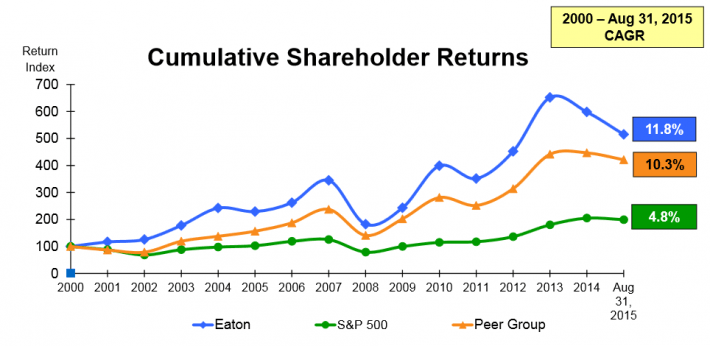

Eaton Corporation PLC (NYSE:ETN) looks cheap at first glance. The company has a price-to-earnings ratio of 11.5 and a dividend yield of 4.2%. Even better, the company has given investors better total returns than the overall market over the last 15 years:

Source: Eaton Citi Industrial Conference

Is the company truly an undervalued gem, or is there serious trouble at Eaton?

This article takes a look at the investment merit of diversified manufacturer Eaton.

Eaton was founded in 1911. The company currently has a market cap of $24.7 billion. The company’s shares have not done well over the last several months. The company’s stock price is down about 24% in the last quarter alone.

The company’s share price has fallen so far due to weakness in the industrial manufacturing industry.

Eaton operates in 2 large ‘sectors’: electrical and industrial. The electrical sector generated 61% of the company’s sales in 2014, while the industrial sector generated the remaining 39% of sale.

The electrical sector provides comprehensive solutions from power generation through to the end user. The sector is further broken down into 2 divisions:

- Products (32% of total sales)

- Systems & Services (29% of total sales)

The industrial sector operates in 3 divisions:

- Hydraulics (13% of sales)

- Aerospace (8% of sales)

- Vehicle (18% of sales)

The image below gives a visual breakdown of the company’s sectors and divisions:

Weakness is a result of the beginnings of a global economic slowdown. Hydraulic revenue fell 18% percent in the company’s most recent quarter. Revenue was down (though not as much) in all of the company’s other divisions in the quarter.

There are a myriad of factors reducing sales for Eaton. Low agriculture prices are reducing hydraulic purchases from companies like Caterpillar (NYSE:CAT). Low oil and gas prices are impacting global energy segment sales, and vehicle sales are being impacted by growth slowdowns in China and South America.

With declines in revenue across the board, you may think that Eaton saw its operating income plummet, but that is not the case. Eaton actually managed to grow operating income 3.4% versus the same quarter a year ago due to margin increases.

Recession Performance

Despite the company’s operating income growth in-the-face of recent challenges, Eaton will likely not hold up well if the global economy continues to decline.

If the global economy does enter into a full blow recession, Eaton’s earnings will very likely fall precipitously.

The company’s earnings-per-share through the Great Recession of 2007 to 2009 are shown below to illustrate this point:

- 2007 Earnings-per-share of $3.38

- 2008 Earnings-per-share of $3.42

- 2009 Earnings-per-share of $1.30 (recession low)

- 2010 Earnings-per-share of $2.73 (beginning of recovery)

As you can see, Eaton’s earnings fell substantially during the last recession. The company’s energy and industrial customers tend to hold off making purchases during recessions, which results in declining sales and earnings for Eaton.

With that said, the company did manage to remain profitable through the Great Recession – which is one of the worst global financial crises of the last century.

Dividend Analysis & Shareholder Friendliness

Eaton has paid steady or increasing dividends for 32 consecutive years. Management is very clearly committed to rewarding investors with steady or rising dividends.

Over the last decade, Eaton has compounded its dividend payments at a robust 13.6% a year. The company currently has a payout ratio of 44.7%. Eaton’s management is on record as saying that “dividends are targeted to grow in-line with future earnings growth”. I would not expect double-digit dividend growth from Eaton going forward.

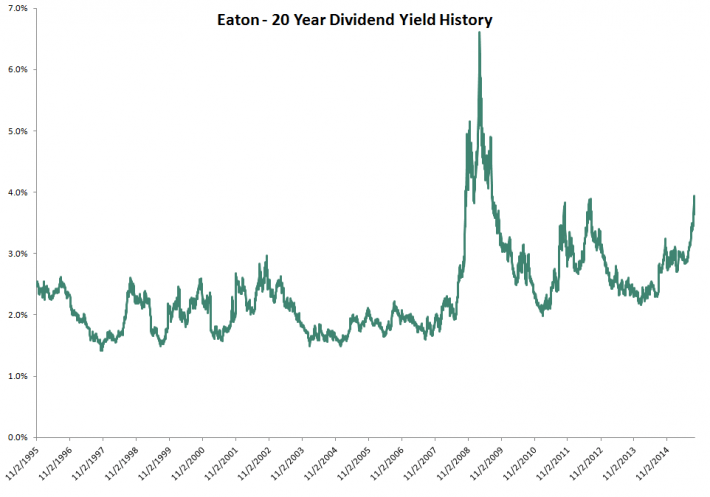

But… investors seeking current income won’t need double digit dividend growth from Eaton because the company is currently yielding 4.2%.

This is the highest dividend yield Eaton has had, excluding the period of the Great Recession in the last 20 years. The image below shows the company’s 20 year dividend history:

Eaton may not increase its dividend rapidly over the next several years, but it will reward shareholders with share repurchases. The company plans to repurchase 1% to 2% of its shares outstanding each year. These repurchased combined with the company’s current dividend yield gives investors an expected shareholder yield of between 5% and 6% a year at current prices.

Growth Prospects

Over the last decade, Eaton has compounded its earnings-per-share at 6.3% a year. This is by no means bad, but it is not stellar growth either.

Earnings growth should be slow (and possibly negative) over the next few years – especially if we enter into a global recession.

With that said, the long-term growth prospects of Eaton remain bright. The company should manage to compound its earnings-per-share at between 5% and 7% a year over full economic cycles.

This growth, combined with the company’s current 4%+ dividend yield gives investors an average expected total return of around 10% a year.

Final Thoughts

I agree with much of the conclusion reached by Stephen Simpson, CFA in a recent article he did on Eaton:

“It’s getting scary out there in the industrial sector. Patient investors might be licking their chops at the prospect of picking up very good (if not great) companies at good long-term prices, but that comes with the risk of seeing the global economy weaken even further and lead to some sizable paper losses in the meantime. If you’re a patient investor who can live with short-term underperformance, Eaton may hold some appeal; but I don’t think investors need to be in a big hurry to buy these shares.”

Investors don’t need to rush to pick up shares of Eaton, but the company is a fantastic value at current prices, both historically and compared to its peers and the overall market.

Dividend investors who can withstand volatility (especially if we do enter into another recessions) will likely do very well over the long run with Eaton. The company offers a high yield, reasonable growth, a shareholder friendly management, and is significantly undervalued at current prices. That’s a winning combination – as a result, Eaton ranks very highly.