138.4 million.

Strong Liquidity Position, AUM Improves

As of Oct 31, 2017, Eaton Vance had $610.6 million in cash and cash equivalents compared with $424.2 million as of Oct 31, 2016. Further, the company had no borrowings outstanding against its new $300 million credit facility.

Eaton Vance’s consolidated AUM climbed 26% from the year-ago quarter to $422.3 billion, reflecting net inflows of $37.8 billion and a market price appreciation of $38.2 billion. Further, the company’s acquisition of Calvert Investment Management’s business assets added $9.9 billion to consolidated AUM.

Share Repurchase

During fiscal 2017, Eaton Vance repurchased nearly 2.9 million shares of its Non-Voting Common Stock for $126.2 million under its existing repurchase authorization.

Our Viewpoint

Eaton Vance’s improving AUM along with revenue rise is likely to support its growth in the quarters ahead. However, rising expenses remain a major headwind.

Eaton Vance carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

The Blackstone Group L.P. (NYSE:BX) reported third-quarter 2017 economic net income of 69 cents per share, surpassing the Zacks Consensus Estimate of 57 cents. Improvement in revenues largely boosted earnings. However, a rise in expenses was an undermining factor.

BlackRock, Inc. (NYSE:BLK) reported third-quarter 2017 adjusted earnings of $5.92 per share, which outpaced the Zacks Consensus Estimate of $5.59. Results benefited from revenue growth, rise in AUM and steady long-term inflows. However, increase in operating expenses acted as a headwind.

Waddell & Reed Financial Inc.’s (NYSE:WDR) third-quarter 2017 earnings of 45 cents per share exceeded the Zacks Consensus Estimate of 40 cents. Higher gross sales and a decline in net outflows marginally supported the results. However, lower revenues and a rise in expenses were the undermining factors.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Waddell & Reed Financial, Inc. (WDR): Free Stock Analysis Report

The Blackstone Group L.P. (BX): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

Eaton Vance Corporation (EV): Free Stock Analysis Report

Original post

Zacks Investment Research