Eastman Chemical Company (NYSE:EMN) is set to increase the selling prices of certain products. The price hike is due to elevated operating costs, especially in raw materials.

The company will raise the prices of N Propyl Acetate and N Propyl Alcohol by 5 cents per lb in both North and Latin America. Prices of Solvent Blend 8020 and 9010 will also increase by 5 cents per lb in both North and Latin America.

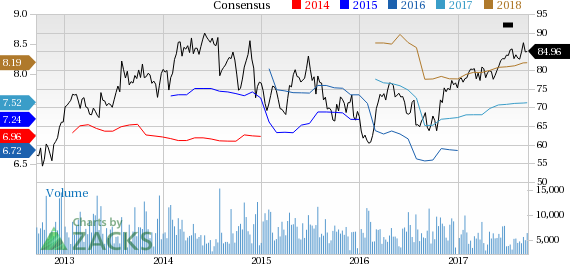

Eastman Chemical’s shares have moved up 31.1% over a year, outperforming the industry’s 27% gain.

Eastman Chemical expects to drive growth on the back of innovation and high-margin products amid an uncertain global business environment. Eastman Chemical believes that disciplined capital allocation and aggressive cost-management policies might contribute to earnings and offset challenges faced by the company in Fibers and ethylene pricing.

Factoring in strong first-half 2017 results, the company expects adjusted earnings per share for 2017 to grow 10-12% year over year, up from its earlier view of 8-12%.

Eastman Chemical remains focused on cost-cutting and productivity actions. The company aims to achieve $100 million of cost savings in 2017. The company remains committed to reduce debt and boost shareholder returns.

Eastman Chemical is also gaining from synergies of acquisitions, especially Taminco Corporation. The Taminco acquisition has provided attractive cost and revenue synergy opportunities.

However, Eastman Chemical continues to witness pricing pressure in some businesses. Lower prices of acetate tow are hurting its Fibers unit. Moreover, the company expects ethylene prices to be lower in second-half 2017 vis-à-vis the first half. As such, ethylene margins are expected to be under pressure in the second half. The company is also exposed to a volatile raw material pricing environment.

Eastman Chemical Company Price and Consensus

Zacks Rank & Key Picks

Eastman Chemical currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the chemical space are Arkema S.A. (OTC:ARKAY) , Kronos Worldwide (NYSE:KRO) and Akzo Nobel N.V. (OTC:AKZOY) .

Arkema has an expected long-term earnings growth of 12.8% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos Worldwide has an expected long-term earnings growth of 5% and flaunts a Zacks Rank #1.

Akzo Nobel has an expected long-term earnings growth of 11.1% and carries a Zacks Rank #2 (Buy).

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Download the new report now>>

Eastman Chemical Company (EMN): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Akzo Nobel NV (AKZOY): Free Stock Analysis Report

Original post