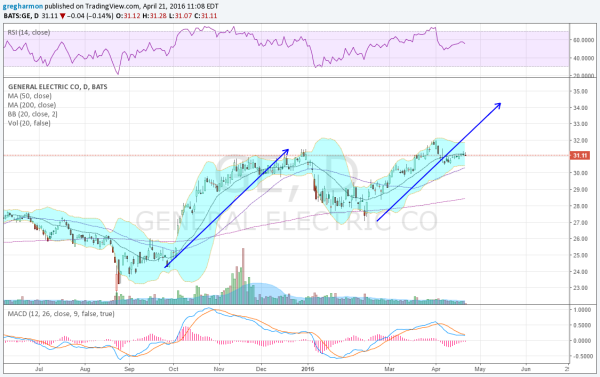

General Electric Company (NYSE:GE) has been moving higher in steps for a long time. The last move up may have stalled short of the target to 34.25, but made a higher-high at 32 -- extending the trend higher. The key to this stock has been if it is over its 20-day SMA, it's trending higher. Under that point, though, and it may fall back to the 200-day SMA or lower.

Ahead of Friday's earnings, GE is right at that 20-day SMA.

It has a RSI that's in the bullish zone but turning lower while the MACD is level after resetting lower. The MACD may be avoiding a cross up, though, which is a bad sign. The flat Bollinger Bands® give no insight into direction. Short interest for this behemoth is under 2%.

There is support lower at 30.55 and 30, followed by 29.20 and 28.50. There is resistance at 31.25 and 32. Above that and you need to go back to 2001. The stock continues a long-term breakout over 32. The reaction to the last 6 earnings reports has been a move of about 1.33% on average -- or $0.42 -- making for an expected range of 30.70 to 31.50.

The at-the-money April 22 Expiry Straddles suggest a slightly larger 50-cent move by Expiry with Implied Volatility at 38% above the May at 15%. Open interest is biggest at 31 on the Call side, with some size above there at 31.5 and 32. On the Put side, the biggest open interest is at 31, as well, but close at 29.5 with size at 30.5 too.

Five Ways To Play GE

- Trade Idea 1: Buy the April 22 Expiry 31/31.5 Call Spread for 23 cents.

- Trade Idea 2: Buy the April 22 Expiry 30.5/31 Call Spread (39 cents) and sell the April 22 Expiry 30.5 Put for $0.32.

- Trade Idea 3: Buy the April 22 Expiry 31.5/31 1×2 Put Spread for $0.10.

- Trade Idea 4: Buy the May 31/April 22 Expiry 31.5 Call Diagonal (50 cents) and sell the April 29 Expiry 31 Put for 18 cents.

- Trade Idea 5: Sell the April 22 Expiry 31 Straddle for a $0.52 credit.

#1 gives the upside while #2 sees the upside deeper in the money, but with a possible entry to the stock at 30.5 on Friday.

#3 gives the downside with leverage and a possible entry at 30.5.

#4 gives the upside longer term, with leverage and a possible entry next week at 31.

#5 is profitable on a close from 30.48 to 31.52 at Expiry, looking for a pin at 31.

I prefer #4 or #5.