Investment Grade Corporate bonds have had a tremendous run as evident by the decline in yields which has led to outperformance relative to Treasuries. Furthermore, inflows into corporate bond funds and ETFs have skyrocketed due to investors seeking high quality assets that provide some pickup in yield relative to Treasuries.

Despite the strong technical backdrop of the corporate bond market, the recent string of positive quarters for companies may be at risk due to results from second quarter earnings. Citigroup’s High Grade Strategy team suggests that the recent earnings season has “left much to be desired from the fundamental perspective.” Given the headwinds of slowing growth, corporate earnings in the coming quarters may be impacted which could in turn negatively affect performance and corporate bond holders.

In their latest U.S. Credit Outlook,the research team wrote the following:

…an underwhelming second quarter suggests that slower growth may be starting to impact earnings. And with the ‘fiscal cliff’ rapidly approaching there’s scope for quite a bit more deterioration ahead, in our view.

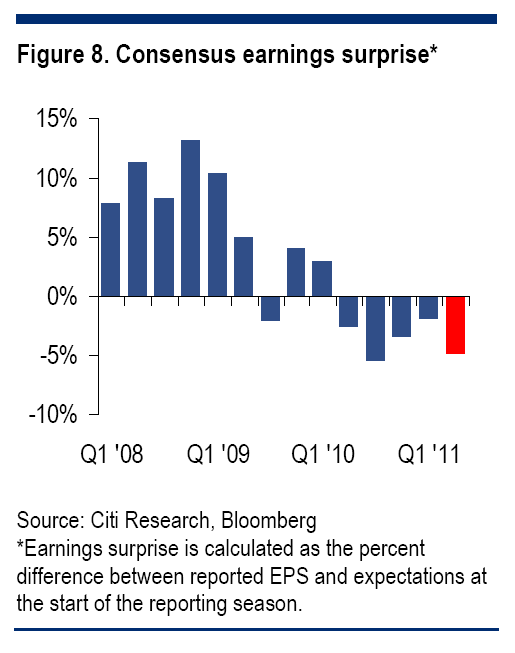

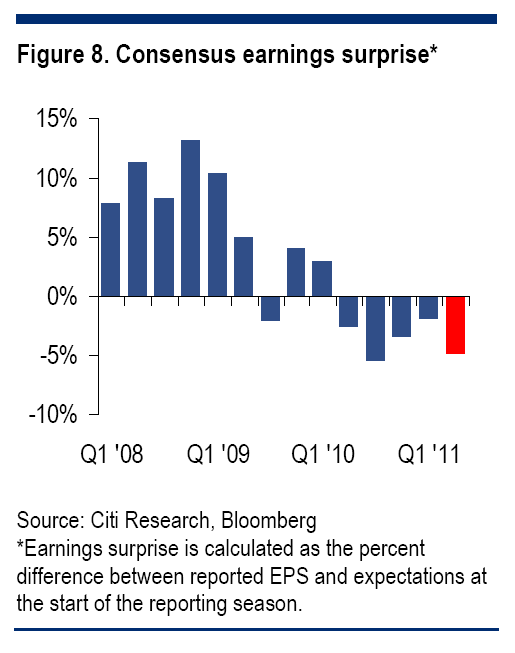

It’s not that second quarter earnings were terrible, per se. Top line revenues were weak, but margins remained strong. The issue seemed to be with the setting of expectations. If one were to evaluate second-quarter earnings relative to where bottom-up analyst estimates were a month prior to the beginning of the reporting period (so as to remove the effect of on-going revisions), it’s clear that the quarter was a disappointment to the analyst community. From a historical context one has to go back to the third quarter of 2011 to find a quarter where analyst estimates were off by so much, and that quarter was impacted by the tsunami and the debtceiling negotiations.

What’s more, the possibility that a similar narrative unfolds in the fourth quarter appears to be quite high. Bottom up consensus estimates envision a third quarter that’s relatively flat to the second in terms of revenue and earnings, but the expectations for the fourth quarter of 2012 and 2013 as a whole are far higher. To our minds, these look overly optimistic even before considering the potential impact from the ‘fiscal cliff’.

While stocks are near their recent highs with the S&P 500 trading near the 1400 level, there is a certain air of complacency as if all is well with the economy. However, the fact is that economic data has been tepid at best and the Fiscal Cliff and its potentially crippling effects on the economy, is fast approaching.

And yet, as Citi economists note, one really can’t form a complete earnings outlook for late 2012 or 2013 without taking a view on the actions of policymakers. For if a compromise can not be reached to avoid the 3%-plus GDP drag from taking effect, it’s almost a certainty that earnings will suffer.

Earnings weakness usually does not affect corporate bond holders to the same degree as stock owners for investment grade corporate issuers since their credit worthiness in the grand scheme of things remains fairly intact.

However, the recent trend of companies catering to shareholders first may ultimately hurt bondholders. Specifically, dividends which reduces cash on hand to service debt holders have been increasing. Furthermore, share repurchases which increase leverage ratios for a company since it reduces the amount of equity outstanding while debt levels remain the same, can hurt bondholders.

As a result, fundamentals are at risk for turning sour as we approach the end of 2012. If such a scenario plays out, the potential for corporate bonds to underperform is high given the current environment of limited liquidity for corporate bond players.

But for those that believe the technicals are unassailable in credit, it’s worth bearing in mind that a turn in the fundamentals is likely to diminish the relative attractiveness of the asset class. And in today’s poor liquidity environment, the outflows need not be all that great to push valuations wider.

Disclaimer : The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.

Despite the strong technical backdrop of the corporate bond market, the recent string of positive quarters for companies may be at risk due to results from second quarter earnings. Citigroup’s High Grade Strategy team suggests that the recent earnings season has “left much to be desired from the fundamental perspective.” Given the headwinds of slowing growth, corporate earnings in the coming quarters may be impacted which could in turn negatively affect performance and corporate bond holders.

In their latest U.S. Credit Outlook,the research team wrote the following:

…an underwhelming second quarter suggests that slower growth may be starting to impact earnings. And with the ‘fiscal cliff’ rapidly approaching there’s scope for quite a bit more deterioration ahead, in our view.

It’s not that second quarter earnings were terrible, per se. Top line revenues were weak, but margins remained strong. The issue seemed to be with the setting of expectations. If one were to evaluate second-quarter earnings relative to where bottom-up analyst estimates were a month prior to the beginning of the reporting period (so as to remove the effect of on-going revisions), it’s clear that the quarter was a disappointment to the analyst community. From a historical context one has to go back to the third quarter of 2011 to find a quarter where analyst estimates were off by so much, and that quarter was impacted by the tsunami and the debtceiling negotiations.

What’s more, the possibility that a similar narrative unfolds in the fourth quarter appears to be quite high. Bottom up consensus estimates envision a third quarter that’s relatively flat to the second in terms of revenue and earnings, but the expectations for the fourth quarter of 2012 and 2013 as a whole are far higher. To our minds, these look overly optimistic even before considering the potential impact from the ‘fiscal cliff’.

While stocks are near their recent highs with the S&P 500 trading near the 1400 level, there is a certain air of complacency as if all is well with the economy. However, the fact is that economic data has been tepid at best and the Fiscal Cliff and its potentially crippling effects on the economy, is fast approaching.

And yet, as Citi economists note, one really can’t form a complete earnings outlook for late 2012 or 2013 without taking a view on the actions of policymakers. For if a compromise can not be reached to avoid the 3%-plus GDP drag from taking effect, it’s almost a certainty that earnings will suffer.

Earnings weakness usually does not affect corporate bond holders to the same degree as stock owners for investment grade corporate issuers since their credit worthiness in the grand scheme of things remains fairly intact.

However, the recent trend of companies catering to shareholders first may ultimately hurt bondholders. Specifically, dividends which reduces cash on hand to service debt holders have been increasing. Furthermore, share repurchases which increase leverage ratios for a company since it reduces the amount of equity outstanding while debt levels remain the same, can hurt bondholders.

As a result, fundamentals are at risk for turning sour as we approach the end of 2012. If such a scenario plays out, the potential for corporate bonds to underperform is high given the current environment of limited liquidity for corporate bond players.

But for those that believe the technicals are unassailable in credit, it’s worth bearing in mind that a turn in the fundamentals is likely to diminish the relative attractiveness of the asset class. And in today’s poor liquidity environment, the outflows need not be all that great to push valuations wider.

Disclaimer : The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.