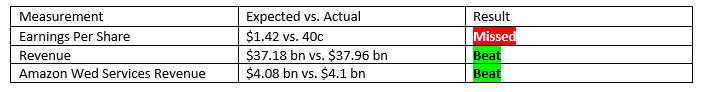

Amazon (NASDAQ:AMZN) reported a seven-quarter low for earnings, sending the stock 3% lower in after-hour trading.

The tech-leader sent a wave of bearish bets through equities, touching as far as Europe, the US and Asian markets.

It isn’t all bad news however as Amazon is a growth-focused company, and has performed well in revenue growth and market share expansion.

The tech-giant added 25% to its sales year-over-year. Profits slid as the company explores new areas such as video and international expansion.

Amazon Web Services is the company’s main growth provider, expanding 42% year-over-year and adding $916 million to its operating income cash pile.

The company is enthralled with change, buying Whole Foods last month and launching a number of Echo devices as it rivals other home voice assistant providers.

Reportedly, the company is sprawling beyond the tech sector, into pharmaceuticals and healthcare.

Over the past two years, Amazon’s stock has nearly doubled in price, leaving it a very attractive growth share for an investment portfolio amid the backdrop of a wider tech rally over the past few months.