One of the popular financial engineering ‘trades’ has been to convert anything that uses real estate into a Real Estate Investment Trust (REIT). One that caught my eye this weekend was DuPont (N:DD) Fabros Technology (N:DFT). This REIT is an aggregator, owner, manager and developer of large-scale data center facilities. Think giant warehouses full of servers.

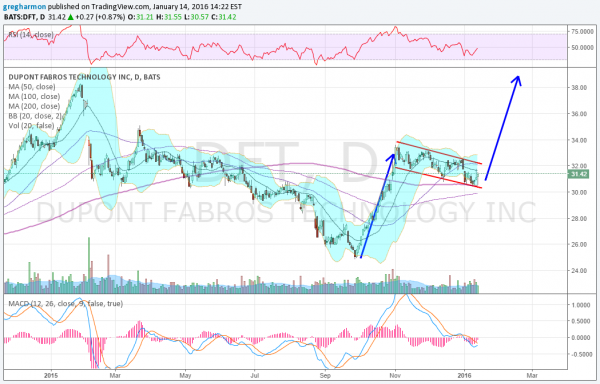

The stock of this company was beaten up early in the year but recovered into the fall. In November it started another pullback but it has been very shallow so far. In fact in the chart below it looks like a bull flag. A break of that flag to the upside would target a move to near 39. That is near its 52 week high at 38.20.

Will it break out? The momentum indicators are starting to turn back higher. That is a plus. And the 200 day SMA has acted as support through out this 2016 market pullback. As long as that or the 100 day SMA below continue to hold, you get paid a 6.12% dividend to sit and wait. Not bad sitting on your hands money.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.