Fed-fever swept through currency markets yesterday to not only push the US dollar index (DXY) up to a three-week high, but also suggest a cycle low could be in place.

We can see on the daily chart that yesterday’s range expansion cut through its descending retracement line like butter. Up by 0.75% by the close it was its best session since June and second strongest close this year. However, what makes it the more impressive is how it has accelerated above and beyond its 200-day average, cementing key support at 93.81 as a key swing low.

Near-term support resides around the 94.40/43 zone and the next target for bulls become the September and August highs at 95.74 and 96.98 respectively. Moreover, if DXY is indeed in ‘rally mode’ then we can expect cleaner trends across FX markets.

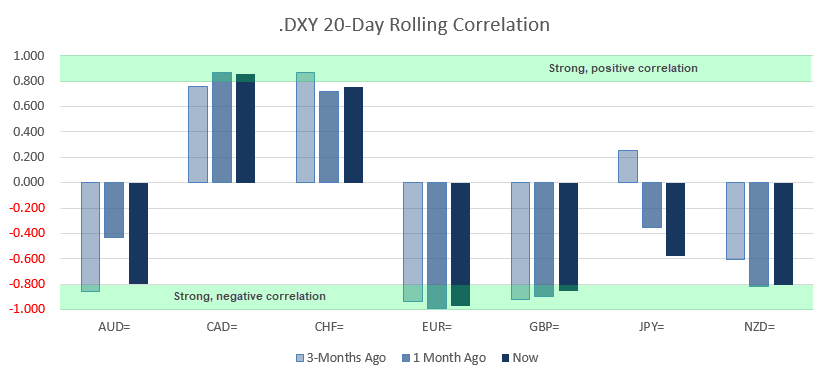

As DXY is heavily weighted towards the euro, an obvious short contender is EUR/USD. However, the 20-day correlation is also currently strong for AUD, CAD, GBP and NZD which makes them viable majors to trade around the ‘long DXY’ theme.

That said, we can also see that correlations aren’t set in stone as these relationships change over time. So, if we want to focus on the more stable relationships then EUR, CAD, GBP and CHF are also ones to consider. Either way, let price action be your guide and hopefully we’ll see some follow-through of USD strength over the foreseeable future.