Shares of Biogen Inc (NASDAQ:BIIB) are hovering around breakeven today at $318.97, as traders gear up for the company's third-quarter earnings report. The pharma name is scheduled to report before the market opens this Tuesday, Oct. 23, and speculative traders are banking on a much bigger-than-usual post-event price swing for BIIB stock.

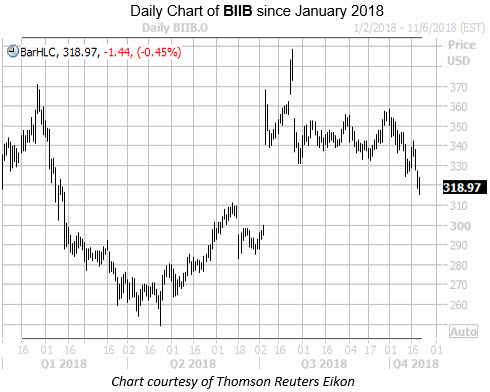

On the charts, BIIB has had a volatile run in 2018. The stock fell as low as $249.17 on April 24, but bounced back to hit a three-year peak of $388.67 as soon as July 25. As a result, a 50% Fibonacci retracement of the aforementioned annual low and multi-year high rests at $318.92 -- just pennies below the stock's current trading levels, and in line with BIIB's year-to-date breakeven mark of $318.57.

Digging into its earnings history, BIIB closed higher the day after reporting in six of the last eight quarters, including the last three in a row. Looking broader, the shares have averaged a 2.6% move the day after earnings over the last two years, regardless of direction. This time around, BIIB options traders are expecting nearly four times that average move, with a 10.6% swing priced in for Tuesday's trading.

Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows BIIB with a 10-day put/call volume ratio of 1.43, which ranks in the 96th percentile of its annual range. This suggests that puts have been purchased over calls at a near-annual high pace during the past two weeks, with traders showing a distinct preference for bearish bets on BIIB ahead of earnings.

Conversely, analyst sentiment has been extremely optimistic toward the drug stock. This is per the overwhelming 18 of 24 brokerage firms that sport a "buy" or better rating. Plus, BIIB's average 12-month price target of $390.88 stands at a 22.5% upside to current levels.

Given the technical significance of the $318-$319 neighborhood where the stock is currently trading, traders will certainly be watching this area closely in the aftermath of BIIB's quarterly results. And with sentiment polarized ahead of earnings, the stage could be set for an extreme move in one direction or the other in the wake of the report.