Uncertainty

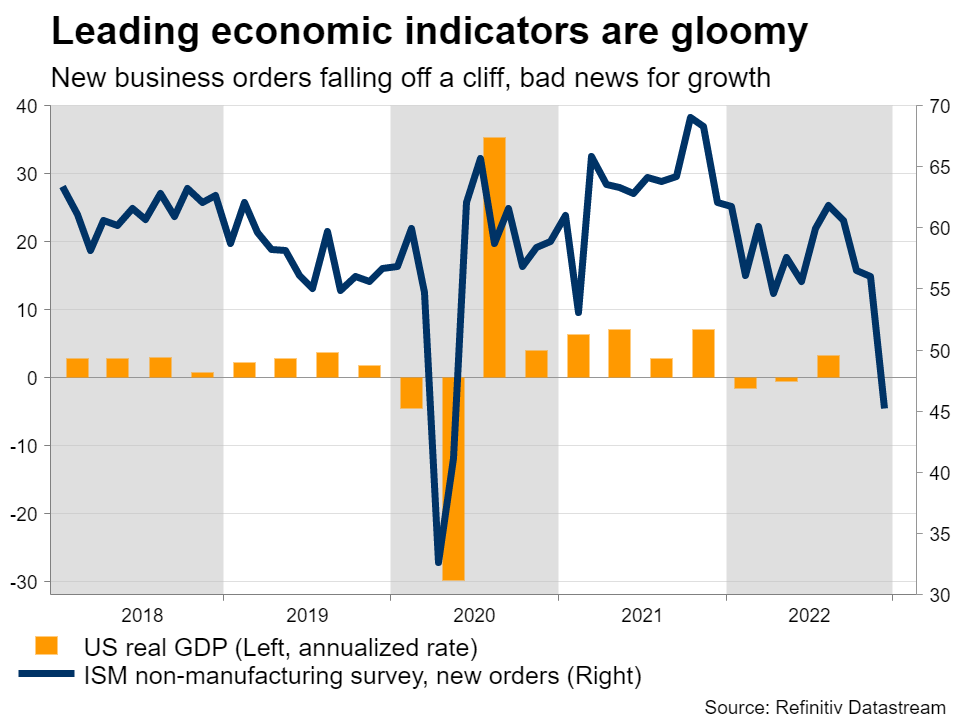

Equity markets started the new year on a strong note, but it’s questionable whether this optimism will last. Leading indicators such as business surveys warn that the US economy is losing steam, potentially heading into a recession later this year as demand is softening at a dramatic pace.

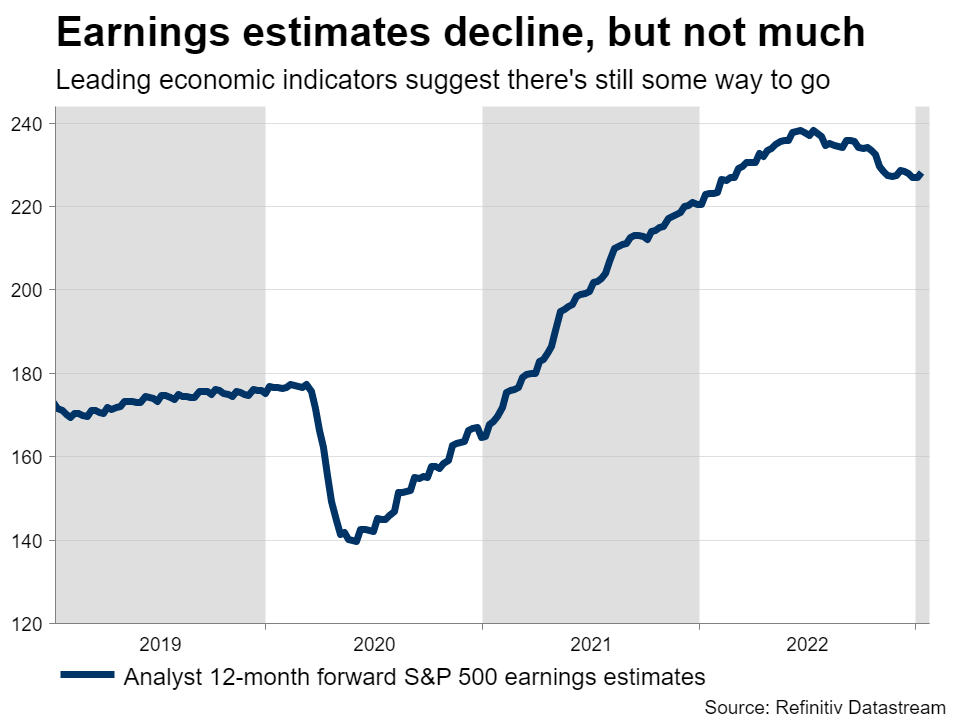

Heading into this earnings season, investors are concerned that this negativity in the leading indicators might be reflected in corporate results or downbeat guidance by management teams for the next quarters. Earnings estimates by analysts remain quite high, raising concerns that they are out-of-sync with economic reality and vulnerable to downside revisions.

Admittedly, it might be too early for any real weakness to show up in this reporting cycle. We saw similar fears in the last couple of quarters, only for corporate reports to exceed expectations. Nonetheless, it seems to be a matter of ‘when’, rather than ‘if’, earnings will feel the heat of a weakening economic data pulse.

Earnings set to drop

On the index level, S&P 500 earnings are projected to decline by more than 4% from one year ago. That would mark the first negative reading in over two years, when businesses were still dealing with rolling lockdowns in Western economies to control the virus.

In fact, if the energy sector is excluded from this calculation, the expected decline in earnings would be far worse. Energy companies are still earning supernormal profits because of the lingering effects of the global power crunch. Without them in the S&P 500, earnings would be anticipated to drop almost twice as much, around 8% lower from last year.

Therefore, earnings seem to be rolling over and another similar performance next quarter would meet the definition of an ‘earnings recession’. It’s worth noting that S&P 500 companies earn roughly 40% of their revenue from overseas, so even if the US economy somehow manages to remain resilient, earnings could still struggle in a fragile global environment.

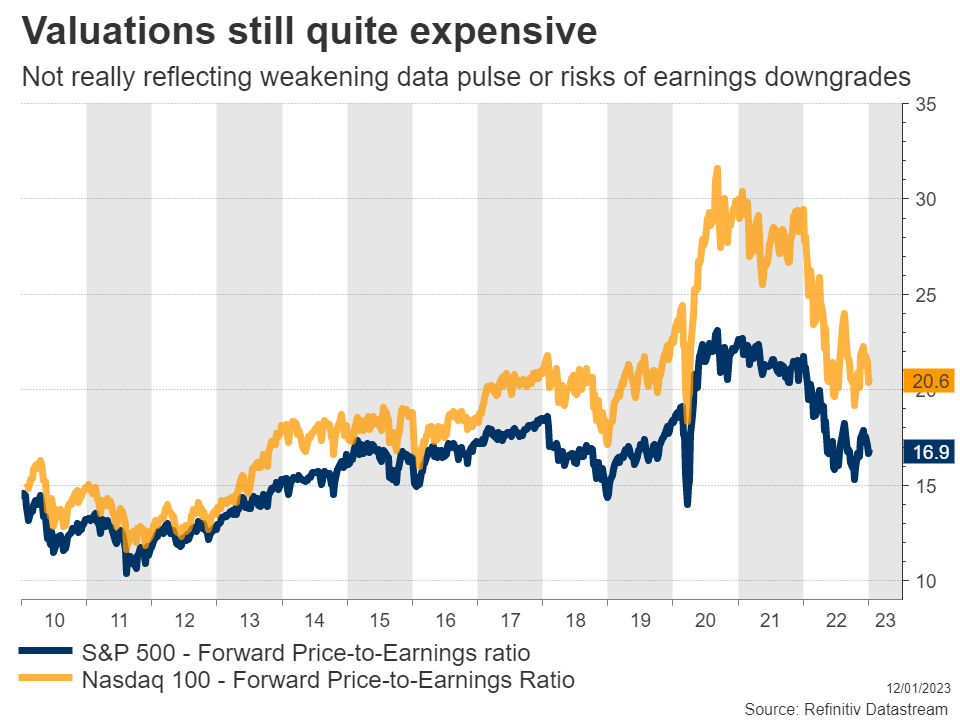

Asymmetric risks, due to rosy valuations

In this earnings season, the playbook might be that the market is ‘unforgiving’. In other words, there might be an asymmetric reaction, with any companies that exceed analyst expectations not being rewarded much, but any businesses that disappoint getting punished severely.

The logic behind this call relies on valuations. With the S&P 500 still trading at 17 times this year’s anticipated earnings, the market is very optimistic, essentially pricing in a soft landing for the US economy. Previous bear markets have bottomed with a multiple closer to 13x or 14x, so the market is still quite expensive from a valuation perspective.

And that’s before considering the risk that earnings estimates will be revised lower during the year. In that case, the current valuation would be even more bizarre. Earnings estimates have started to come down, but not dramatically. We are probably in the early stages of this process.

Therefore, there isn’t much room for error. Valuations are so rosy that any positive results might not be enough to really boost the market, as those are already baked into the price. On the flipside, any disappointments could be met with heavy selling.

Charts paint a similar picture. The S&P 500 is still trading below the downtrend line drawn from its record high and also below its 200-day moving average, keeping the index in a clear downtrend. Those two obstacles have converged around the 3,990 region, which might act as resistance to any advances.

The earnings show will kick off with the big US banks on Friday, which are often seen as bellwethers for the broader economy, elevating the importance of their results. Highlights in the following week include Netflix (NASDAQ:NFLX) and Procter & Gamble on January 19, before the spotlight turns to Microsoft (NASDAQ:MSFT) and Tesla (NASDAQ:TSLA) on January 24 and 25, respectively.