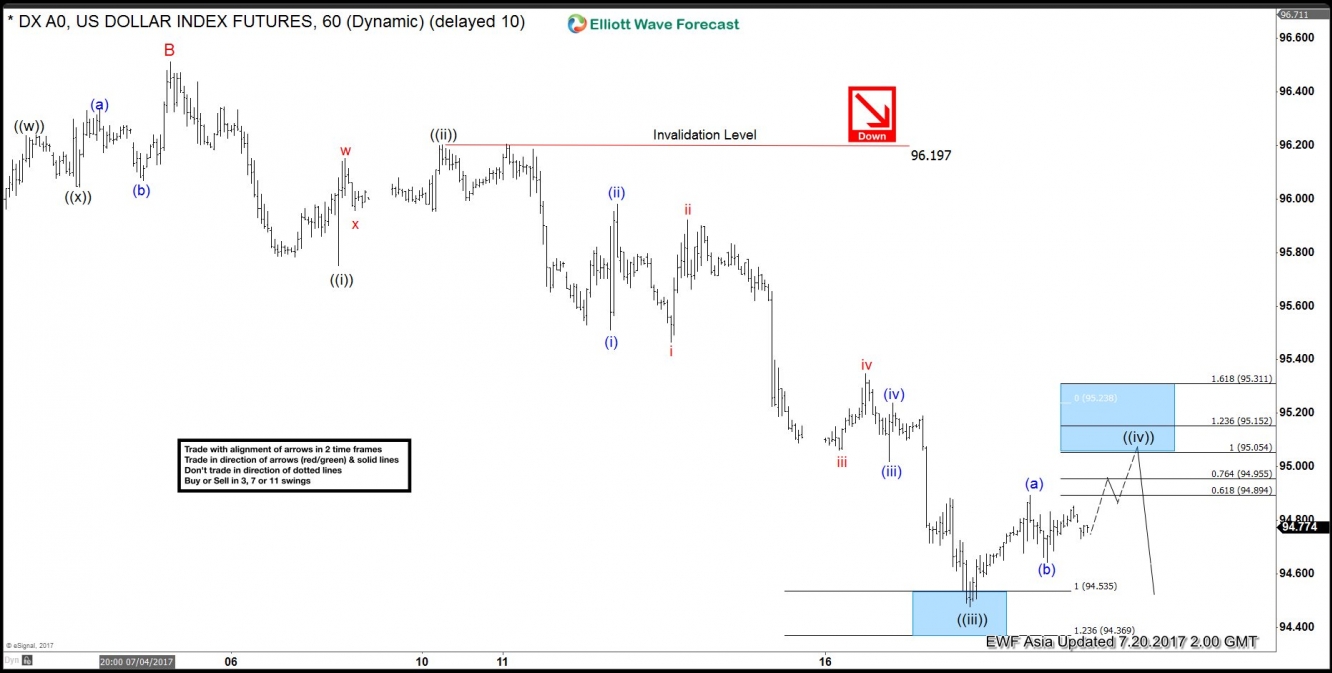

Short term DXY (USD Index) Elliott Wave view suggests the decline from 6/20 peak (97.87) is unfolding as a Zigzag Elliott Wave structure. Down from 97.87 high, decline to 95.47 ended Minor wave A, and bounce to 96.51 high ended Minor wave B. Wave C is unfolding as an Elliott wave Impulse structure with extension where Minute wave ((i)) ended at 95.75, Minute wave ((ii)) ended at 96.2, and Minute wave ((iii)) ended at 94.47. Minute wave ((iii)) is subdivided into another impulsive wave of a smaller degree. Minute wave (i) ended at 95.51, Minute wave (ii) ended at 95.98, Minute wave (iii) ended at 95.01, Minute wave (iv) ended at 95.24, and Minutte wave (v) of ((iii)) ended at 94.47.

Currently Minute wave ((iv)) is in progress to correct cycle from 7/10 high as a double three Elliott wave structure towards 95.05 - 95.15. While pivot at 7/10 high holds, expect Index to turn lower again. We don’t like buying the Index and expect bounces to find offer in the above area for more downside or 3 waves pullback at least.

DXY 1 Hour Elliott Wave Chart