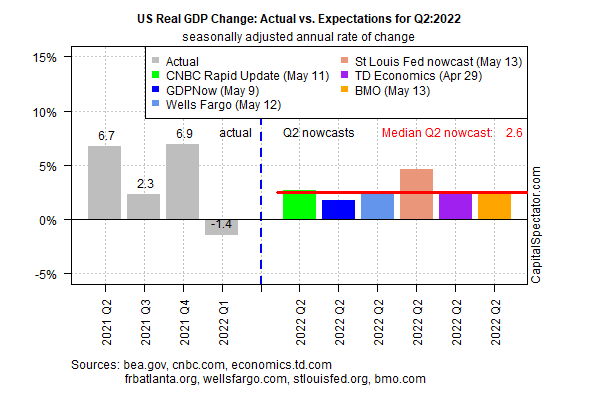

US economic activity is expected to bounce back in the second quarter following Q1’s contraction, according to a set of GDP nowcasts compiled by CapitalSpectator.com.

The estimates should be viewed cautiously this early in the quarter, but the initial outlook is encouraging.

Output is expected to rebound with a 2.6% increase in GDP (seasonally adjusted annual rate) for the April-through-June period via the median for several Q2 nowcasts.

The estimate reflects a solid recovery following Q1’s 1.4% contraction.

Despite the upbeat Q2 outlook, several risks hang over the estimate, starting with the simple fact that it’s relatively early in the current quarter for hard data and so incoming updates that inform the nowcast can and will change the estimate, perhaps dramatically, in the weeks ahead.

More importantly, the global economy is in a relatively precarious state due to a set of familiar headwinds of late: high inflation, rising interest rates and the ongoing blowback on various fronts from the Ukraine war.

Former Federal Reserve Chair Ben Bernanke says he sees a potential for stagflation—high inflation and slow growth—as a non-trivial risk.

“Inflation’s still too high but coming down,” he advises. “So there should be a period in the next year or two where growth is low, unemployment is at least up a little bit and inflation is still high. So you could call that stagflation.”

There’s no shortage of pessimism on the economic outlook from other sources. Goldman Sachs economists, for example, see a “very high” risk of recession on the horizon.

“If I were running a big company, I would be very prepared for it. If I was a consumer, I’d be prepared for it,” Lloyd Blankfein, the investment bank’s senior chairman, told CBS News’ “Face the Nation” on Sunday.

Not all economists agree on the severity of risk, however. Brian Wesbury, chief economist at First Trust Advisors, estimates that a recession is “unlikely in 2022.” Writing on Monday, he explains:

“We think the near-term pessimism is overdone. Yes, a recession is likely on the way, but it probably has about two more years before it arrives, which means corporate earnings have plenty of room to exceed expectations in the year ahead and for equities to rebound before year-end.”

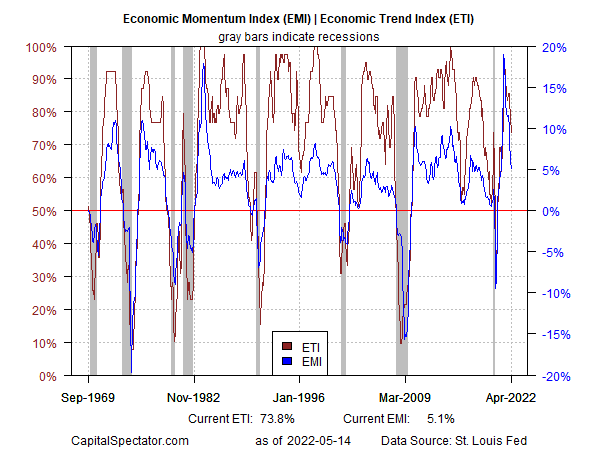

CapitalSpectator.com’s econometric assessment shows that an NBER-defined recession is unlikely to start this month or in June. This week’s update of a pair a proprietary business-cycle indexes in US Business Cycle Risk Report indicate that while growth continues to slow, the deceleration isn’t expected to reach a tipping point in the immediate future.

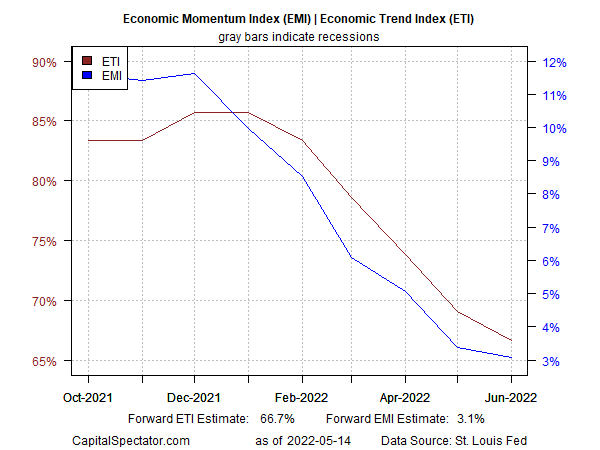

The threat of a downturn rises for Q3 and Q4, although it’s too early to make a high-confidence estimate that far out in time.

For perspective, here’s the current update of Economic Momentum Index (EMI) and Economic Trend Index (ETI) through April. A clear deceleration remains in progress and looks set to continue for the near term.

Forward estimates of ETI and EMI indicate that the slowdown will continue, which may become acute at some point as early as late-Q3. But for the immediate future, the economy will continue to expand and so recession risk will stay low through June— i.e., ETI and EMI are expected to hold above their tipping points that signal recession: 50% and 0%, respectively.

Looking further out, by contrast, carries much higher levels of uncertainty vs. the near-term estimates through June presented below.

The good news is that the economy looks set to recover in Q2 after the contraction in the first quarter. It’s debatable if the bounce will be enough to inoculate against a recession later in 2022, but it’s certainly a step in the right direction.