The pair started the week by growing to 1.2420 (the middle line of Bollinger Bands®, Fibo correction 38.2%) but failed to break through it. The American currency was supported by yesterday's statement by FOMC head Janet Yellen who characterized the state of the US economy as healthy. This is confirmed by the main indicators: the inflation is approaching the target level of 2.0%, and unemployment rate reached 4.5% which is borderline total employment.

On the other hand, March data on the UK Consumer Price Index had a certain impact on GBP. On the YoY basis the indicator remained on the level of 2.3%, and the basic Consumer Price Index dropped from 2.0% to 1.8%. The total increase of prices for food products was compensated by the reduced cost of fuel and transport tariffs, especially on aviation. Experts believe it is due to Easter being in April which influences the volumes and cost of transportation.

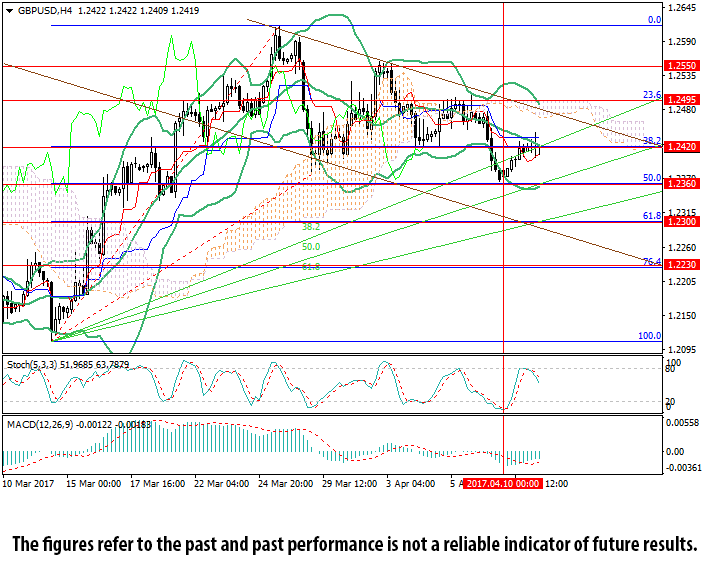

Technically, the price remains at the level of 1.2420 (middle line of Bollinger Bands, Fibo correction 38.2%). If it is broken through, the growth may continue to 1.2495 and 1.2550. Otherwise the fall will resume to the level of 1.2360 (correction 50.0%) and 1.2300 (correction 61.8%). The fall option seems preferable as Bollinger Bands and Stochastic are directed downwards.

Support levels: 1.2360, 1.2300, 1.2230.

Resistance levels: 1.2420, 1.2495, 1.2550.