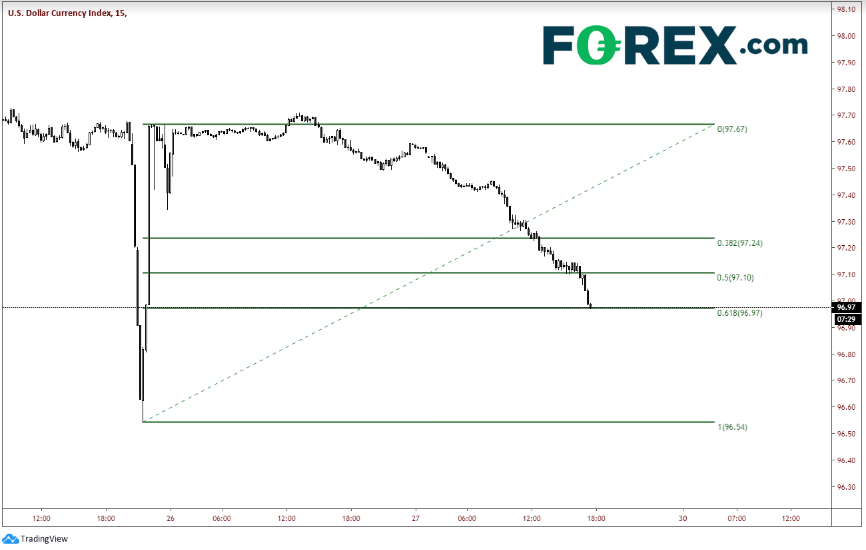

On Thursday we wrote about how the U.S. Dollar Index had a nasty move on December 25/26 during quiet trading, which was exacerbated by the holiday with many markets closed. Price spiked lower by over 100 pips and bounced back to unchanged within 2 hours. Looks like there may be some real money behind that move as the USD continued to move lower on Friday. The move on the 25 had the look of a Central Bank all over it (ie..no idea how to trade, just get it done). Whoever was selling U.S. dollars on Friday seemed to have learned from that move. Instead of dumping the USD position all at once in a thin market, someone may have realized it's smarter to piece meal the trade. (This is total speculation on my part).

As of mid-day, price had retraced 61.8% of the spike lower to 96.97. If the dollar breaks below, price can easily run down to the spike low at 96.59. And as we have discussed before, if someone needs to get something done heading into year end, price and technical won’t matter.

Source: Tradingview, FOREX.com

On a daily timeframe, the U.S. dollar broke lower on December 13 out of the upward sloping channel where price has been since mid-2018. Price then bounced and retested the bottom trendline of the channel and the 200-day moving average near 97.70. With the spike lower to the lows of December 13, it opened the door for another move lower to the 96.59 level as possible a decisive move lower away from the channel.

Source: Tradingview, FOREX.com

As a result of the U.S. dollar move, related pairs such as EUR/USD and GBP/USD are also having a big day.

EUR/USD is up 75 pips near 1.1170 and looking to retest the highs from December 13 and the 61.8% Fibonacci retracement level from the June 25 highs to the October 1 lows near 1.1207.

Source: Tradingview, FOREX.com

GBP/USD is up over 100 pips near 1.3090 and looking to test the 38.2% Fibonacci retracement level from the spike higher on December 12 after the election to the low on December 23 at 1.3137. Resistance above isn’t until 1.3210, which is the 50% retracement level.

Source: Tradingview, FOREX.com

Watch for these trends continue into yearend early next week.