Fox Business

On Tuesday I joined Charles Payne on Fox Business’ Making Money with Charles Payne. Thanks to Kayla Arestivo, Nick Palazzo and Charles for having me on the show. In this segment, we talked about how the “dumb money” has been right and the “smart money” has been wrong this year and in recent preceding years. We also covered the playbook for the second half of the year and how to deal with short-term seasonal volatility:

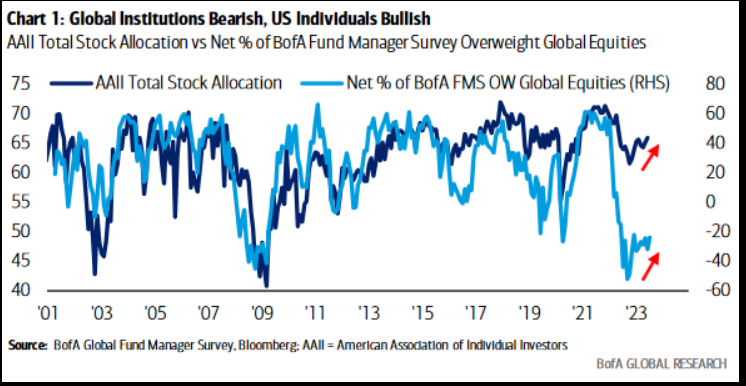

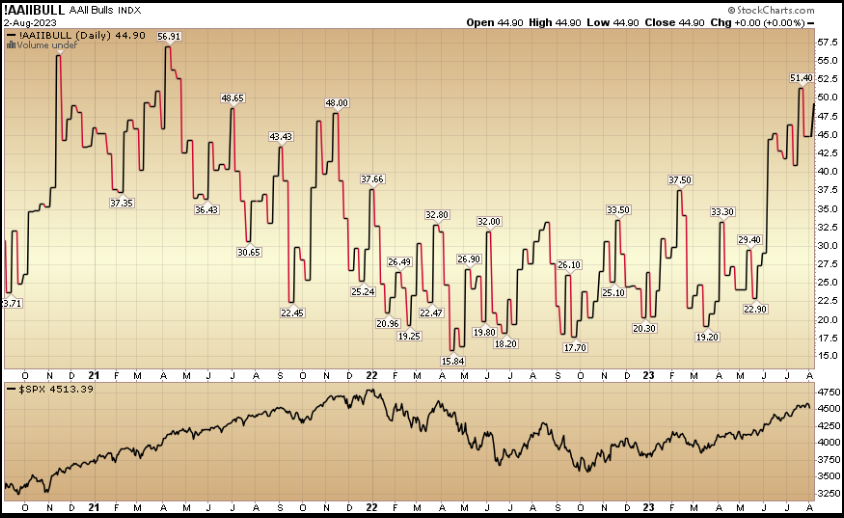

This is the chart that shows you how retail investors have been right in 2016, 2020 and 2023 and institutions had/have to play “catch up”:

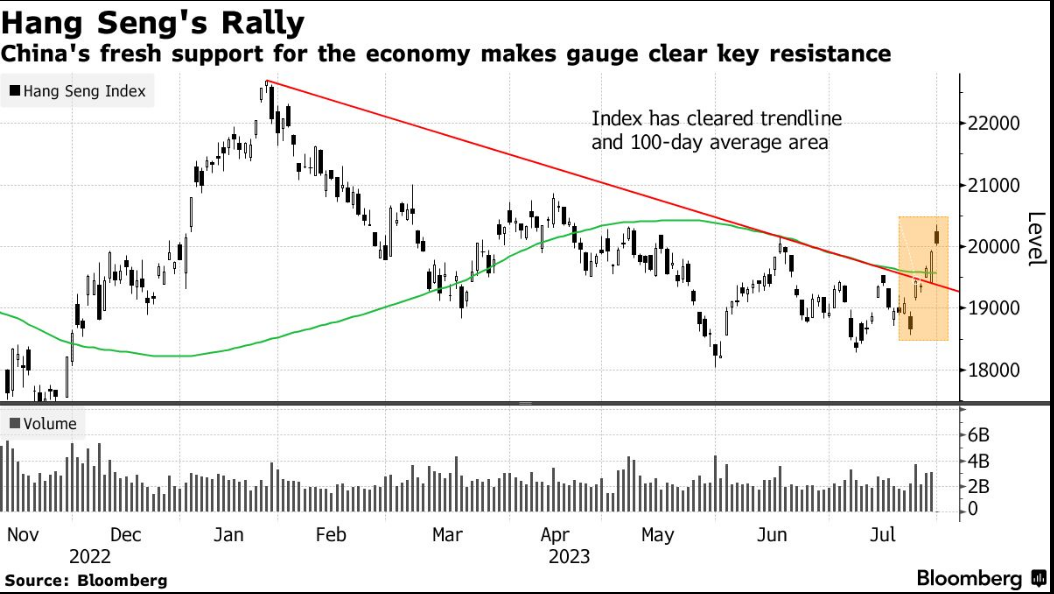

We also gave an update on Alibaba (NYSE:BABA), but didn’t have time to go into these updated charts:

Alibaba P/E:

Hang Seng relative to MSCI ACWI:

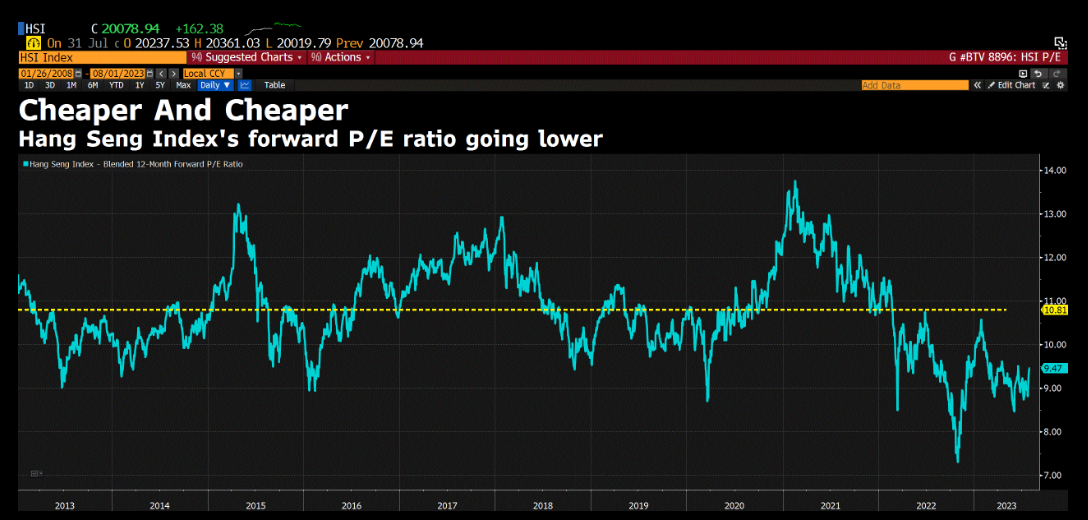

Hang Seng P/E:

h/t Rick C. & Ben H. for helping with these.

And lastly, we were prepared to put out a new pick (Disney) but ran short on time:

From “Show Notes”

NEW “HATED” PICK: DISNEY

-Rare opportunity to buy highest quality asset while in the “bargain bin.” Fell 68% during 200-2002 recession, 57% during GFC, 56.47% since 2021. 3rd chance to buy world-class franchise at ½ off. Never make an investment decision based on politics. You snooze, you loose.

-Spend at parks up 40% over 2019 levels.

-Iger sticking around long enough to right the ship.

-Just brought in 2 former “heir apparent(s)” (Kevin Mayer and Tom Staggs) to fix linear TV issues.

–34% EPS growth next year. 21.26% 5yr expected growth rate.

-Benefit once in 100 year weakness. China parks coming back strong. Cost cutting with a machete (Marvel/Star Wars spends).

-Unrivaled global content library and parks.

-We think this stock can be up 50-100% over the next 24-36 months.

Catalysts:

Near term catalysts include: (1) additional updates on the strategic outlook for DIS with a very positive message likely at the Analyst event in September, (2) continued robust theme park demand and (3) sports betting optionality at ESPN (4) Dividend could return by eoy (5) Possibly bundle Hulu/Dis+/ESPN

Debt Downgrade

I’ll save us a ton of time on AMA questions tonight! In this important segment on CNA Asia last night I covered the US Debt Downgrade in detail (and implications moving forward). Hint: It’s not what you think! In fact, it may be the OPPOSITE!

Thanks to Thanks to Olivia Marzuki, Elizabeth Anne Neo, and MARIANNE STAR INACAY for having me on CNA to discuss Debt Downgrade, Stock Market, Outlook:

If you didn’t pick it up in the interview, listen again. The timing of the downgrade is uncanny…

PayPal (NASDAQ:PYPL) Update

We originally discussed Paypal publicly on Yahoo! Finance on June 15:

Cooper Standard

Reports earnings tonight and presents at JP Morgan (NYSE:JPM) Auto Conference next Thursday (August 10) at 8am. Details here.

Now onto the shorter term view for the General Market:

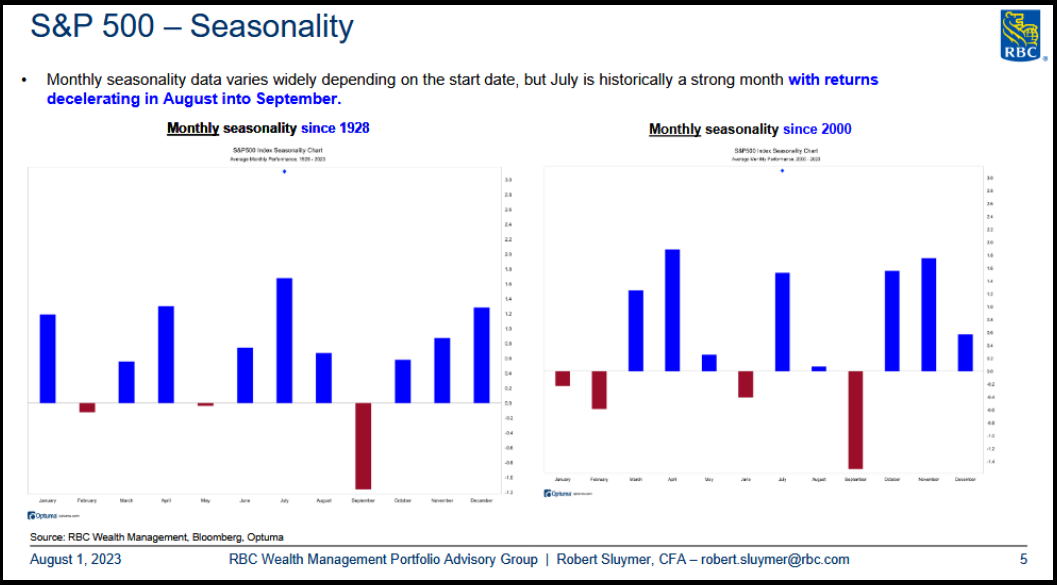

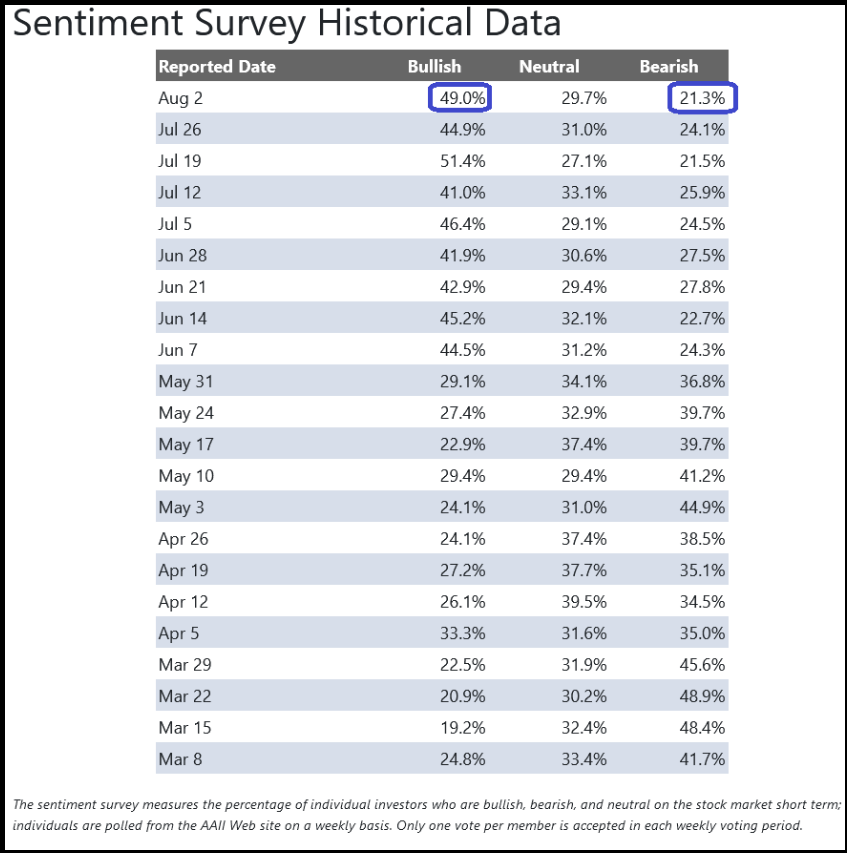

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 49% from 44.9% the previous week. Bearish Percent dropped to 21.3% from 24.1%. The retail investor is still optimistic. This can stay elevated for some time based on positioning coming into these levels, but it would not surprise us to see a little seasonal give-back in coming weeks.

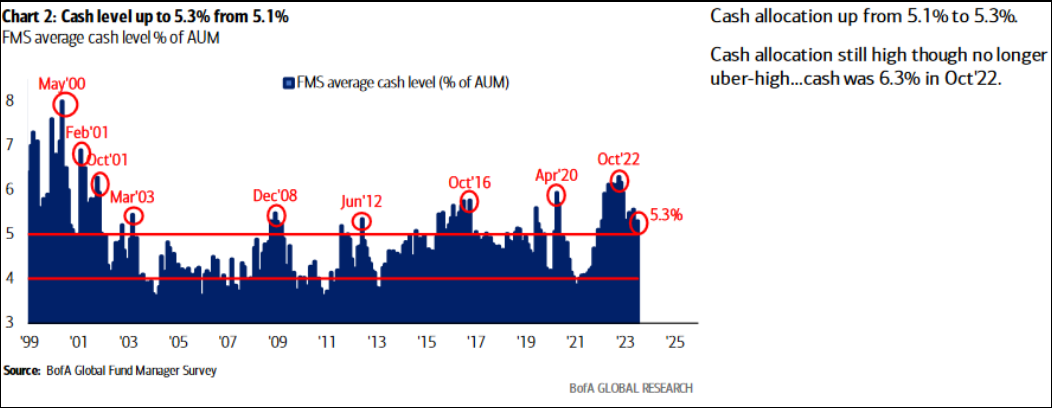

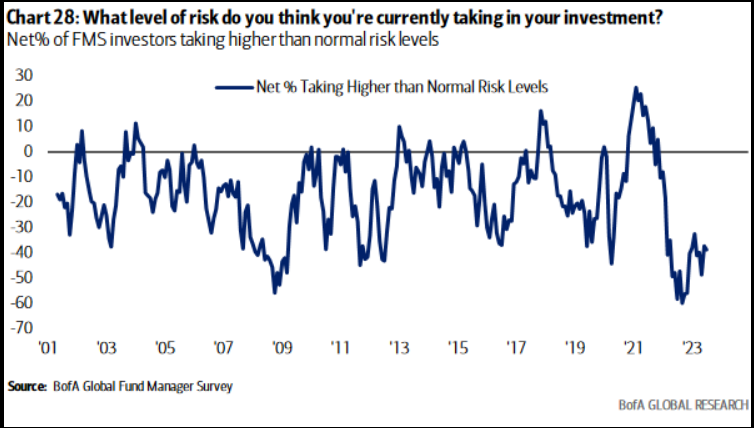

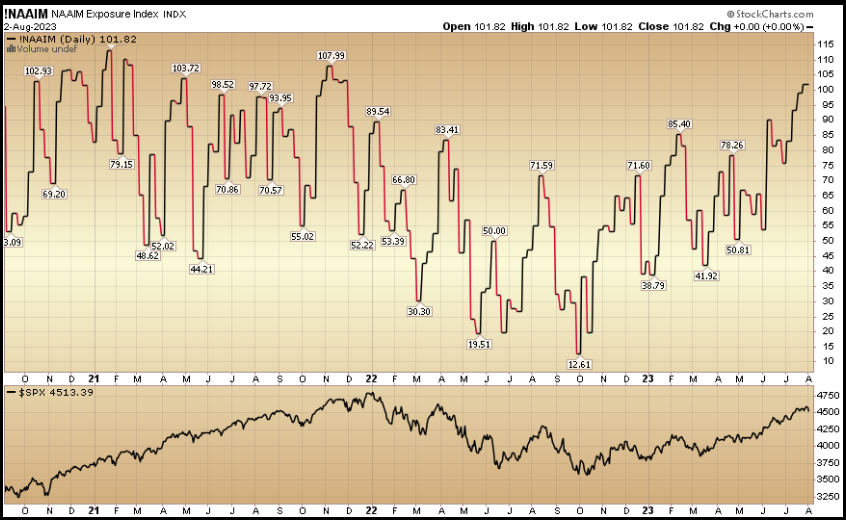

Keep in mind, institutional investors are nowhere near fully invested yet, so there will be a persistent bid on any bumpy pullbacks through year-end.

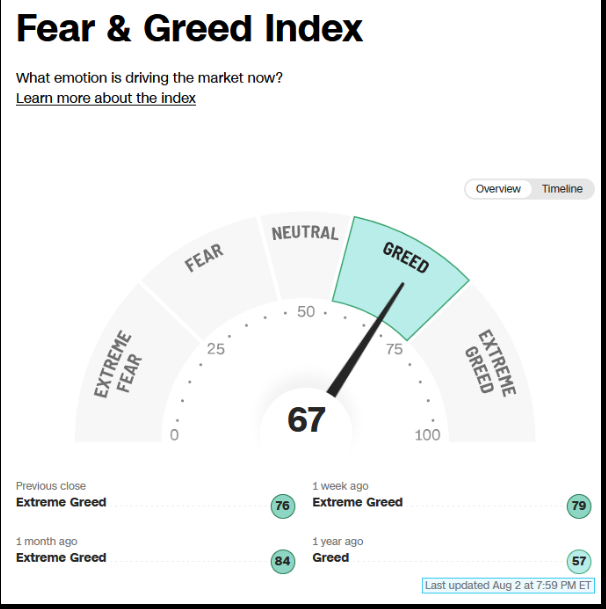

The CNN “Fear and Greed” dropped from 80 last week to 67 this week. Sentiment cooled a bit this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 101.02% this week from 99.05% equity exposure last week. Managers have been chasing the rally.

This content was originally published on Hedgefundtips.com.