Have you been eager to see how Eaton Vance Corp. (NYSE:EV) performed in third-quarter fiscal 2017 (ended Jul 31) in comparison with the market expectations? Let’s quickly scan through the key facts from this Massachusetts-based investment management firm’s earnings release this morning:

Earnings Miss

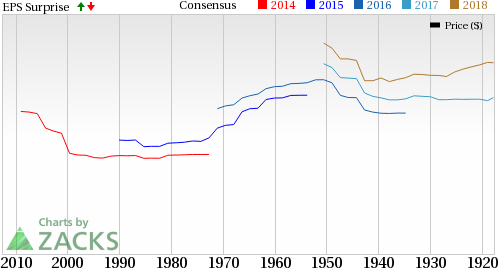

Eaton Vance came out with adjusted earnings per share of 62 cents, missing the Zacks Consensus Estimate of 67 cents.

Higher expenses were largely responsible for the earnings lag.

How Was the Estimate Revision Trend?

You should note that the earnings estimate for Eaton Vance depicted pessimism prior to the earnings release. The Zacks Consensus Estimate for the current quarter declined 1.5% over the last 30 days.

Notably, Eaton Vance doesn’t have a decent earnings surprise history. Before Q3 earnings, the company has an average negative earnings surprise of 2.6%.

Revenue Came In Lower Than Expected

Eaton Vance posted total revenue of $393.7 million, which lagged the Zacks Consensus Estimate of $400 million. Also, it compared favorably with the year-ago number of $341.2 million.

Key Statistics/Developments

As of Jul 31, 2017, assets under management (AUM) were $405.6 billion, up 21% year-over-year. Also, total net inflows amounted to $34.7 billion in the reported quarter.

During first nine months of fiscal 2017, Eaton Vance repurchased nearly 2.3 million shares of its Non-Voting Common Stock for $100.2 million.

What Zacks Rank Says

The estimate revisions that we discussed earlier have driven a Zacks Rank #3 (Hold) for Eaton Vance. However, since the latest earnings performance is yet to be reflected in the estimate revisions, the rank is subject to change. While things apparently look unfavorable, it all depends on what sense the just-released report makes to the analysts.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.

See Stocks Now>>

Eaton Vance Corporation (EV): Free Stock Analysis Report

Original post