The recent slowdown in US economic growth is expected to continue in the third quarter, based on recent nowcasts. The numbers suggest that the current expansion, the longest on record, will endure. But with no end in sight for the US-China trade war, and elevated risk that a currency war is brewing for the planet’s two largest economies, the potential for trouble is rising.

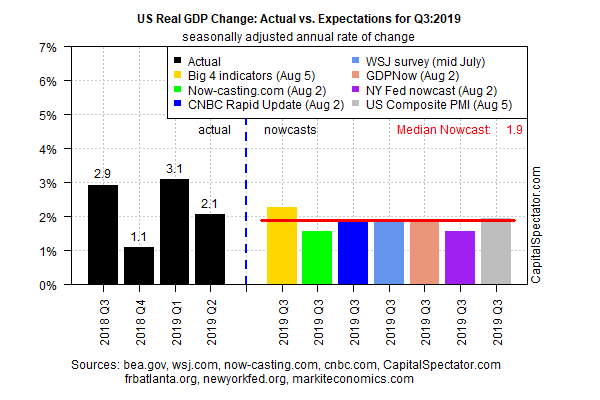

Using data published to date, however, suggests that the downshift in US GDP growth in Q2 will more or less hold in the July-through-September period, based on the median of several nowcasts compiled by The Capital Spectator (see chart below). The current median estimate calls for output to rise 1.9% in Q3, down slightly from Q2’s 2.1%. That’s strong enough to avoid a new recession, but the expected increase is slow enough to leave the economy vulnerable to macro shocks.

One of the inputs into today’s estimate is the US Composite PMI for July, a proxy for GDP. This week’s estimate aligns with Q3 growth at just under 2.0% at the start of the current quarter. But there are warning signs in the details.

“The PMIs for manufacturing and services collectively point to GDP expanding at an annualized rate of under 2% in July, below that seen in the second quarter and among the weakest seen over the past three years,” says Chris Williamson, chief business economist at IHS Markit, which publishes the PMIs. “A sharp drop in future expectations meanwhile suggests downside risks have increased in the near-term at least, hinting that the upturn in growth seen in July [in the Composite PMI] could prove short-lived and that GDP growth could remain disappointingly modest in the third quarter.”

The ongoing trade conflict between the US and China doesn’t help. The combination of heightened uncertainty and pinched trade is gradually taking a toll and raising warning signs, says Lawrence Summers, a former US Treasury secretary and White House economic adviser. Speaking on Bloomberg TV, he said that recession risk is “much higher than it needs to be and much higher than it was two months ago.”

The Treasury market is already pricing in elevated risk that a new US economic contraction is near. In particular, the yield spread on the 10-year Note less a 3-month T-bill fell deeper into the red on Tuesday (Aug. 6), settling at -32 basis points. The inverted curve (short rates above long rates) is widely seen as a prediction that a recession will start in the near term.

Note, however, that another widely followed Treasury spread (10-year less 2-year) is still mildly positive, albeit just barely at +13 basis points.

Meantime, a broad read on the US economy in late-July via a diversified set of indicators continues to reflect low recession risk–a profile reaffirmed in this week’s edition of The US Business Cycle Risk Report.

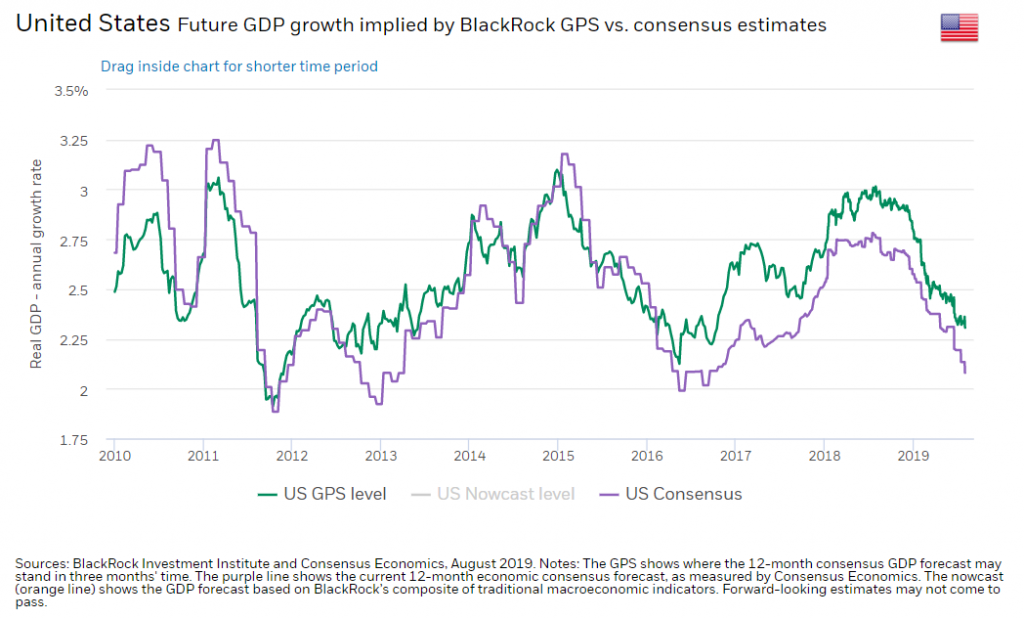

Nonetheless, it’s been clear for some time that the macro trend for the US is slowing, as BlackRock’s latest estimate of the GDP trend reminds.

Despite the risks and the deceleration in growth, the economy remains on track to expand at a moderate pace. But the critical variable is how the trade war blowback shakes out in the weeks and months ahead.

“Up until the latest salvo from Trump, the strategy was working out pretty well,” advises Sung Won Sohn, a business economist at Loyola Marymount University. “But the latest salvo, 10% tariffs on $300 billion, was a significant policy mistake,” he warns.

The question is whether that “policy mistake” marks a tipping point for an economy that’s remained resilient so far?