The major Gamesys earn-out period finished in March 2017 and, as expected, Jackpotjoy PLC (LON:JPJ) has announced a £94.2m payment for its penultimate earn-out. There is a further c £44m due for the Spanish assets (Botemania) in June 2018, which should be comfortably covered by operating cash flow. Although adjusted net debt/EBITDA of c 4.0x remains high, we expect significant deleverage from 2018.

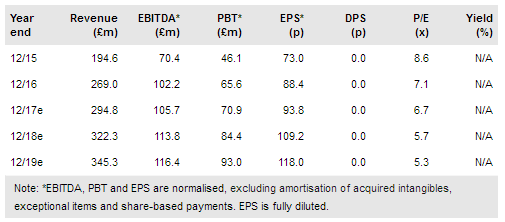

The stock has recovered some ground recently, but continues to trade at a significant discount to peers, with 2018e multiples of 6.8x EV/EBITDA and 5.7x P/E. Given the company’s leading market position and robust cash flow generation, we would expect a re-rating as the market regains confidence in the business model. Our forecasts remain unchanged.

Penultimate £94.2m earn-out payment to Gamesys

The Jackpotjoy division was acquired from Gamesys in April 2015 for an initial price of c £425.8m and the major earn-out period finished in March 2017. JPJ has now paid the largest earn-out of £94.2m, which comprised the final £63.9m payment for the non-Spanish assets and £30.3m for the Spanish brand, Botemania.

We expect a further final payment of c £44m in June 2018 for Botemania and estimate that the total acquisition price equates to c 6.3x 2017e EV/EBITDA. With an unrestricted cash balance at Q117 of £112m (pre earn-out) and an ongoing quarterly operating cash flow of c £25m, JPJ is well positioned to internally fund its future obligations.

To read the entire report Please click on the pdf File Below: