The market caught deal fever last week but hope turned into skepticism early this week. Indices are higher, awaiting the release from the rest of U.S. bank earnings (after JPMorgan Chase & Co (NYSE:JPM) beat estimates). GBP is the strongest performer of the day amid recurring remarks from UK and EU officials expressing attempts to reach a deal in the final innings (more below).

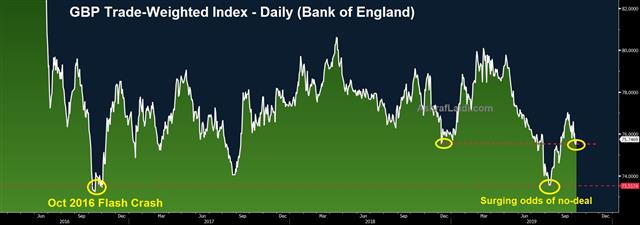

Beijing said it would buy $50 billion more in U.S. agricultural goods only if Washington removed retaliatory tariffs set since the start of the trade war. A new Premium trade has been issued, backed by three charts and six key notes. The chart below highlights the emerging support for the GBP's trade weighted index amid Brexit negotiations.

One way to look at the China-U.S. trade deal is probably through the Federal Reserve's prism. Policymakers have been relatively consistent with the idea that the economic impact has been modest, but uncertainty did curb business investment, while threatening consumer confidence.

The deal announced Friday is a short-term ceasefire that removes two months of uncertainty at best. Reviews in the Chinese press have left out parts of the deal that that U.S. has touted, like agricultural purchases and the 'phase 1' terminology that Trump has touted. It all reflects an unease that any commitments will last. That was reflected in trade on Monday as yen crosses drifted lower along with stock markets.

Earlier today, St Louis Fed president Bullard said the Fed's hitting the low side of inflation target is concerning and that monetary policy will not fix the problems created by tariffs.

UK-EU not giving up

A revised set of proposals with regards to the cutsom rules for Northern Ireland was submitted by UK negotiators to the EU as the 2 sides attempt to reach a deal this week. Worries remain concrete with DUP officials expressing skepticism of any deal that doesn't leave them fully in the UK. Yet the highest levels in 10 Downing Street report that EU and UK officials are making progress. That leaves markets in the uneasy position of wondering if a deal can get through Parliament.

Elsewhere, U.S. banks' earnings season hits today, with JPMorgan Chase & Co (NYSE:JPM) beating earnings estimates. Goldman Sachs (NYSE:GS), Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC) will follow shortly.