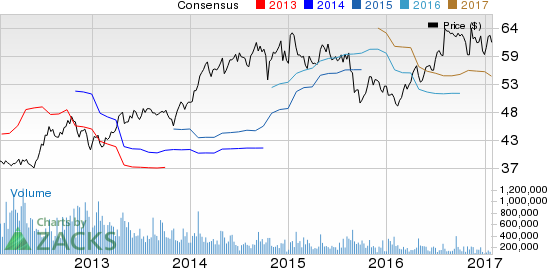

We expect pharma heavyweight Merck & Co., Inc. (NYSE:MRK) to beat expectations when it reports fourth-quarter 2016 and full-year earnings results on Feb 2, before the market opens. Last quarter, the company delivered a positive earnings surprise of 9.18%.

Merck’s shares rose 3.9% so far this year, while the Zacks classified Large-Cap Pharma industry lost 1.8%.

Merck’s performance has been pretty impressive, with the company exceeding earnings expectations consistently. The average positive earnings beat over the last four quarters is 4.30%.

Let’s see how things are shaping up for this quarter.

Factors at Play

Merck’s new products like Keytruda (cancer) and Zepatier (HCV) have been doing well. We believe strong uptake, launches in new countries and expansion into additional indications will continue to drive Keytruda’s sales in the fourth quarter. Importantly, Keytruda should have received a boost in the to-be-reported quarter from the FDA approval in the first-line non-small cell lung cancer (NSCLC) indication in October and in the previously treated recurrent or metastatic head and neck cancer (HNSCC) indication in August.

Meanwhile, Zepatier was launched in the European markets in late Nov 2016, which should contribute to the top line.

Investors will also be focused on the performance of Merck’s DPP-4 inhibitor, Januvia, considering the effect of pricing pressure and the loss of market share to SGLT2, if any.

However, the company will continue to face headwinds in the form of genericization and increasing competition, as well as the negative impact of currency exchange.

Meanwhile, Remicade will continue to be hurt by biosimilar competition in the upcoming quarters with biosimilars benefiting from increased patient starts as well as patient switching. Merck’s partner for Remicade – Johnson & Johnson (NYSE:JNJ) which reported earlier this week said that the drug garnered worldwide sales of $1.62 billion in the fourth quarter, down 3.3% year over year.

Sluggish growth of the integrase class and continued competitor dynamics in the U.S. and Europe will affect Isentress’ sales. Cubicin and Nasonex will be under pressure given their loss of exclusivity. Though Cubicin’s sales were better than expected in the third quarter due to delay in entry of generics, sales are expected to decline rapidly in the fourth quarter and thereafter. Both Nasonex and Cubicin lost patent protection in 2016.

However, Merck’s cost-cutting efforts, share buybacks and other strategic initiatives should support the bottom line. On the flip side, fourth-quarter gross margins are expected to be lower year over year due to the unfavorable mix impact of generic competition for Zetia and Cubicin in the U.S. Zetia lost market exclusivity in the U.S. in Dec 2016 and its U.S. sales are expected to decline significantly hereafter.

What Our Model Indicates

Our proven model shows that Merck is likely to beat earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen and Merck has the right mix.

Zacks ESP: The Earnings ESP, which represents the difference between the Most Accurate estimate (89 cents per share) and the Zacks Consensus Estimate (88 cents per share), is +1.14%. This is a meaningful indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Merck has a Zacks Rank #3.

The combination of Merck’s favorable Zacks Rank and positive ESP makes us confident of an earnings beat in its upcoming release.

Conversely, Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Other Stocks to Consider

Other stocks in the large cap pharmaceuticals sector that have both a positive ESP and a favorable Zacks Rank are:

Eli Lilly and Company (NYSE:LLY) has an Earnings ESP of +1.01% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here. The company is scheduled to release results on Jan 31.

Pfizer, Inc. (NYSE:PFE) has an Earnings ESP of +2.04% and a Zacks Rank #3. The company is scheduled to release results on Jan 31.

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 ""Strong Buy"" stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 ""Strong Sells"" and other private research. See these stocks free >>

Pfizer, Inc. (PFE): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Original post

Zacks Investment Research