The Federal Reserve tightened until it broke something: the small banks. Classic Fed!

Meanwhile, here at Contrarian Outlook, we’ve been waiting patiently for a big buying opportunity. Biding our time. So… is this our moment?

Bank runs are textbook “blood in the streets” moments. There’s fear. There’s loathing. This is usually our cue to spring into action.

So, should we contrarians simply “hold our noses” and buy?

Regional bank stocks haven’t been this cheap since the summer of 2020. Sure, Silicon Valley Bank has gone to zero. But many small businesses, mine included, still prefer to bank with the folks down the street.

Been there, done that in terms of banking with the big boys before. No thanks! I’ll count on that FDIC insurance if it comes to it. Otherwise, it’s play on as far as I’m concerned.

But I have to admit, I’m stubborn. And do I ever worry that this crisis has relegated regional banks to “feeder system” status for the “too big to fail” crowd.

So…are we holding our noses and buying the big banks?

Not quite. Not yet. There’s an even better next-level dividend opportunity developing.

What’s with these levels? Let’s tip our caps to renowned value investor Howard Marks, chief of Oaktree Capital Group and billionaire (with a “B”). Marks introduced the second-level concept in his excellent book The Most Important Thing: Uncommon Sense for the Thoughtful Investor.

To use his next-level vernacular:

- First-level investors see regional banks plunge. They buy. Think Invesco KBW Bank ETF (NASDAQ:KBWB), which yields 2.8%.

- Second-level observers notice deposits are flowing from regional to “too big to fail.” They buy the big banks. Think SPDR® S&P Bank ETF (NYSE:KBE), which pays 3.4%.

Fine. But I see two more levels. Let’s head upstairs!

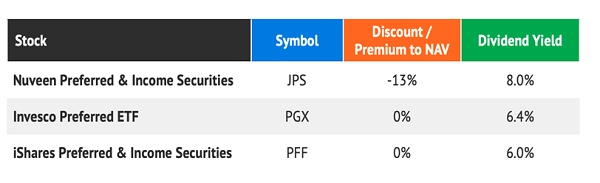

On floor three we have iShares Preferred and Income Securities ETF (NASDAQ:PFF), which owns preferred stock issued by the likes of Bank of America (NYSE:BAC) and JPMorgan Chase & Co (NYSE:JPM). Preferred shares pay more than mere common stock. Plus, they are paid first—it’s nice to have preferred status during shaky financial times like these.

PFF yields 6%. It’s been hit by panic bank selling, but that’s subsiding. PFF is likely to bounce back as the hysteria relaxes.

Invesco Preferred ETF (NYSE:PGX) should eventually bounce back too. PGX owns some BAC preferreds and lots of JPM’s. Its “too big to fail” portfolio is just right for those of us looking for safe, cheap dividends. And PGX pays a much more attractive 6.4%.

Here on level four resides Nuveen Preferred Securites Income Fund (NYSE:JPS), a closed-end fund that yields 8%. And trades at a 13% discount to net asset value (NAV). Now we’re talking.

We have a better deal on JPS during panics (like these) because, as a CEF, JPS has a fixed pool of shares. Which means when investors flip out and sell, JPS can trade below its NAV. Today, it’s selling for 87 cents on the dollar.

Justified? A bit. The fund’s number five position is from—you guessed it—Credit Suisse Group, which just went down and was peddled to UBS Group AG (SIX:UBSG) in an emergency sale. Ouch. Still, with only two percent of the portfolio exposure, the 13% discount seems overdone.

It’s a bit early to buy JPS, though. The fund uses a lot of leverage—41%—to juice returns. This is great when rates are low, but not so much when the cost of money has climbed in record time.

JPS was burning the candle on both ends. Each Fed hike increased its cost of money, making that 41% leverage burn. Plus, the value of the fund’s holdings declined as long rates rose.

And now, the banking crisis.

All of these worries will eventually pass. We’ll be ready to scoop up JPS for cheap when they do. It’s exactly the type of 7%+ monthly dividend payer we want to buy low and hold for a long time.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."