DuPont’s (NYSE:DD) Crop Protection business has introduced EverpreX herbicide that offers extended residual control of ALS-, PPO- and/or glyphosate resistant weeds, including waterhemp, Palmer amaranth and other pigweed species.

EverpreX is a valuable solution for weed resistance as it helps safeguard yield potential by minimizing competition for nutrients, moisture and sunlight.

EverpreX provides excellent weed resistance when tank-mixed with glyphosate herbicides, such as DuPont Abundit Edge. It provides a residual control of Palmer amaranth, waterhemp, lambsquarters, nightshade, foxtails and other small-seeded grasses and broadleaf weeds when tank-mixed with other pre- or postemergence herbicides.

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Akzo Nobel NV (AKZOY): Free Stock Analysis Report

Original post

Zacks Investment Research

EverpreX is a valuable solution for weed resistance as it helps safeguard yield potential by minimizing competition for nutrients, moisture and sunlight.

EverpreX provides excellent weed resistance when tank-mixed with glyphosate herbicides, such as DuPont Abundit Edge. It provides a residual control of Palmer amaranth, waterhemp, lambsquarters, nightshade, foxtails and other small-seeded grasses and broadleaf weeds when tank-mixed with other pre- or postemergence herbicides.

EverpreX is compatible and can be easily mixed with many other soybean herbicides. Also, it contains S-metolachlor for residual control via inhibition of shoot- and root-tissue growth soon after weed germination.

The herbicide has the flexibility to be applied 45 days prior to planting and up to 90 days before harvest. It can be used as an early preplant, preplant incorporated, pre-emergence or postemergence herbicide that provides recropping adaptability when rotating from soybeans to other crops.

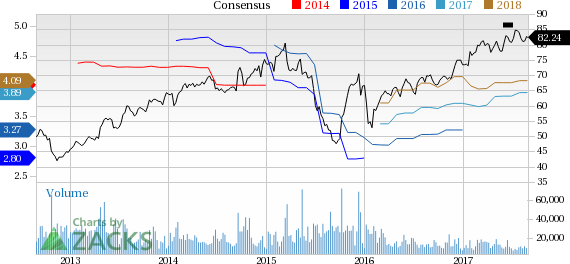

DuPont has outperformed the industry over a year. The company’s shares have rallied 18.2% compared with the industry’s 17.9% gain during this period.

DuPont kept its positive earnings surprise streak alive with a solid beat in second-quarter 2017. The company recorded adjusted earnings per share of $1.38 in the reported quarter, up 11% from $1.24 a year ago. Results topped the Zacks Consensus Estimate of $1.29. DuPont logged net sales of $7,424 million, up roughly 5% year over year on higher volumes. The figure surpassed the Zacks Consensus Estimate of $$7,260 million.

DuPont is well-positioned to gain from cost-cutting and productivity improvement measures plus product launches. The company has numerous new products in pipeline, expected to create value for customers.

E.I. du Pont de Nemours and Company Price and Consensus

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Akzo Nobel NV (AKZOY): Free Stock Analysis Report

Original post

Zacks Investment Research