The headlines say the durable goods sector declined significantly in March. This analysis says the data is very soft if one ignores civilian aircraft.

EconintersectAnalysis:

- new orders down 2.6% month-over-month, and down 1.4% year-over-year

- Inflation adjusted new orders are down 2.0% month-over-month, and down 0.2% year-over-year (same as last month)

- production (inflation adjusted using the Federal Reserve’s Industrial Production Index – durable goods) unchanged month-over-month, up 4.0% year-over-year [note that this is a series with moderate backward revision - and it uses production as a pulse point (not new orders or shipments)]

- backlog (unfilled orders) down 0.4% month-over-month

- civilian airplanes were the headwind for durables this month – but most everything was soft or a headwind.

- new orders down 5.7% (last month up a revised 4.3%) month-over-month

- backlog (unfilled orders) down 0.6% month-over-month

- the market expected new orders down 3.1% to 4.0% versus the 5.7% actual

Econintersect concentrates on new orders as it is the entry point for future production – and somewhat intuitive economically.

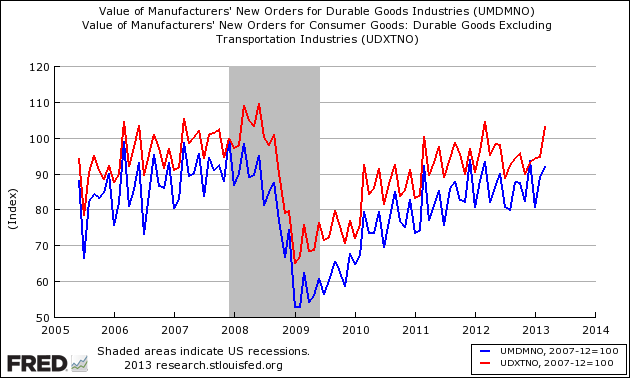

Unadjusted Durable Goods New Orders – Current Value (blue line) and Current Value less Transports (red line)

Census Headlines:

- new orders down 5.7% (last month up a revised 4.3%) month-over-month

- backlog (unfilled orders) down 0.6% month-over-month

- the market expected new orders down 3.1% to 4.0% versus the 5.7% actual

The trend of growth new orders continues downward (graph below):

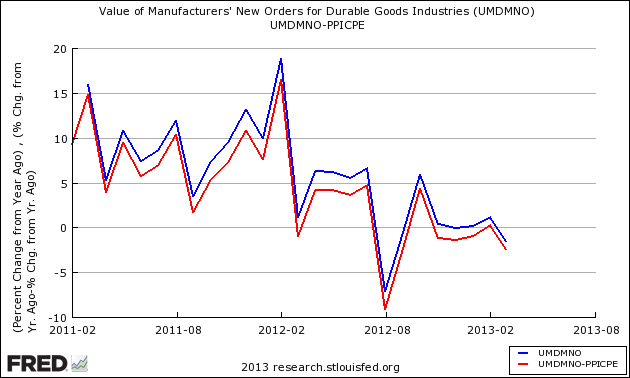

Year-over-Year Growth Durable Goods New Orders – Unadjusted (blue line) and Inflation Adjusted (red line)

The above graphic shows both the year-over-year change for unadjusted new orders and inflation adjusted new orders using the PPI for inflation adjustment.

The growth trend appears to be on up when viewed with this months data – however the overall 12 month trend remains down. Any decline is a serious economic warning sign.

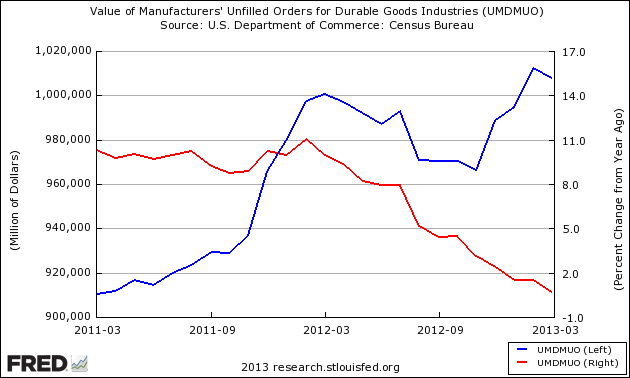

Unadjusted Durable Goods Unfilled Orders – Current Value (blue line, left axis) and Year-over-Year Change (red line, right axis)

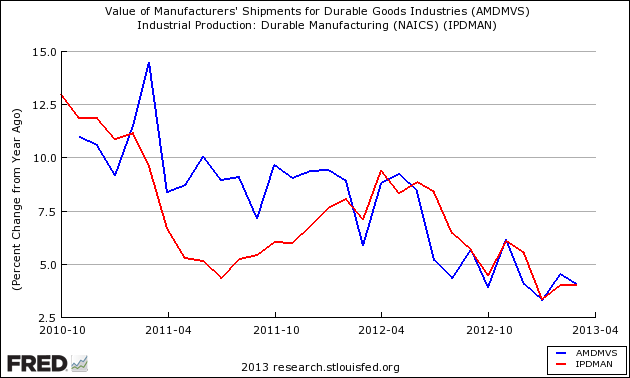

The Federal Reserves Industrial Production (Durable Goods) subindex shows production unchanged month-over-month, up 4.0% year-over-year – both Census Durable Goods and the Fed’s Industrial Production are in a long term down trend.

Comparing Seasonally Adjusted Durable Goods Shipments (blue line) to Industrial Production Durable Goods (red line)

One final look at the Durable Goods data in our search for a slowing economy is for inventory buildup. Although this series is noisy, it appears inventory levels have remained relatively constant since the beginning of 2010 – however their seems to a general trend towards higher inventory levels in the last 12 months.

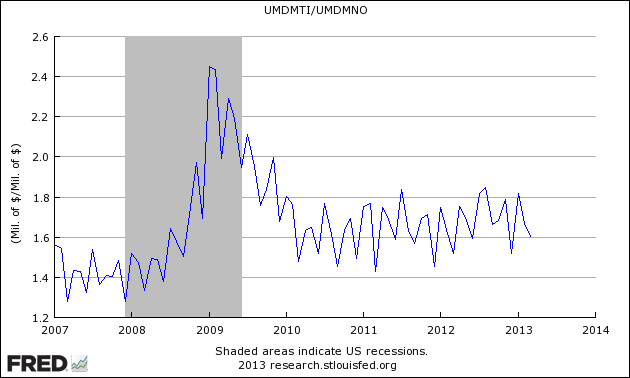

Unadjusted Inventory to Sales Ratio

Caveat on the Use of Durable Goods

The data when first released is subject to several months of revision. The revisions currently have been minor – making the initial headline data reasonably accurate in real time.

The data in this series is not inflation adjusted – and Econintersect adjusts using the appropriate BLS Producer Price Index for durable goods or uses Industrial Production (IP) – durable goods sub-index which is a non-monetary index.

As in most US Census reports, Econintersect does not agree with the seasonal adjustment methodology used and provides an alternate analysis. The issue is that the exceptionally large recession and subsequent economic roller coaster has caused data distortions that become exaggerated when the seasonal adjustment methodology uses several years of data. Further, Econintersect believes there is a New Normal seasonality and using data prior to the end of the recession for seasonal analysis could provide the wrong conclusion.

Econintersect determines the month-over-month change by subtracting the current month’s year-over-year change from the previous month’s year-over-year change. This is the best of the bad options available to determine month-over-month trends – as the preferred methodology would be to use multi-year data (but the New Normal effects and the Great Recession distort historical data).

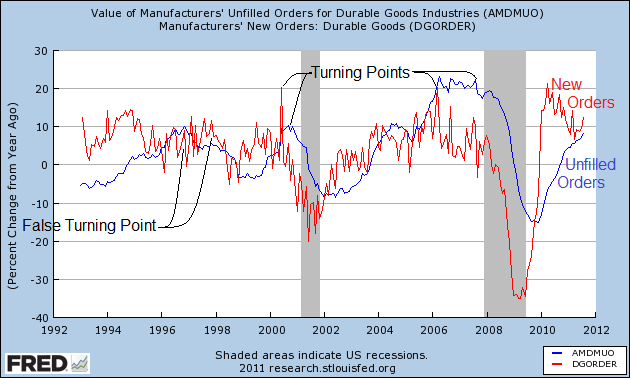

Durable goods expenditure is a major element of GDP. Therefore may pundits look for enlightenment within the durable goods data for economic direction. To illustrate how durable goods new orders and backlog fits into a recession watch, the Fred graph below (produced based on August 2011 data) shows clearly that data trends down preceding a recession. Unfortunately, there are several false indications of recessions.

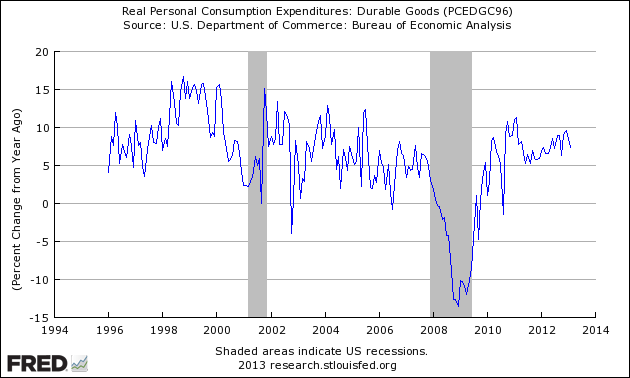

More importantly, durable goods as discussed in this post is not the durable goods of the consumer – as it includes business and government consumption while excluding imports. For a better understanding of consumer demand for durable goods, the BEA’s Personal Consumption Expenditure’s Durable Goods data series should be used:

Durable goods is not a good economic forecasting tool as it contains too many false warnings of economic contraction.