Cybersecurity concern Palo Alto Networks Inc (NYSE:PANW) is slated to report its fiscal third-quarter earnings after market close on Monday, June 4. Palo Alto Networks stock is down 0.2% at $207.70 at last check, despite a round of bullish analyst notes yesterday. Regardless, PANW shares have a history of positive earnings reactions, and below we will take a look at what the options market is pricing in for the stock's post-earnings move.

Digging into earnings history, PANW has closed higher in the session following each of the company's last four reports, including a 17.2% jump this time last year. Widening the scope, the stock has averaged a one-day post-earnings swing of 11.5% over the past two years, regardless of direction. However, the options market is pricing in a smaller-than-usual 9.5% move this time around, per data from Trade-Alert.

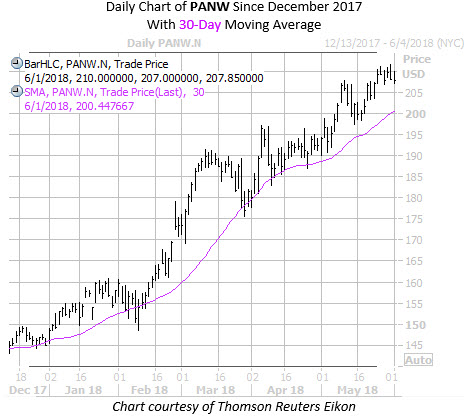

The stock has been an outperformer in 2018, just yesterday surging to a fresh record high of $211.69, while gaining over 43% year-to-date. What's more, the stock has seen healthy support from the rising 30-day moving average since mid-February. And though the options market is pricing in a smaller-than-average post-earnings move for the stock, a lift of that magnitude would put Palo Alto's share price at $227.50.

Analyst attention has been overwhelmingly optimistic on Palo Alto stock. Of the 33 analysts covering the online concern, 30 sport "buy" or "strong buy" recommendations. At the same time, PANW's average 12-month price target of $210.72 prices in almost no upside from current levels. As such, yesterday's round of price-target hikes (Raymond James led the way with a hike to $240) could indicate a future trend, as more analysts rush to raise their outlooks on the outperformer.

Sentiment has not been quite so optimistic in the options pits, however. PANW's Schaeffer's put/call open interest ratio (SOIR) of 1.06 ranks higher than 84% of all comparable readings taken in the past year. In simpler terms, this means options traders are more put-heavy than usual among contracts set to expire in three months or less.