Shares of Dunkin' Brands Group, Inc. (NASDAQ:DNKN) were up nearly 2% in the trading session on Jul 27, after the company reported mixed second-quarter 2017 results. While, the bottom line outpaced the Zacks Consensus Estimate, the top line lagged the same.

Earnings and Revenues Discussion

Adjusted earnings of 64 cents per share beat the Zacks Consensus Estimate of 62 cents by 3.2% and increased 12.3% year over year. This upside was mainly owing to better margins, offset by an increase in shares outstanding.

Dunkin' Brands’ revenues in the quarter increased 1% year over year to $218.5 million. The improvement was on the back of a rise in royalty income as well as a boost in rental income. But it was also partly offset by a decrease in sales at company-operated restaurants and decline in sales of ice cream and other products, particularly in the Middle East, along with decrease in other revenues. Moreover, the top line missed the Zacks Consensus Estimate of $219.6 million by 0.5% in the reported quarter.

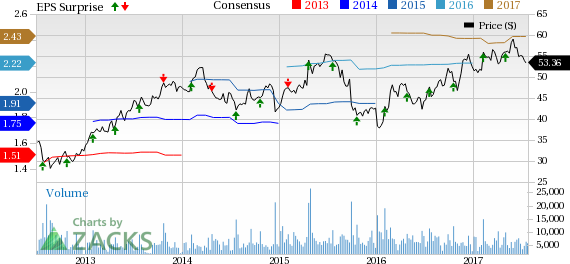

Dunkin' Brands Group, Inc. Price, Consensus and EPS Surprise

Inside the Headline Numbers

Dunkin' Brands operates through its Dunkin’ Donuts and Baskin-Robbins brands.

The company’s system-wide sales increased 4.6% in-line with the 4.6% growth recorded in the prior quarter.

Dunkin’ Donuts

Dunkin' Donuts U.S. reported revenues of $157.1 million, which reflects an increase of 2.2% over the prior-year quarter. The upside was attributable to higher royalty income and rental income as well as an increase in franchise fees, partly offset by a decrease in sales at company-operated restaurants and a decline in other revenues.

Comps increased 0.8% in the Dunkin Donuts U.S. division comparing favorably with 0.5% growth in the prior-year quarter, and flat comps in the preceding quarter.

But, comps at Dunkin’ Donuts International division decreased 2.8% compared with 3.1% decline in the prior-year quarter. In fact, the figure compared unfavorably with the decline of 0.2% in the preceding quarter.

Baskin Robbins

Baskin-Robbins U.S. revenues were up 4.4% from the prior-year quarter to $10.6 million. The uptick in revenues was primarily owing to an increase in royalty income and an improvement in sales of ice cream and other products.

However, comps decreased 0.9% in the Baskin Robbins U.S. division comparably weaker than 0.6% growth in the year-ago quarter but better than the 2.4% decline in the prior quarter.

At Baskin Robbins International division, comps grew 3.3%, better than the 6.6% slump in the prior-year quarter and the 2.0% decline in the prior quarter.

Operating Margin

Adjusted operating income rose 6.9% from the prior-year quarter to $118.9 million mainly backed by an increase in royalty income as well as rental margin, and a decrease in general and administrative expenses. The upside was partly offset by a decrease in other revenues. Meanwhile, adjusted operating income margin was up 290 basis points to 54.4%.

Store Update

In the reported quarter, Dunkin' Brands opened 133 net new restaurants worldwide. These include 64 net new Dunkin' Donuts U.S. locations, offset by the closure of one Dunkin' Donuts international outlet. In fact, there were 12 net new openings under the Baskin-Robbins U.S. division and 58 net new Baskin-Robbins International outlets.

Additionally, Dunkin' Donuts U.S. franchisees remodeled 114 restaurants, while Baskin-Robbins U.S. franchisees renovated 19 outlets.

Guidance for 2017

For 2017, Dunkin’ Brands continues to expect adjusted earnings per share in the range of $2.40 to $2.43 and maintains the projection of mid-to-high single-digit growth in adjusted operating income.

Also, the company continues to anticipate low-to-mid single-digit revenue growth. Additionally, it projects low-single-digit comps growth for Dunkin' Donuts U.S., in line with previous expectation.

Notably, it now expects slightly negative comp sales for Baskin-Robbins U.S. (comparing unfavorably with the previous expectation of low-single-digit growth).

Currently, Dunkin’ Brands carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

McDonald's Corp. (NYSE:MCD) reported second-quarter adjusted earnings per share of $1.73 beating the Zacks Consensus Estimate of $1.62 by 6.79%. Earnings also increased 19% year over year.

Chipotle Mexican Grill, Inc.’s (NYSE:CMG) second-quarter 2017 adjusted earnings were $2.32 per share, which outpaced the Zacks Consensus Estimate of $2.16 by 7.41%. Also, earnings compared favorably with the year-ago quarter figure of 87 cents per share, given a substantial rise in revenues.

In second-quarter 2017, Domino’s Pizza, Inc. (NYSE:DPZ) posted earnings of $1.32 per share that outpaced the Zacks Consensus Estimate of $1.22 by 8.20%. Further, earnings climbed 34.7% year over year on strong sales and a lower share count.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Dunkin' Brands Group, Inc. (DNKN): Free Stock Analysis Report

Original post

Zacks Investment Research