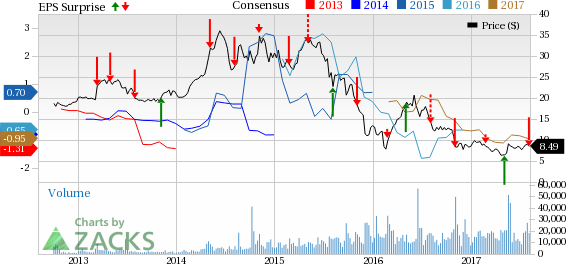

Dynegy Inc. (NYSE:DYN) reported second-quarter 2017 loss of 83 cents per share wider than the Zacks Consensus Estimate loss of 22 cents.

Revenue

Dynegy's revenues came in at $1,164 million in the second quarter, beating the Zacks Consensus Estimate of $972 million by 19.7%. Revenues also increased 28.8% year over year from $904 million.

Highlights of the Release

Operating and maintenance expenses for the quarter were recorded at $282 million, up 10.2% from $256 million for the corresponding quarter in the previous year.

Interest expenses in the reported quarter increased 12.8% year over year to $159 million from $141 million.

During the quarter the company generated in excess of 25 million megawatt hours of electricity.

As of Jun 30, the company had $1.4 billion in liquidity. Dynegy received nearly $480 million from the sale of Troy and Armstrong facilities received in July.

Financial Update

As of Jun 30, Dynegy’s cash and cash equivalents were $447 million compared with $1,692 million at the end of 2016.

Cash from operating activities was $230 million for the first half of 2017.

Guidance

Dynegy reaffirmed its full-year 2017 adjusted EBITDA guidance in the range of $1,200–1,400 million.

The company also reiterated adjusted free cash flow range in the range of $300–$500 million.

Zacks Rank

Dynegy has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Utilities

Among other players from the industry that have reported their second-quarter earnings, both NextEra Energy, Inc. (NYSE:NEE) and Eversource Energy (NYSE:ES) beat their respective Zacks Consensus Estimate, while FirstEnergy Corporation (NYSE:FE) reported earnings on par with the Zacks Consensus Estimate.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Dynegy Inc. (DYN): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

Eversource Energy (ES): Free Stock Analysis Report

Original post

Zacks Investment Research