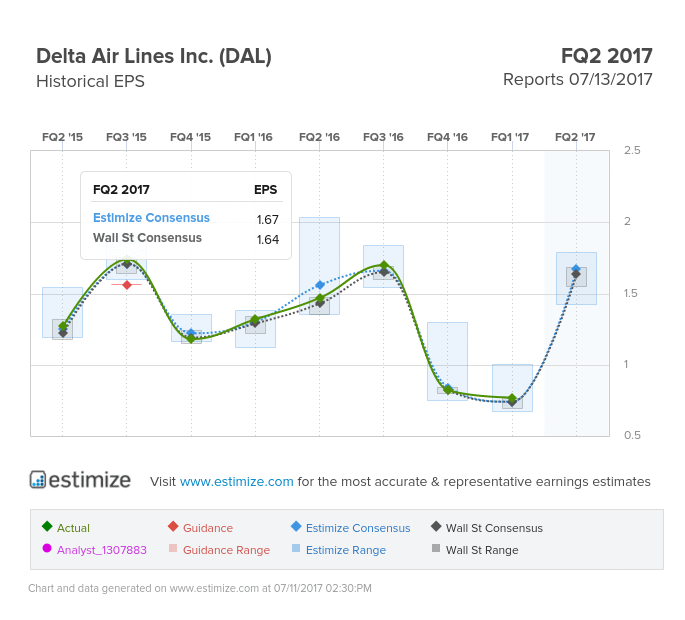

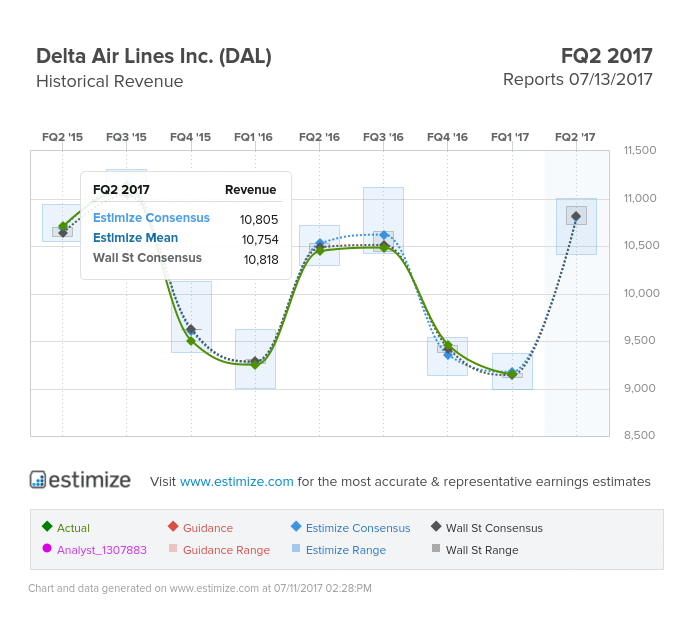

Delta Air Lines (NYSE:DAL)) is set to release Q2 results on Thursday, July 13. Estimize and The Street have been very much in line with each other when it comes to their estimates for Delta’s EPS. According to Estimize, EPS is set to increase roughly 114%, from $0.77 in FQ1’17, up to $1.65 in FQ2’17. Likewise, Wall Street is looking for an identical spike. Furthermore, it looks as though the consensus among Estimize and Wall Street remains fairly similar regarding revenue. In FQ1’17, Estimize estimated revenue of $9.175M and Wall Street came in at $9.140M; the actual number lying at $9.140M. This quarter, both Estimize and the Street are looking for revenue to increase nearly 18%. It seems like we have been pretty consistent with The Street on this one and Delta is on the uptrend.

Despite airline stocks not having much popularity among investors, Delta appears to still be showing strength in an unattractive market. With a high dividend yield of about 1.5%, Delta is proving to be something to keep your eye on. With a number of new developments, such as its recent deal with Korean Air and its current testing of using biometrics rather than boarding passes, there is going to be lots of eyes on Delta in the future. Despite the fact that using fingerprints and eye measurements rather than boarding passes could potentially pose privacy issues and controversy, we definitely recommend taking a closer look at this company prior to earnings announcements.