Eastman Chemical Company (NYSE:EMN) is set to increase prices of certain products in North and Latin America. The price hike, effective from Oct 1 or as contracts permit, is due to elevated operating costs, especially in raw materials.

The company will increase the price of Tri-n-butylamine and Diisopropylamine by 6 cents per lb in North and Latin America. Prices of Di-n-butylamine and Monoisopropylamine will rise by 5 cents per lb in both North and Latin America. Mono-n-butylamine’s price will be hiked by 4 cents per lb in both North and Latin America.

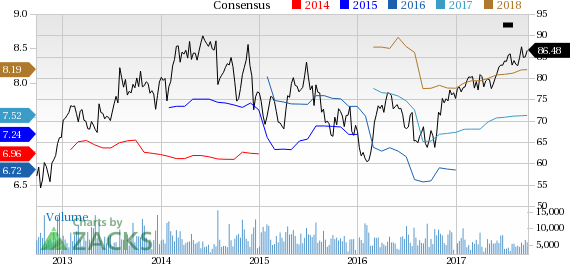

Eastman Chemical’s shares have moved up 3.3% over the past three months, underperforming the industry’s 9.7% gain.

Eastman Chemical expects to drive growth on the back of innovation and high-margin products amid an uncertain global business environment. Eastman Chemical believes that disciplined capital allocation and aggressive cost-management policies might contribute to earnings and offset challenges faced by the company in Fibers and ethylene pricing.

Factoring in strong first-half 2017 results, the company expects adjusted earnings per share for 2017 to grow 10-12% year over year, up from its earlier view of 8-12%.

Factoring in strong first-half 2017 results, the company expects adjusted earnings per share for 2017 to grow 10-12% year over year, up from its earlier view of 8-12%.

Eastman Chemical remains focused on cost-cutting and productivity actions. The company aims to achieve $100 million of cost savings in 2017. The company remains committed to reduce debt and boost shareholder returns.

Eastman Chemical is also gaining from synergies of acquisitions, especially Taminco Corporation. The Taminco acquisition has provided attractive cost and revenue synergy opportunities.

However, Eastman Chemical continues to witness pricing pressure in some businesses. Lower prices of acetate tow are hurting its Fibers unit. Moreover, the company expects ethylene prices to be lower in second-half 2017 vis-à-vis the first half. As such, ethylene margins are expected to be under pressure in the second half. The company is also exposed to a volatile raw material pricing environment.

Eastman Chemical Company Price and Consensus

Eastman Chemical Company Price and Consensus

Zacks Rank & Key Picks

Eastman Chemical currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the chemical space are Kronos Worldwide (NYSE:KRO) , Koppers Holdings Inc. (NYSE:KOP) and Arkema S.A. (OTC:ARKAY) .

Kronos has an expected long-term earnings growth of 5% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Koppers has an expected long-term earnings growth of 18% and flaunts a Zacks Rank #1.

Arkema has an expected long-term earnings growth of 12.8% and carries a Zacks Rank #2 (Buy).

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

Eastman Chemical Company (EMN): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Koppers Holdings Inc. (KOP): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Original post

Zacks Investment Research