Eastman Chemical (NYSE:EMN) saw higher profits in the second quarter of 2017, aided by its cost management actions, disciplined capital allocation and growth of high-margin products. The chemical maker recorded profit of $292 million or $2.00 per share, up roughly 15% from the year-ago figure of $255 million or $1.71.

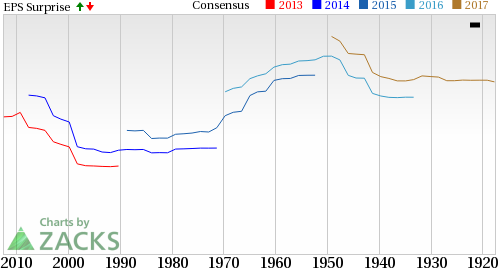

Barring one-time items, earnings were $1.98 per share for the quarter, up from $1.68 in the year ago-quarter. Earnings topped the Zacks Consensus Estimate of $1.89 per share.

Revenues rose around 5% year over year to $2,419 million in the quarter, beating the Zacks Consensus Estimate of $2,366 million.

Segment Review

Revenues from the Additives and Functional Products division went up 8% year over year to $830 million in the reported quarter. The increase was attributable to higher sales volumes and pricing for most product lines.

Revenues from the Advanced Materials unit rose 2% year over year to $657 million on increased sales volumes across the segment, including premium products.

Chemical Intermediates sales rose 11% to $703 million on the back of higher selling prices and improved competitive conditions.

Fibers segment sales fell 8% to $215 million due to lower selling prices, in particular, for acetate tow.

Financials

Eastman Chemical ended the second quarter of 2017 with cash and cash equivalents of $222 million, down roughly 8% year over year. Net debt at the end of the quarter was $6,659 million, up 1% year over year.

Eastman Chemical generated operating cash flows of $431 million during the quarter. The company returned $100 million to shareholders through share repurchases during the quarter.

Outlook

The company expects to drive growth on the back of innovation and high margin products amid an uncertain global business environment. It believes that disciplined capital allocation and aggressive cost management policies should contribute to earnings growth and help to offset challenges faced by the company in Fibers and ethylene pricing. Factoring in strong first-half results, the company now expects adjusted earnings per share for 2017 to grow 10-12% year over year, up from its earlier view of 8–12%.

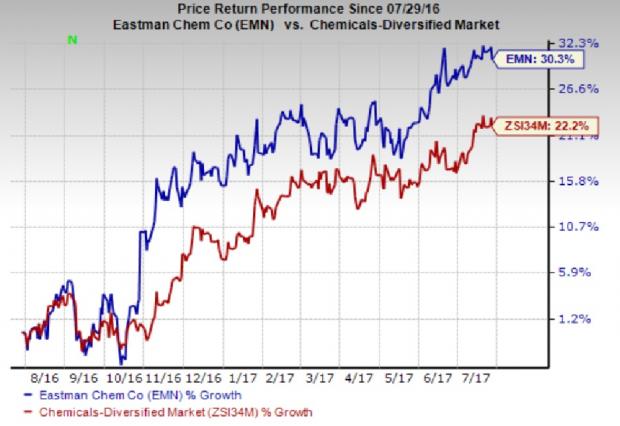

Price Performance

Eastman Chemical’s shares have rallied 30.3% over the past year, outperforming the 22.2% gain of the industry it belongs to.

Zacks Rank & Key Picks

Eastman Chemical currently carries a Zacks Rank #2 (Buy).

Other well-placed companies in the chemicals space include The Chemours Company (NYSE:CC) , Kronos Worldwide, Inc. (NYSE:KRO) and BASF SE (OTC:BASFY) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected long-term earnings growth of 15.5%.

Kronos has an expected earnings growth of 396.8% for the current year.

BASF has an expected long-term earnings growth of 8.8%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

BASF SE (BASFY): Free Stock Analysis Report

Eastman Chemical Company (EMN): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post