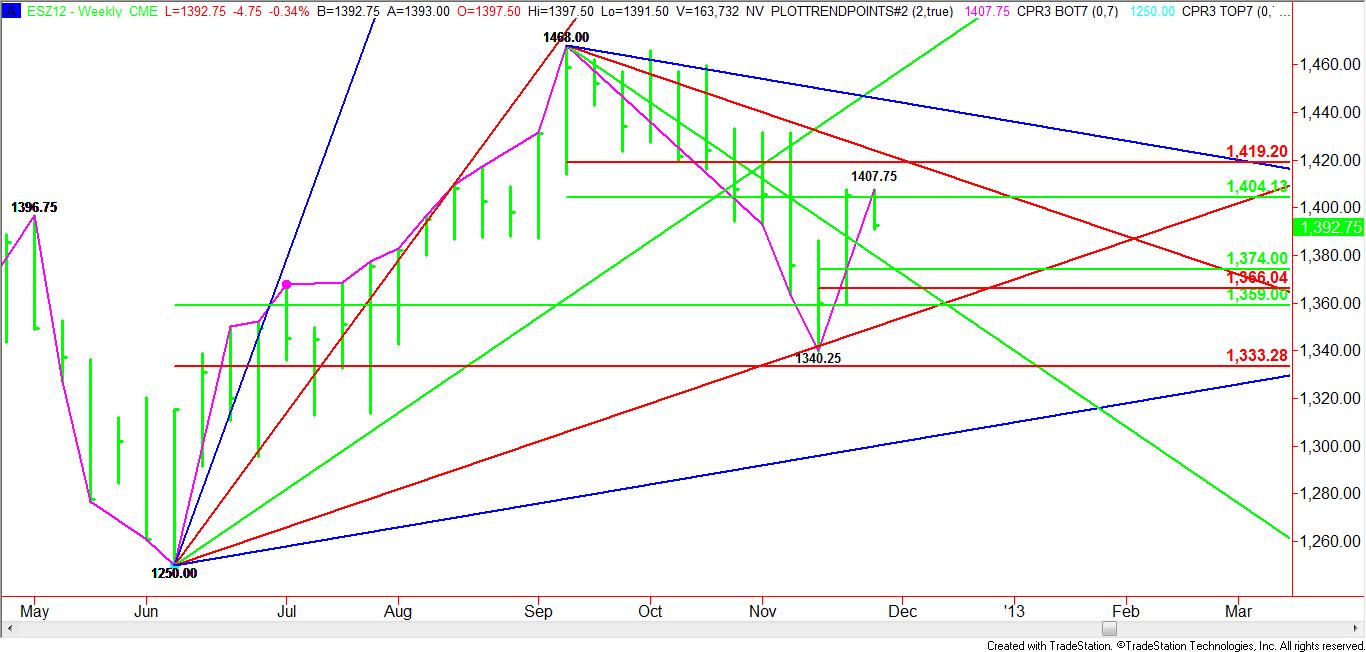

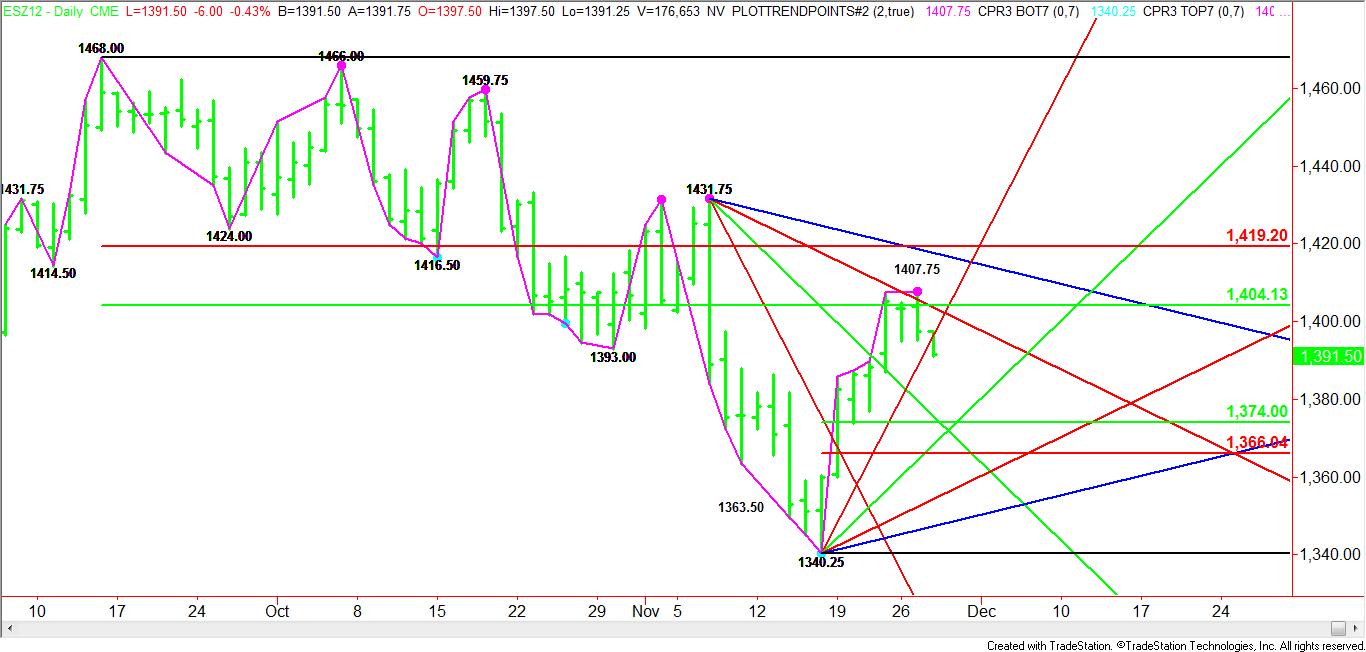

Last week the December E-mini S&P 500 futures contract completed a 50% retracement of the break from 1468.00 to 1340.25. The close over 1404.25, however, left traders a little optimistic that the rally would continue on to the Fibonacci level at 1419.25 or the downtrending Gann angle at 1424.00.

This hasn’t been the case however this week, as the market failed to generate any buying interest when it attempted to breakout over last week’s high at 1407.50. The failure at 1407.75 on Tuesday has set up the market for further downside pressure into the end of the week.

On Tuesday, the December E-mini S&P 500 formed a daily closing price reversal top. This chart pattern typically leads to a 2 to 3 day break equal to at least 50% of the last rally. Based on the short-term range of 1340.25 to 1407.75, traders should watch for a break into 1374.00 to 1366.00 over the near-term.

Last night’s follow-through to the downside and the breaking of an uptrending Gann angle at 1396.25 are two signs that the selling pressure may have started already. An uptrending Gann angle at 1368.25 is also a potential downside target today. This price forms a potential support cluster with 1366.00.

On the upside, a downtrending Gann angle at 1403.75 is the first resistance level, followed by a major 50% price level at 1404.25 and the closing price reversal top at 1407.75. A trade through this price will negate the potentially bearish chart pattern.

Fundamentally, investors are beginning to bail out of the long side of the market due to concerns about the impending fiscal cliff. An air of uncertainty has hit the market in anticipation of a drawn out negotiation process.

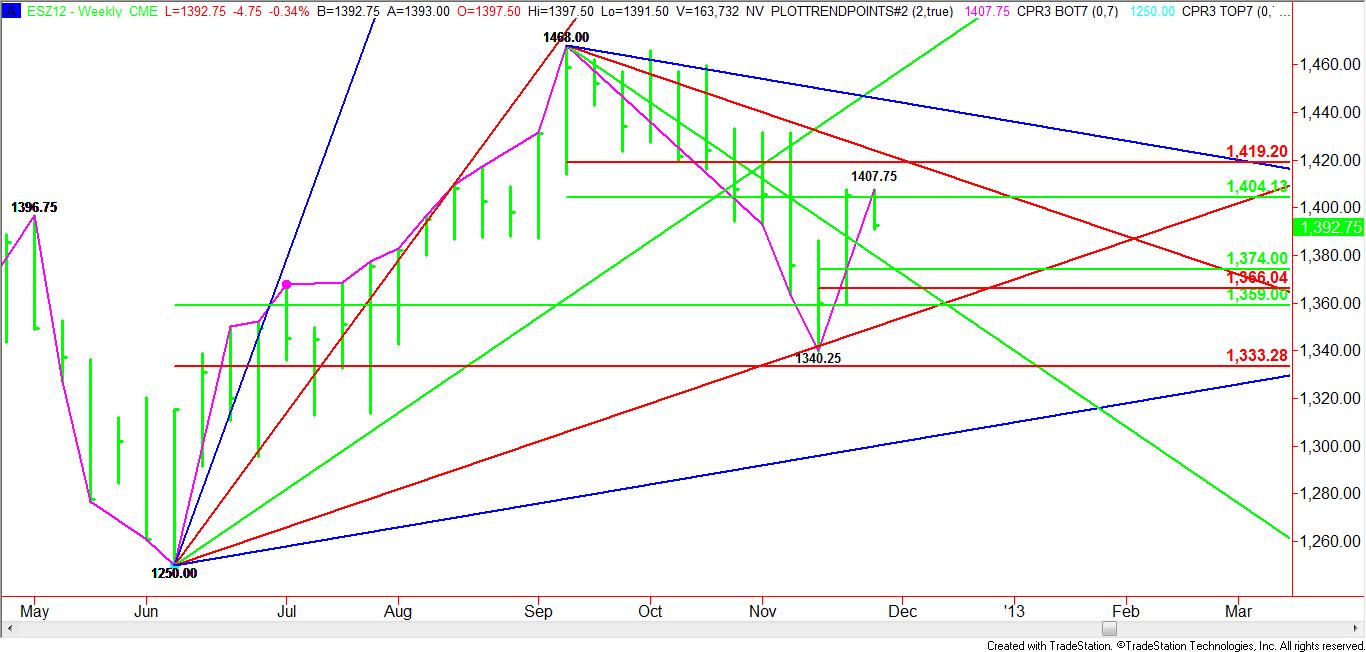

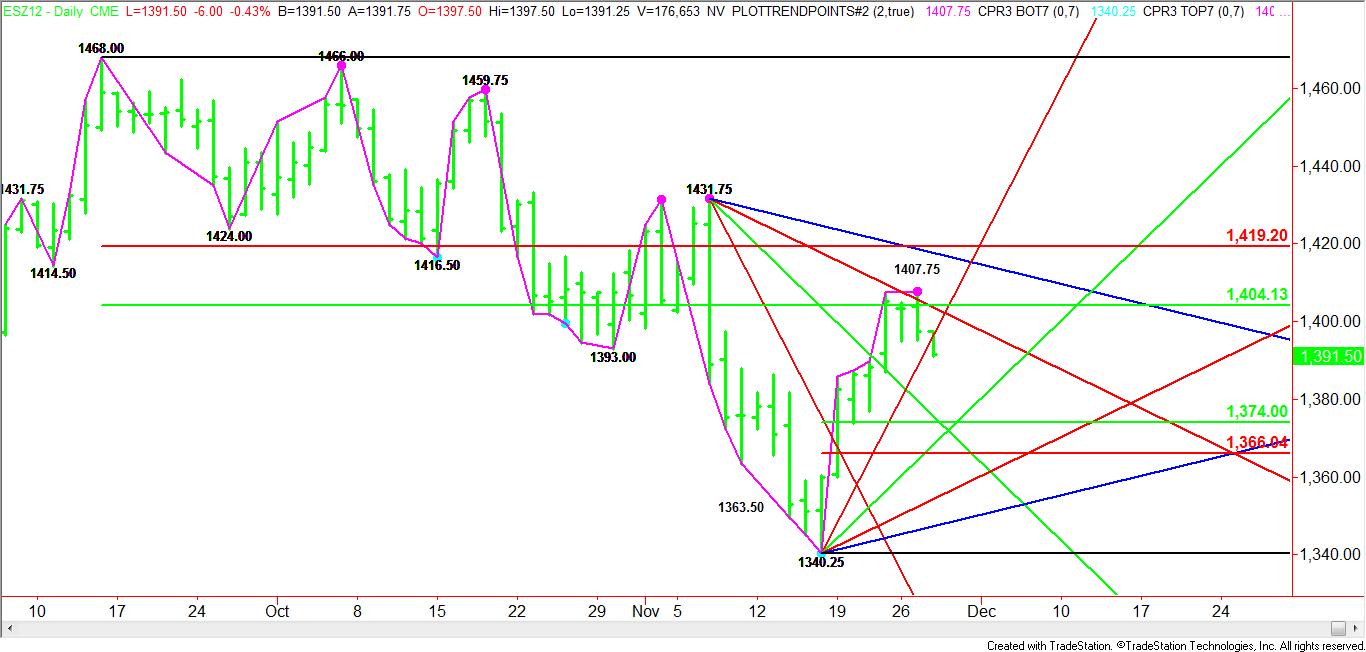

This hasn’t been the case however this week, as the market failed to generate any buying interest when it attempted to breakout over last week’s high at 1407.50. The failure at 1407.75 on Tuesday has set up the market for further downside pressure into the end of the week.

On Tuesday, the December E-mini S&P 500 formed a daily closing price reversal top. This chart pattern typically leads to a 2 to 3 day break equal to at least 50% of the last rally. Based on the short-term range of 1340.25 to 1407.75, traders should watch for a break into 1374.00 to 1366.00 over the near-term.

Last night’s follow-through to the downside and the breaking of an uptrending Gann angle at 1396.25 are two signs that the selling pressure may have started already. An uptrending Gann angle at 1368.25 is also a potential downside target today. This price forms a potential support cluster with 1366.00.

On the upside, a downtrending Gann angle at 1403.75 is the first resistance level, followed by a major 50% price level at 1404.25 and the closing price reversal top at 1407.75. A trade through this price will negate the potentially bearish chart pattern.

Fundamentally, investors are beginning to bail out of the long side of the market due to concerns about the impending fiscal cliff. An air of uncertainty has hit the market in anticipation of a drawn out negotiation process.