Traders are gearing up for a full barrage of earnings reports as we settle in for a new week of trading. A number of key announcements could shape the tone for various industries this week, including:

- Gaming: Wynn Resorts (WYNN)

Expectations for second-quarter earnings reports have already been trimmed, given the macro challenges plaguing Europe, China and the U.S. There is no question that the fundamental environment is weakening -- but the key variable to consider at this point, is how much of the weakness is already priced in?

Last week’s action offered a great example of how pessimistic expectations can actually provide the fuel for a sharp market rebound:

Heading into Friday, stocks were trading lower as investors cut back on risk assets, and battened down the hatches to prepare for an ugly earnings season. But pockets of strength such as small cap stocks offered clues that the action was becoming extended and was vulnerable to a snapback rally.

Sentiment levels shifted dramatically after a not-bad-as-feared GDP report from China, plus non-disastrous earnings from JPMorgan Chase (JPM) and Wells Fargo (WFC). Friday’s rebound brought the S&P 500 full circle -- erasing losses for the week, leaving investors with a turbulent gain of 0.15%.

This week we will be watching to see if the bullish sentiment shift can continue to lift stock prices as more managers participate. Since long-only managers have lowered exposure levels, the rally that started on Friday could be temporarily self-reinforcing, as institutional traders scramble to re-leverage in hopes of keeping up with benchmark averages.

Our current trading book is relatively light (with a modest amount of bullish exposure), but there are a number of great opportunities setting up for potential trades as we head into the thick of earnings season.

“Safe” Treasuries Vulnerable To Risk-On Trading

United States treasury securities have the distinct quality of being just about the safest place for parking capital. Say what you will about U.S. debt levels and the dangers of currency printing, for the time being, the U.S. treasury market is a magnet for capital when investors are risk averse.

On the other hand, when institutional investors find themselves in a place where they NEED exposure to risk assets, the U.S. treasury market can be vulnerable to capital outflows as managers pull money out of safe-haven areas and begin to put it back to work.

The sentiment see-saw can be particularly volatile in bearish economic environments. Investors have conflicting interests in terms of protecting capital, but also protecting against the pain of missing -- or not fully participating in -- an upside reversal.

The Big Sin

Individual investors and absolute return money managers, rightly worry most about the serious downside risks in this market. But for much of the bench-marked, long-only money management crowd, it’s a bigger sin to miss an upside move than it is to lose big on a downside move.

The psychology of Wall Street is such that, if you fail conventionally, you're okay, because all your peers did too. But if the market moves up big without you, your career is on the block.

This mentality, coupled with awareness of big upside blasts via surprise interventions at crisis points past, may be helping to give markets a bid.

With yields at historically low levels and equity prices now on the rise, the reward-to-risk scenario for shorting treasuries looks intriguing.

At the end of last week, we began buying the UltraShort 20+ Year Treasury (TBT) ETF, giving us bearish exposure to bonds. Treasuries are hitting resistance near the same level where they topped out in early June (seen as support on the inverse TBT chart) allowing us to enter the trade with a relatively tight risk point and plenty of room for profits as the bond market sells off.

U.S. Drought: Price Hikes Coming

A stifling heat wave may have been a major inconvenience for traders in NYC and Chicago, but it represented a crisis environment for U.S. farmers as crops withered.

Crops on July 1 were in the worst condition since 1988 as a Midwest heat wave last week set or tied 1,067 temperature records, government data show. Prices surged 37% in three weeks and Rabobank International said June 28 that corn may rise 9.9% more by December to near a record $8 a bushel.

The gain is threatening to boost food costs the United Nations says fell 15% from a record in February 2011 and feed prices for meat producers including Smithfield Foods Inc.(SFD)

“The drought is much worse than last year and approaching the 1988 disaster,” said John Cory, chief executive officer of Rochester, Indiana-based grain processor Prairie Mills Products LLC. “There are crops that won’t make it. The dairy and livestock industries are going to get hit very hard. People are just beginning to realize the depth of the problem.”

The reduced production projections and spiking corn prices are creating a domino effect for a number of different industries.

Fertilizer stocks, which had been cooling off following the massive rally two years ago, are now in play. Depending on when (and if) the current drought breaks, demand for fertilizer could pick up substantially, driving prices higher and further boosting stock prices for fertilizer producers.

Potash Corp. (POT) has already bounced sharply off its early June low and may be setting up an attractive entry after slow drift into support.

Meanwhile, meat and poultry producers such as Tyson Foods (TSN) and Sanderson Farms (SAFM) are in free-fall mode as feed costs crimp future profit margins. The selloff has intensified as analysts issue downgrades, leading one to wonder if the price action is extended enough to support at least a short-term snapback rally.

The restaurant industry also bears watching as higher food costs are hitting at a time when consumer confidence is declining and retail stocks are under pressure.

We’ve already begun to see weakness in well-loved stocks like Chipotle Mexican Grill (CMG) and Panera Bread (PNRA) and the trend continue if drought conditions don’t quickly improve.

Emerging Market weakness creates a bearish backdrop for australia

This week’s GDP report from China may not have been as bad as some expected but it definitely confirmed that the world’s largest growth economy is decelerating. The 7.6% second quarter GDP growth was the slowest measurement since the financial crisis and the data is also suspect, considering China’s propensity to “fudge" its numbers when it comes to public economic figures.

The ramifications for a Chinese deceleration are particularly noteworthy for resource-rich Australia, which relies heavily on Chinese demand.

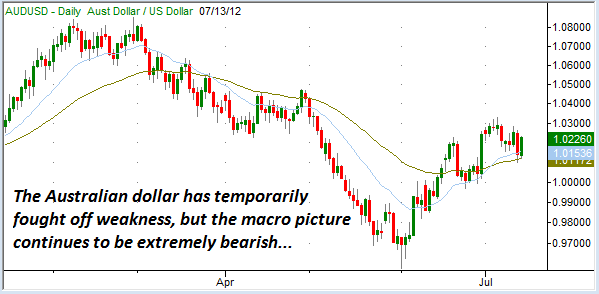

Earlier this year we captured material profits shorting the Australian dollar as the severity of China’s deceleration began to sink in (trades documented in real-time via the Mercenary Live Feed).

Since then, the Aussie has rallied possibly setting up for another short entry. We’re currently watching from the sidelines but expect to re-enter the position at some point as the macro picture is extremely bearish and should remain so for quite some time.

Disclosure: This content is general info only, not to be taken as investment advice. Click here for disclaimer