FUNDAMENTAL OUTLOOK (actual from May 21)

Current economic situation:

USD

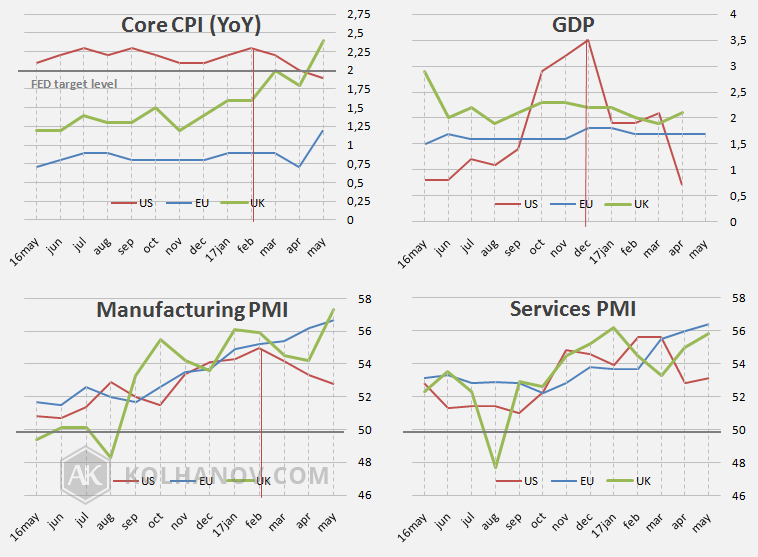

(-) Core CPI YoY felt to 1.9%, below FEDs target level of 2%, because of falling oil prices and this can be the reason for FED pause in % increasing;

(-) GDP and PMI strongly falling;

(-) Trump policy without changes;

(-) Risk of Trump impeachment;

EURO

(+) CPI raised above 2%, PMI of Manufacturing and Services and PPI is strongly rising.

Conclusion: all against dollar and eur/usd will continue uptrend to 1.1350

Economic perspective:

DOLLAR

(-) if this week Wednesday’s “FOMC Meeting Minutes” will have information about negative Core CPI and possible pause in % rates rising, this will be very negative signal for dollar. In other way, if all will be the same, dollar stay more neutral;

(-/+) If oil prices after Thursday’s “OPEC meeting” will not go above $50, US CPI have risk to continue its falling or to be below 2% of target level. In other way oil now have strong uptrend and OPEC can support it, after that WTI can reach price $55, that will increase US CPI above 2%;

(+/-) this week we have a lot of FED speeches, when some of them can say about risk in % rates pause;

(-) talking about Trupm’s impeachment can to be continue and if will increase turnover, increase risk for dollar and gold uptrend;

(-) Friday’s “US GDP” have chance to continue falling, because all other economic indicators continue their falls, that will harm the dollar.

EURO

(+) CPI raised above 2% and this week on “Draghi speech” possible can say something about decreasing of QU tapering;

Conclusion: more negative scenarios for dollar, so eur/usd will continue uptrend to 1.1350

Remaining news of this week:

Thursday

- US – Kaplan speech

- OIL – OPEC meeting!!!

- GBP – GDP

Friday

- US – GDP; Durable Goods; G7 meeting

TECHNICAL FORECAST

EUR/USD

DAILY FORECAST

Uptrend scenario:

While market is trading above support level 1.1180, we can expect continuation of uptrend with target on resistance level 1.1350.

Downtrend scenario:

Today after "US FOMC" news we have a chance that market will go to change current uptrend, where is case, if pair will drop down below support 1.1180, will start downtrend with target on support level 1.1030.

LONG TERM FORECAST

Uptrend scenario:

The market is trading along an uptrend with target on 1.1350 - 1.1500. Supports: 1.1180, 1.1145.

Downtrend scenario:

An downtrend is not expecting for this week.

DAILY FORECAST

Uptrend scenario:

Market is trading in sideways trend between support 1246 and resisatnce 1265, where uptrend will start in case of break up of this resistance, after that will reach resistance on the price 1293.

Downtrend scenario:

An downtrend will start as soon, as the market drops below support level 1246, which will be followed by a move down to support level 1222.

LONG TERM FORECAST

Uptrend scenario:

The market is trading along an uptrend with target on 1265 and then to 1291 - 1319. Supports: 1246.

Downtrend scenario:

An downtrend is ot expecting for this week, but possible sideways trading between resistance 1265 and support 1246.

Uptrend scenario:

The market is trading along an uptrend with target on 53.70, but this week OPEC Meeting probably can change this trend and we will need to look at alternative scenario closer to this news day. Supports: 49.70, 49.00.

Downtrend scenario:

An downtrend will start as soon, as the market drops below support level 49.00 - 48.50, which will be followed by a move down to support level 46.65.