In response to the Italian Referendum which caused prime minister Matteo Renzi to resign, the EUR/USD took a dive from 1.0672 to as low as 1.0506.

The euro has since rallied strongly, gaining 2.7 percent. What’s going on?

EUR/USD 15-Minute Chart

What’s Going On With the Euro?

More than likely this is a combination of several factors:

- Traders positioned themselves heavily short the euro expecting the referendum to fail. Sentiment was extreme enough, there were few left to short.

- The referendum failed by a larger than expected amount, but Italy will not blow up or leave the eurozone immediately. Italy will leave the eurozone in due time, but the market won’t worry about that until the last moment as is the case in the typical European crisis.

- Axel Weber, Former Bundesbank Head Warns of Coming Rate Hikes by ECB.

Of the three items, points 3 and 1 are the most likely cause at the moment.

Major Top for US Dollar?

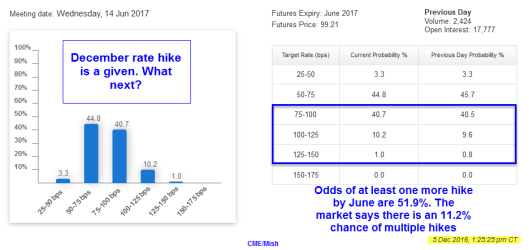

Looking ahead for the US dollar, the market is pricing in at least two rate hikes by the Fed, by June.

If those hikes do not occur as fast as expected, or the ECB tapers QE, the dollar is likely to decline, even if the ECB does not hike.