DXY dollar index Short Term Elliott Wave view suggests that the decline from 8/16 peak is unfolding as an Ending Diagonal Elliott Wave structure. Down from 8/16 high, Minor wave 1 ended at 91.62 and Minor wave 2 ended at 93.347. Minor wave 3 is unfolding as a double three Elliott wave structure. Minute wave ((w)) of 3 ended at 91.01 and Minute wave ((x)) of 3 is proposed complete at 92.08.

While bounces stay below 92.08, but more importantly below 8/31 high at 93.36, Index should resume lower or at least pullback in 3 waves. If the Index breaks above 92.08, then cycle from 8/16 high has likely ended. In that case, Index should correct larger degree cycle from 8/16 high in 7 swing before the decline resumes provided pivot at 92.08 stays intact. We don’t like buying the Dollar Index.

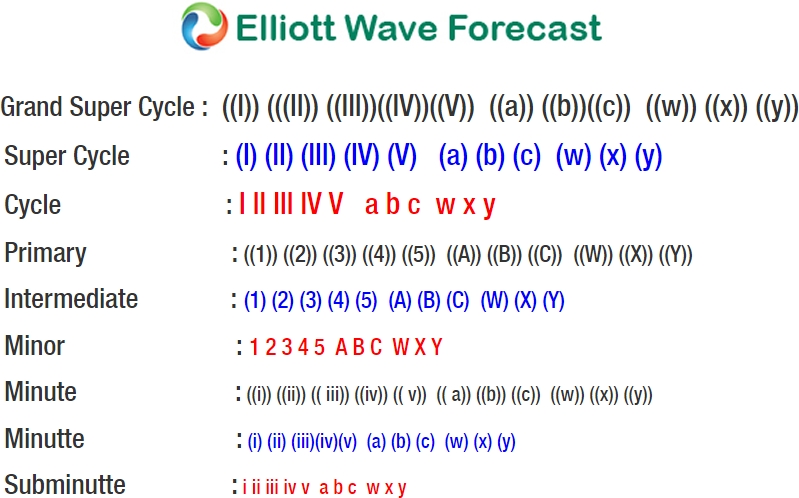

DXY 1 Hour Elliott Wave Chart